The week saw Anil Ambani-promoted Reliance Communications Ltd (RCOM) move towards significantly reducing its debt, by agreeing to offload a 51% stake in its mobile phone tower company Reliance Infratel to Canadian Brookfield Infrastructure Group for Rs 11,000 crore ($1.65 billion). RCOM and Brookfield signed a non-binding term sheet, which, when materialises, will be the second-largest private equity deal in India, since Singapore government owned Temasek Holdings invested $2 billion in Bharti Telecom in 2007.

New York-based private equity fund Argand Partners closed its deal to buy out Sigma Electric Manufacturing Co. from Goldman Sachs Private Equity and other shareholders.

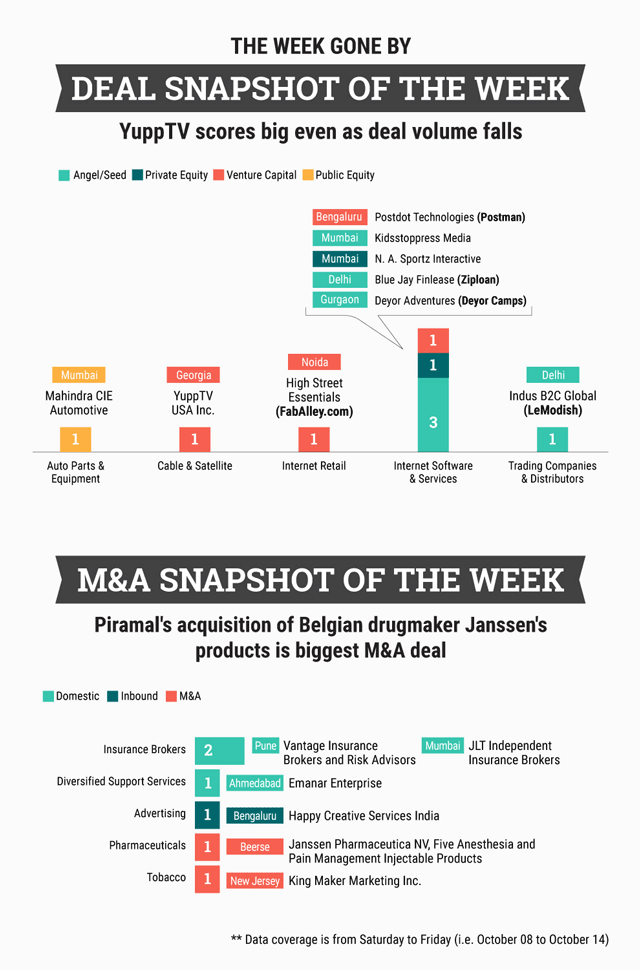

On the M&A front, Piramal Enterprises’ acquisition of five anesthesia and pain management injectable products from Belgium’s Janssen Pharmaceutica for $175 million was the biggest reported deal. Cigarette-to-hospitality conglomerate ITC had struck a deal to sell its wholly owned US-subsidiary King Maker Marketing Inc, a cigarette supplier, for $24 million.

Like this report? Sign up for our daily newsletter to get our top reports.