Business must go on - be it boom time or recession. However, businesses need to adapt to be able to survive and the motivations behind strategic decisions get dramatically altered. This ability to take decisionsdepends directly on the wherewithal (financial and otherwise) to see these decisions to fruition. “Opportunity in Adversity” appears to be the phrase of the day for most businesses. Whether it is reality or a survival instinct among businesses that forces them to seek opportunities, is a question that we try to answer here.

The past year was replete with surprises – both pleasant and unpleasant. Indian companies made global headlines with landmark transactions such as Tata Motors, acquisition of Jaguar and Land Rover, and Suzlon’s acquisition of REPower. These were considered very significant for an Indian company. Almost 80% of the Indian transactions of 2008 were cross-border in nature - which in a sense signaled a change in the dynamics of Indian business. Almost all sectors saw active M&A - from infrastructure, to telecommunications, consumer and retails and even transportation and logistics. However, how effective these transactions were remains a question especially in the light of the experiences of companies that paid the top dollar valuation and overleveraged themselves in order to fund ambitious expansion plans on the back of projected markets/order books that seem to have diminished significantly.

So, what is the opportunity made available by recession? For countries like India this implies a relative shift in the dynamics of size, markets and segments that previously dominated transactions. A change in the risk-appetite and drastically altered financial circumstances have led to the emergence of the following key trends:

Niche acquisitions to take priority

With the global downturn, Indian companies are cautious on entering new markets. The companies are instead focusing on consolidating their existing businesses and making strategic niche acquisitions backed by intellectual property, technology and technical know-how to drive business growth to enhance their capabilities. Companies in segments such as healthcare equipment, biotechnology, high-end manufacturing equipment/technology, and agricultural R&D (among others) are expected to see an increasing transaction activity.

These are businesses that cater to specific segments or markets. They have been on a steady growth trajectory and provide higher margins. In a tumultuous market, these niche businesses are often more insulated from global fluctuations due to high entry barriers and a relatively steady customer base.

Usually, inorganic growth is considered an effective strategy for knowledge driven businesses because these exhibit high entry barriers due to the need for capital investment in research and development. Also, despite investments, patents tend to restrict possibilities to grow organically - especially for smaller players. Acquiring for the sake of know-how is also a relatively low-risk strategy since, either a tested market is serviced, or a tested product is offered to an available untapped market or, sufficient economies of scale/cost competitiveness can be achieved.

Transactions by mid-size companies

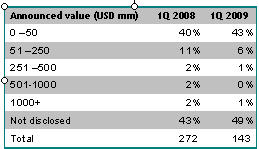

In 2008, the transactions that received coverage and were heard of were large deals by large companies. With the valuation touching the roof across the world, it was only large companies who leveraged their financial strength and raised capital through debt, equity or equity linked structures for financing these acquisitions.

However, with a number of these acquisitions turning sour or at least not in line with the grand projection, these companies are now busy consolidating their acquisitions and re-negotiating with the lenders and investors.

The changing environment is witnessing increased transaction interest from mid-size companies which were holding back due to valuation and financing challenges. These include companies who are sitting on substantive surplus cash either from inherently profitable operations or from private equity capital which they raised at very attractive valuations during the last couple of years. The time is opportune for their acquisitions since distressed assets are available both in the domestic and overseas markets at attractive valuations.

Fundamentally strong business models

India is among the few economies expected to grow at greater than 5% and around 80% of that growth is likely to be based on domestic demand. Therefore the businesses which cater to this domestic consumption in sectors like power, food, consumer products, healthcare and education are expected to grow reasonably well during the global slowdown. This is a tremendous growth opportunity for international players in the light of the relative saturation or uncertainty in most developed markets. Hence, these sectors are likely to witness increased transaction interest from international players. While the Indian businesses in these sectors continue to have growth prospects, the financing options to capitalize on these growth prospects, specially for small and mid sized players, have reduced significantly with the liquidity squeeze in the debt market, the sharp decline in the capital market and a significant drop in appetite and valuation in the private equity segment. These businesses are therefore likely to be open to strategic investments although valuation and control issues will continue to pose the transaction challenge.

Focus on core businesses and consolidation

The global slowdown and the resultant financial crunch are forcing conglomerates to re-evaluate their portfolios and focus on core businesses. “Cash is the King” and these conglomerates are averse to spreading it thinly over a number of unrelated business or in some cases simply do not have a choice of doing so due to the liquidity crunch they face for various reasons. There is an increased willingness to divest certain non-core portfolios and utilize the cash to consolidate core businesses. This provides opportunities to other companies to grow in related businesses through acquisitions.

With the drivers of M&A such as stable markets, demand led business growth and easy access to affordable means of finance evaporating, the relatively rampant level of M&A at astronomical valuations, which was witnessed in the last few years, is likely to slow down considerably. The next few years are likely to witness a shift in the M&A drivers with focus on consolidation in core businesses through strategic niche acquisitions to enhance core capabilities and divestitures resulting from a re-evaluation of business portfolios. The focus will be on fundamentally strong business models backed by domestic consumption as against speculative unrelated investments promising chimerical returns.

Views expressed are personal