In the last decade, the role of APIs in transforming the banking space has come into the limelight as financial institutions push to digitise processes and enable seamless experiences across multiple channels and touchpoints. Bank-fintech partnerships are becoming the key lever to penetrate new segments, creating multiple new touch-points via the so-called ‘neobanks’, ‘challenger banks’, embedded finance offerings, etc. and new intermediaries like API aggregators and banking-as-a-service (‘BaaS’) infrastructure providers.

The release of banking APIs such as for savings accounts has created significant opportunities for fintech players allowing them to tap into new markets and cater to unserved and underserved retail banking segments. Banks themselves are tapping into this, as account APIs provide the power to ‘decentralise’ banking, changing the way savings accounts of the future will be opened, accessed, and managed.

Enabling savings account APIs

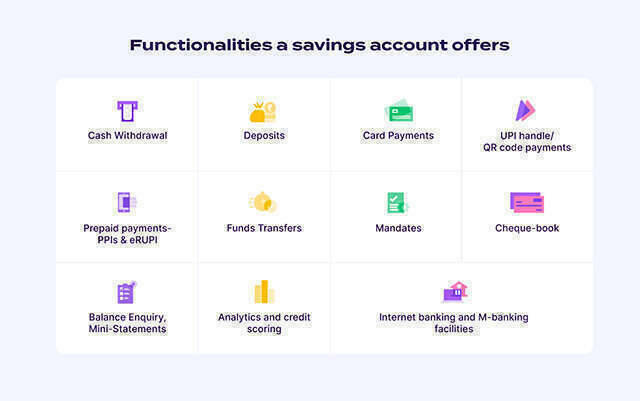

Banks, recognising the monetisation opportunity of fintech partnerships, are continually increasing the products they sachetise and commoditise via APIs and exploring new partnerships. In the case of savings accounts, these enable several functionalities, each of which can be converted into a set of APIs. These APIs in turn become a BaaS product that can be leveraged by neobanks to allow the same core account opening, transactions, management, etc., through a new BaaS touch-point.

These can be classified into 3 broad categories; there can be APIs for:

● Account opening (product eligibility checks, KYC, branch allocation, etc.)

● Account management & fund transfer (balance checks, fetching bank account statements, transactions, etc.), and

● Savings account deposit (fixed and recurring deposits, smart deposits, etc.).

Changing the customer experience

The bank-fintech partnership model allows entities like neobanks and other fintech innovators to leverage banking APIs to form an application layer over multiple licensed partners like banks and NBFCs. This way, these can operate as lightweight entities with highly scalable technology models, which can take a strong, modernised, customer-centric approach to banking. The high level of customisation in this approach enables use-cases including targeted service offerings for customer segments like millennials, agriculture marketplaces, family focussed financial services, and others. It also allows existing fintech and B2C marketplaces to diversify into new offerings to their existing customer base.

The role of API intermediaries

The typical fast growth cycle of the fintech startups requires fast integrations, and this is where BaaS intermediaries come in. These can handle these integrations, aggregating APIs and providing APIs, SDKs and ‘no-code’ based solutions, which can be consumed by fintech entities and other B2C platforms to offer financial services. The value addition of BaaS intermediaries include uniform contracts easing switching partners, efficient management of bank downtimes for higher availability, higher transaction per second support, low-code/ no-code solutions and reduced APIs to integrate with.

Existing regulatory approaches & available options

Under existing regulations, entities like neobanks rely on a multiplicity of licensing and other options. The business correspondent model is the most common, while others include the small bank models, the account aggregator framework, and the PPI license. The recently introduced Digital Banking Units (DBUs) format is another avenue for business correspondents, allowing banks to leverage these to expand their digital footprint. Each of these models however does come with specific functions and restrictions.

To provide new options and a larger scale of operations, Niti Aayog proposed a digital-only bank license model. The RBI’s Digital Lending Report also proposed bringing neobanks under the regulatory purview. Recent indications however are that these are not being considered immediately.

Proposing an alternative regulatory model for bank-fintech partnerships

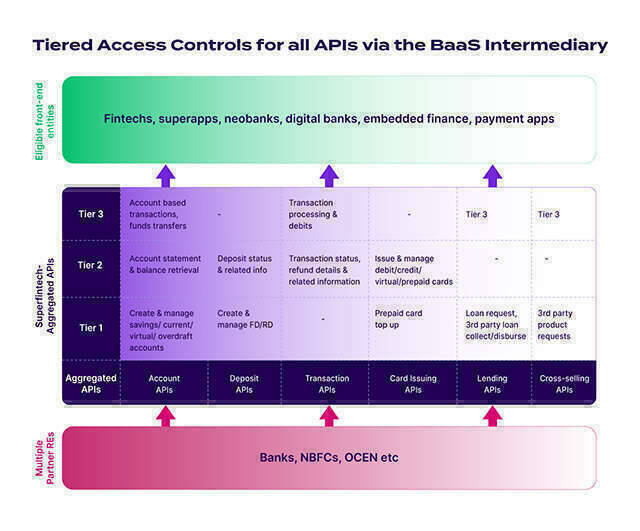

In view of this, alternative solutions can be considered. One way is to introduce a regulatory model enabling BaaS-fintech partnerships . This can take the form of a licensing framework for a BaaS intermediary, enabling tiered access to banking and other financial APIs, where only entities will need to meet pre-defined risk criteria to gain access to a specific tier. This creates a ‘super-fintech’ platform of sorts, which can aggregate APIs across multiple REs and enable a range of BaaS-driven fintech models.

This platform and the aggregation and distribution of APIs would look something like this:

Riding on the license of the intermediary, fintech entities will be able to simply plug in a range of capabilities, allowing them to build front-end/ white-labeled neobanks, a new form of digital-only business correspondents, an embedded finance offering, etc. This way, this model can enable the release of relevant savings account APIs but within the oversight of the regulator.

A close parallel to this is the white-label business correspondent model, first proposed by the Nachiket Mor Committee in 2013. The pace of growth that the fintech market demands today requires an equally dynamic regulatory framework. This framework proposed here can meet this demand, creating a regulated route for fintechs to be flexible with their business models, integrate quickly, be supported by multiple back-end partners, and scale easily.