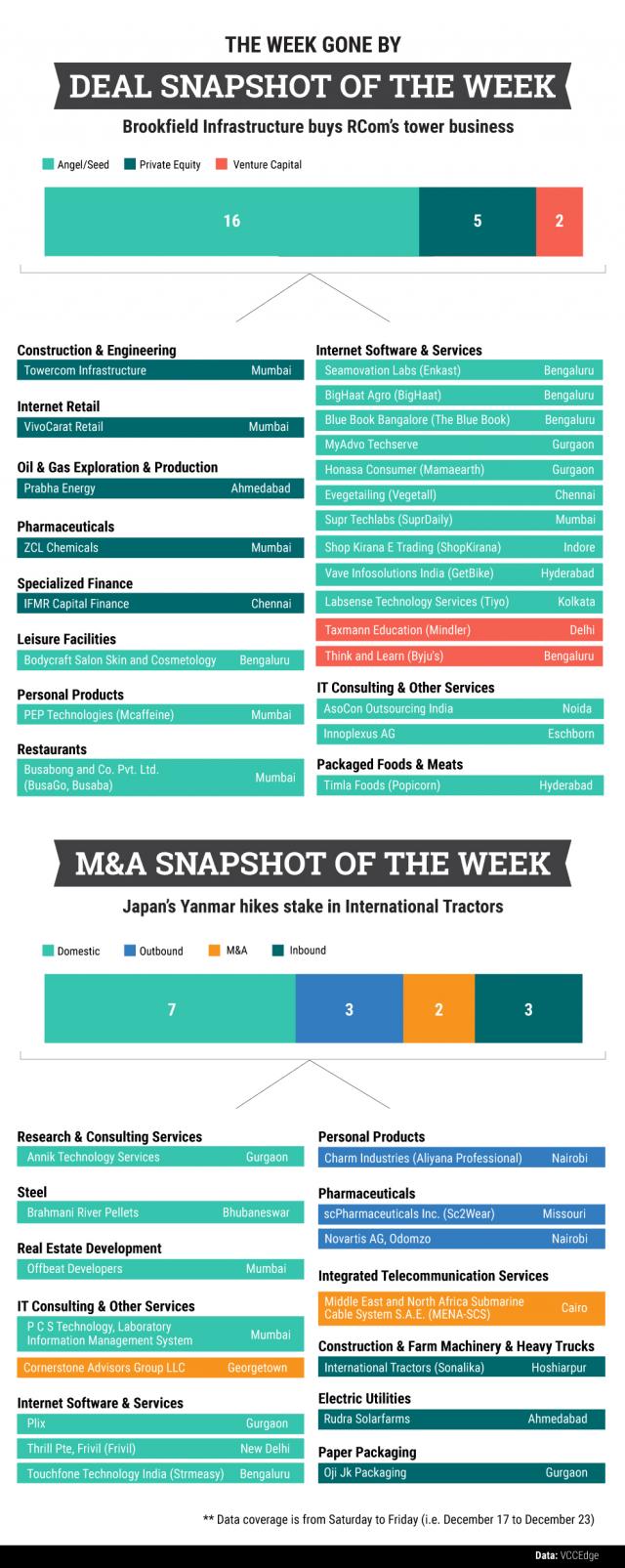

In the deals space, private equity major Brookfield Infrastructure Partners has sealed a deal to acquire Towercom Infrastructure from Reliance Communications for $1.61 billion. The transaction is the second biggest private equity deal in the country.

In another private equity deal, Chennai-based non-banking financial services company IFMR Capital Finance raised $50 million from Standard Chartered Private Equity in a deal which saw partial exit from existing investor LeapFrog Investments.

Mumbai-based pharmaceutical company ZCL Chemicals received $25 million from Morgan Stanley Private Equity Asia.

In the M&A space, Japan’s Yanmar is set to acquire 18% stake held by private equity major Blackstone Group in Punjab-based International Tractors for $235 million, according to a report in The Economic Times. Yanmar will increase its stake in the company to 30% after the transaction.

Sun Pharmaceutical Industries acquired 14.58% stake in the US-based scPharmaceuticals Inc. through a wholly-owned subsidiary for a consideration of $13 million.

In another deal, cloud solutions provider 8K Miles Software Services acquired US-based Cornerstone Advisors Group in a cash-and-stock deal with purchase consideration of $10.25 million.

Like this report? Sign up for our daily newsletter to get our top reports.