At 30 per cent of disposable income, savings rate of the Indian households rivals even China. Interestingly, it has held its ground since 2002, unperturbed by the sharp economic upswing in 2004-08 and even braving the ‘Great Recession’ of 2008. Underlying the stability at the overall level, there has, however, been a metamorphosis of the structure of household savings in India. A major trend is that of households shying away from banks, both in terms of parking funds and borrowing.

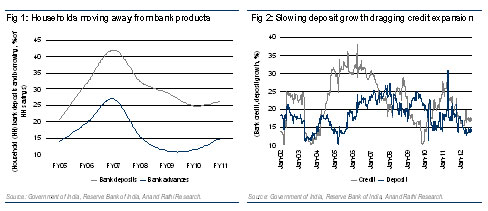

After making a sharp jump from 31.6 per cent in 2006 to 42 per cent in 2007, the share of bank deposits in overall household savings is decreasing and reached 26.3 per cent by 2011. While the overall household savings increased 75 per cent during 2007-2011, saving in bank deposits rose only 10 per cent. Consequently, the share of households in incremental bank deposits declined from 86 per cent in 2007 to 73 per cent in 2011. Households are not only saving less with banks, but are also borrowing less from banks. In 2011, household borrowing from banks was lower against 2007.

Reduced appetite of the households for bank products is partially explained by a switch of the households from financial to physical assets. During 2007-11, the share of physical savings in overall household savings increased by 4.8 percentage points (pp) at the cost of financial savings. During the same period, the rise in shares of non-banking financial companies (NBFC) deposits (by 2.2pp), small savings (1.5pp) and currency (1.3pp) in household savings also have eaten into the share of bank deposits in household savings. Yet, it is important to note that during the same period, household savings in mutual fund instruments declined sharply (by 4.6pp), which could have potentially averted any major decline in the share of bank deposits in household savings.

What seems to be more intriguing is the simultaneous slump in household savings in bank deposits and household borrowing from banks. Between 2007 and 2008, household borrowing from banks as a ratio of household savings declined by 11.4 pp while the share of bank deposits in household savings declined by 9.5 pp. In the next year, these two ratios declined further by 4.4 pp and 3.6 pp, respectively. The sharp deterioration of funding availability during 2008-10 (bank credit growth declined from 28.4 per cent in Nov ’08 to 9.5 per cent by Nov ’09), compelled households to de-leverage by, inter alia, liquidating bank deposits (bank deposit growth slowed to 11.3 per cent by Mar’10 from 24.9 per cent in Aug’09). Thereafter, the marked increase in borrowing cost on account of record monetary tightening by the RBI constrained the households to re-leverage. Personal loan as a percentage of non-food credit has shrunk from 23 per cent in end 2008 to 18.5 per cent by end-Jul’12. During the same period, bank deposit growth decelerated from 20 per cent to 14 per cent.

Deposits account for 90 per cent of bank liabilities and with 75-90 per cent share in bank deposits, households are the main source of funding for banks. This, in turn, decides banks’ lending and investment behaviour. While banks started offering high interests on deposits since 2010, this failed to boost deposit growth. Falling deposit growth in a high interest rate environment is something which does not have precedence. To counter the impact of falling deposit growth on credit expansion, the RBI is infusing liquidity since mid-2010 through liquidity adjustment facility (LAF) mechanism. At the peak, RBI infused Rs.200,000 crore (~4% of banks’ net liabilities) liquidity through the LAF window. In addition, through open market operation (OMO), the RBI has injected Rs.135,000 crore in the last financial year and over Rs.80,000 crore so far in the current fiscal. Cut in Cash Reserve Ratio (CRR) infused another Rs.75,000 crore since Jan’12. Despite all these and also banks overstretching themselves for lending (with credit deposit ratio at 75 per cent), supporting even 17 per cent credit growth is becoming challenging for banks.

In the recent past, banks have started cutting deposit rates. This is likely to lead to further slippage in deposit growth. Consequently, banks would now face constrains in maintaining credit growth even in the mid-teens. Under such a situation, any meaningful recovery in India’s GDP growth would be difficult. Enticing the households back to the banking system looks challenging under the current circumstances. Yet, without that, the economy is unlikely to revert to the high growth trajectory.

(Sujan Hajra is Executive Director, Research, and Chief Economist, Institutional Equity, AnandRathi Financial Services. He can be reached at sujanhajra@rathi.com.)