The Securities and Exchange Board of India (SEBI) is reportedly considering allowing foreign portfolio investors (FPIs) to invest directly in the stock markets, without having to go via intermediaries.

Reports say that the capital markets regulator is looking at first allowing FPIs to invest directly in the debt segment and then subsequently into equities, with the aim of boosting foreign fund inflows into Indian markets.

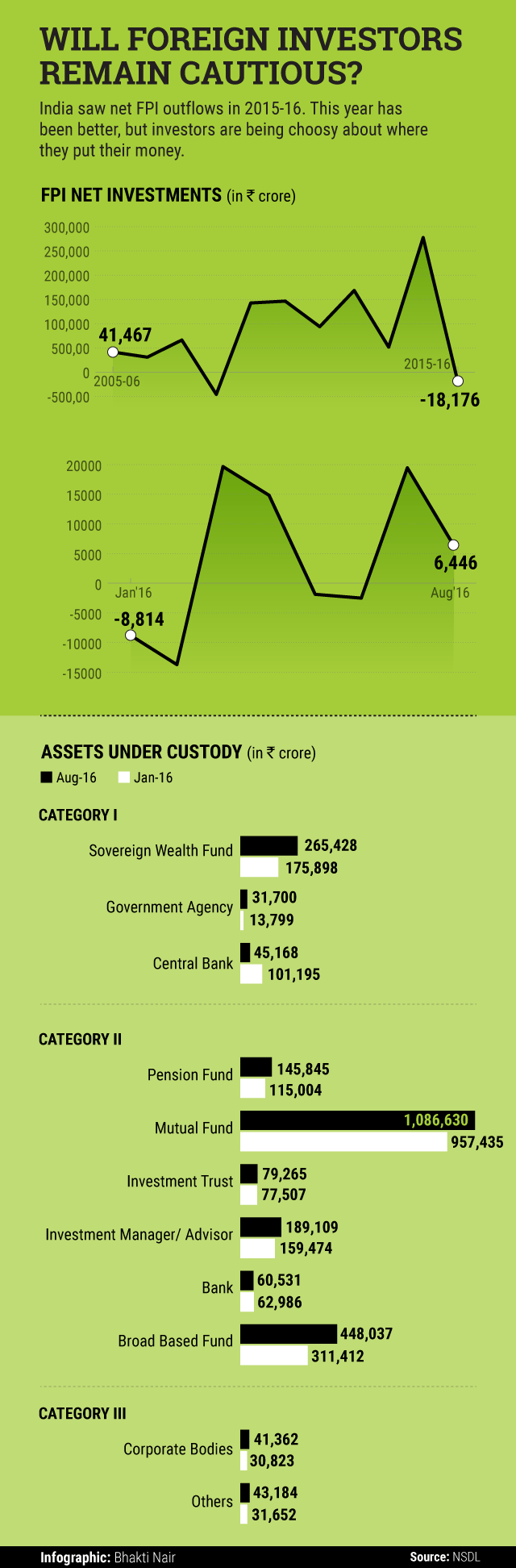

The financial year through March 2016 was a particularly bad year as India saw net FPI outflows for the first time since 2008-09. Even if one considers the available data for the first eight months of 2016 (calendar year), three out of the eight months—February, May and June—saw net outflows.

Since then, however, the tide seems to be turning, with July and August seeing listed foreign funds pump in $1.2 billion and $1.3 billion, respectively. Exchange-traded funds have reportedly invested $845 million by August this year while non-ETFs pumped in $499 million.

The government, capital markets and the regulator will certainly hope this trend continues.

Like this report? Sign up for our daily newsletter to get our top reports.