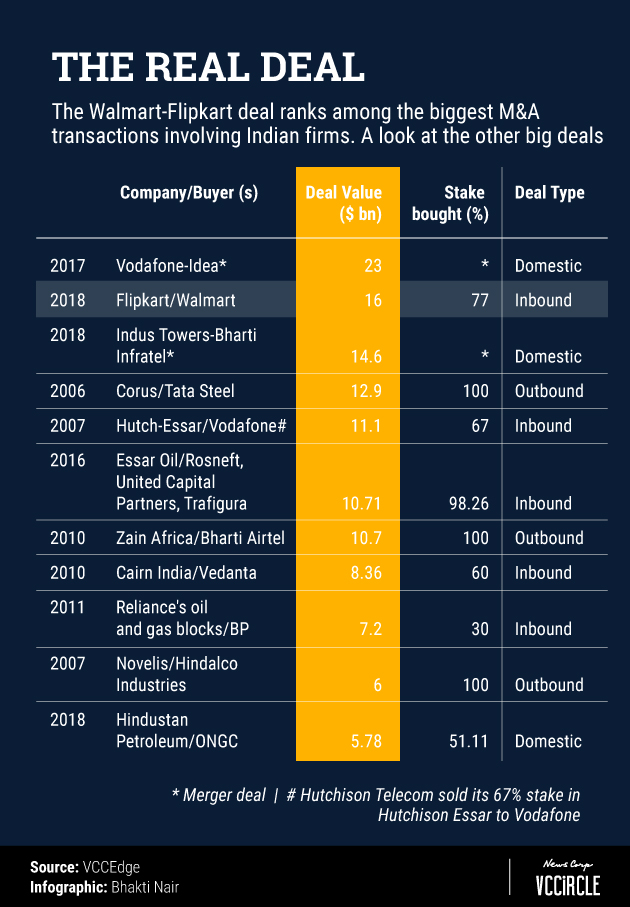

Walmart Inc.’s decision to purchase a majority stake in online retailer Flipkart marks the biggest inbound acquisition in India ever, overtaking Vodafone Group Plc’s 11-year-old deal to buy into a local telecom operator.

The transaction is significant also because all other top M&A deals involving Indian companies relate to non-technology sectors—mainly oil and gas, steel and metals, and telecom.

Also, this is the largest acquisition by Walmart ever and the largest in the e-commerce sector globally. Walmart’s other e-commerce deals include the purchase of Jet.com in the US for $3.3 billion.

In India, the telecom and telecom infrastructure sectors have dominated the M&A landscape with as many as four deals in the top 10. While Vodafone-Idea combination is the biggest M&A deal in India thus far, the merger of Bharti Infratel and Indus Towers comes third in the top 10 list.

The biggest inbound transaction until now is Vodafone’s acquisition of a 67% stake in Hutchison-Essar from Hutchison Telecom in 2007. This is followed by the 2017 deal where Essar Group sold its energy unit to Russia’s Rosneft and a consortium of commodities trader Trafigura and Russian private investment group United Capital Partners.

Tata Steel’s acquisition of Anglo-Dutch steelmaker Corus for $12.9 billion in 2007 is the largest acquisition by an Indian company.