Over 80% of ‘great’ Indian companies slide to mediocrity in a short span of time led by poor strategic decision-making fuelled by ’hubris and arrogance‘. Such faulty strategic decisions usually result in poor capital allocation which destroys RoCE and creates financial stress. Thus, the importance of evaluating and tracking strategic decisions to achieve long-term outperformance cannot be over-emphasised although it is an area that is often overlooked.

The systematic slide to mediocrity

We find that the average probability of a sector leader remaining a sector leader five years later is only 15%, implying that 85% of BSE 500 companies slide towards mediocrity. In fact, the average probability of a ‘great’ company becoming a sector laggard five years later is 25%. Even the Nifty ‘churns’ by around 50% or so every decade (as compared to around 25% for developed markets and around 30-40% in other major emerging markets). The tendency for large, successful companies to slide down the market-cap spectrum is not confined to the Nifty.

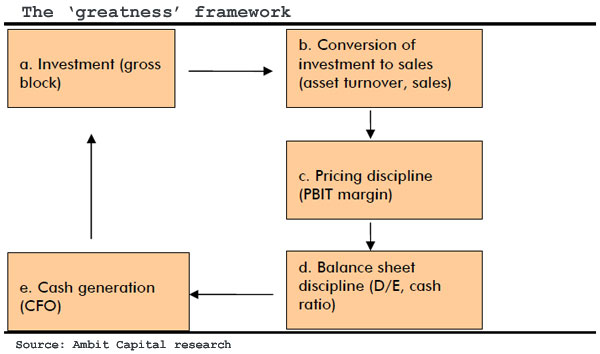

We use our ‘greatness’ model to assess the probability that sector leaders (defined as firms with a ‘greatness’ score in excess of 75th percentile of the sector) from five years ago are now amongst the sector laggards (defined as firms with a ‘greatness’ score of less than 25th percentile of the sector), i.e. what is the probability of self-destruction? We contrast this against the probability of sustaining leadership i.e. what is the probability that sector leaders are still sector leaders five years hence. We check this historically starting from 2003—for example, we assess the chances that a sector leader in 2003 was still amongst the sector leaders in 2008 and contrast this against the chances of it becoming a sector laggard by 2008 and so on.

The five-stage framework

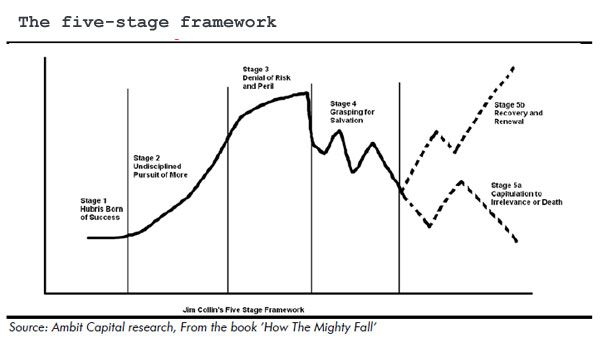

In this note, we use a modified version of Collins’ framework and Thorndike’s approach to analyse capital allocation to understand why great Indian companies slide. The core stages in our framework are as follows:

- Stage 1 - Hubris and arrogance: The company is on top of its game. Operating margins, RoCE, growth, valuation multiples, etc., are at all-time highs. Captivated by the success in its core business, the management starts believing its own press. Success and adulation intoxicates the top brass. Arrogance sets in. The company loses sight of the factors which made it successful in the first place.

(Saurabh Mukherjea is CEO, Institutional Equities, Ambit Capital. Gaurav Mehta is an analyst with Ambit capital.)

To become a guest contributor with VCCircle, write to shrija@vccircle.com.