VCCEdge has released its Monthly Deal Update for May 2012.

Highlights -

Private Equity:

- Private Equity investments in May’ 12 fell to a yearly low of $389 million, a sharp decline of 68% as compared to $1.2 billion recorded in May’ 11.

- Growth capital/late stage investments went down 71.5% from $1.12 billion to $321 million.

- The average deal amount dipped from $32 million to $18 million.

- The median deal amount declined about 55% from $11 million in May’ 11 to $5 million in May’ 12.

- Private equity deals under $50 million accounted for 55.26% of total deal volume.

- Big-ticket deals ($100m and above) accounted for 54.5% of the total capital invested.

- Private Equity Exits in terms of exit value dipped 89% from $505 million to $50 million and deal volume dropped from 14 deals to 8 deals.

Mergers & Acquisitions:

- M&A deal value dipped from $4.28 billion in May 2011 to $435 million this month.

- Deal values dipped by 49.83% and 95.65% and 96.68% across domestic, inbound and outbound deals respectively.

- The average deal size reduced 72.57% from $113 million to $31 million.

- The Median deal size remained unchanged at $25 million.

- Deals under $50 million accounted for 30.76% of total deal volume in May 2012.

- Big ticket deals ($100 million and above) accounted for 37.93% of the total disclosed M&A deal value.

Report Contents

I. EXECUTIVE SUMMARY

II. Private Equity

Private Equity Investments

- Overview

- Deal Type Analysis

- Sector Analysis

- Top 5 Private Equity Investments

Private Equity Exits

- Overview

- Deal Type Analysis

- Sector Analysis

- Top 5 Private Equity Exits

III. Mergers & Acquisitions

- Overview

- Deal Type Analysis

- Sector Analysis

- Top 5 Mergers & Acquisitions

Publication Date: June 6, 2012

Format: Pdf

Price: Rs. 1,299/- (Plus 12.36% Service Tax)

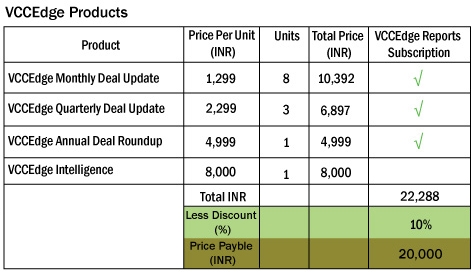

Special offer: Order an annual subscription and save 10%. Plan details below.

For a sample issue or trial login contact sales@vccedge.com.