VCCEdge has released its Monthly Deal Update for August 2012.

- Private equity investments in August 2012 increased by 4.2x in terms of deal value to $1.72 billion as compared to $402 million in August 2011.

Growth capital/late stage investments increased from $294 million to $1.66 billion. The average deal amount increased from $10 million to $64 million. The median deal amount increased two fold from $5 million in August’ 11 to $12 million in August’ 12. Private equity deals under $50 million accounted for 51.21% of total deal volume in August’ 12. Big-ticket deals ($100m and above) accounted for 74.58% of the total capital invested. Private Equity Exits in terms of exit value and deal volume increased 5.3x and 37.5% respectively. - M&A deal value dipped from $3.1 billion in August 2011 to $1.06 billion this month.

Deal values decreased by 75.14%, 94.6% and 27.66% across domestic, outbound and inbound respectively. The average deal size decreased 39.80% from $98 million to $59 million. The Median deal size changed from $53 million to $12 million. Deals under $50 million accounted for 36.58% of total deal volume in August 2012. Big ticket deals ($100 million and above) accounted for 74.57% of the total disclosed M&A deal value. Private Equity Investments

Top 5 Private Equity Investments III. Mergers & Acquisitions

Top 5 Mergers & Acquisitions Publication Date: September 6, 2012

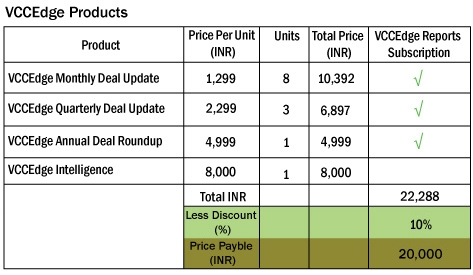

Price: Rs. 1,299/- (Plus 12.36% Service Tax)

Special offer: Order an annual subscription and save 10%. Plan details below.