As an avid poker player, the recent ways in which game theory has revolutionised the game is fascinating to me. My other speciality is helping startups #scalewithspeed with detailed focus in urban tech and sustainability, in particular.

So, it’s not unnatural, I suppose to link this science of incentivising people to sustainability especially when you consider the impact of certain theories such as the Tragedy of Commons or the ‘Cap & Trade’ strategy (made especially popular by Europe).

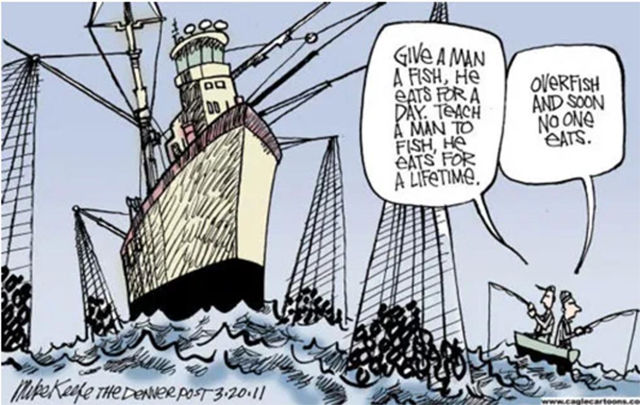

Image Source: caglecartoons.com

The former is simply this: a constructed situation where individuals with access to a public or common resource act in their own interest, and in doing so, ultimately deplete this resource.

Sounds like a sustainability issue, doesn’t it? Here’s a fact we continue to live in denial about: overhunting and overfishing are massively risking marine ecosystem endangerment. Consider the situation at hand: an unlimited number of users, unfettered by limits on access continue to fish, even though they know that eventually this will lead to no fish being available. Put yourself in this position. As a fisherman, what makes you continue to fish when you know there will come a day when no fish are left?

And that is the Tragedy of the Commons.

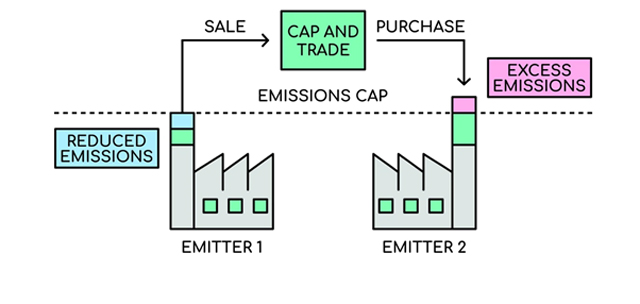

Image Source: Money, Marks and Media

The theory came to my mind during Covid when the shortage of toilet paper became a meme. People grabbed TP because they thought if they didn’t somebody else would, without considering if they really needed it or how much it would cost the earth.

I won’t get into the stats of the adverse effects of TP on the environment, but you get the idea.

Now apply this to the global conundrum of a few basic everyday items. Fast fashion is a particularly toxic example… in fact, did you know that luxury brand Burberry burnt $37.8 million worth of its 2018 season’s leftovers to avoid offering a discount on unsold wares? Or that climate change and human encroachment is endangering 60 percent of different coffee plant species, especially the much-loved Arabica?

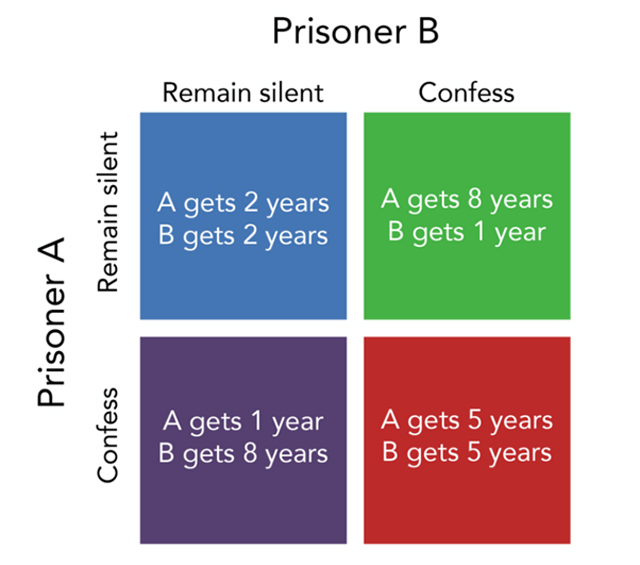

Here’s where another bit of game theory really comes into play, or as we may know it better, the ‘Cap & Trade’. The Cap is a rule companies must follow: A limit on the carbon emissions they produce. Greener and newer companies will naturally produce lower emissions allowing them to earn carbon credit which they can then trade on the market with companies who have not been able to cap their emissions. It’s what forms the essence of the Paris agreement where 196 countries pledged to work to limit the global average temperature increase to 1.5 degree Celsius. India hasn’t just joined the rails; we appear to have scaled the goal if you go by the ambitious targets set during last year’s G20 summit. These requirements need massive financial backing, which brings me to the ‘Prisoner’s Dilemma’: a situation where two potential prisoners need to get to a solution to obtain the best outcome from the spot they are in.

Image Source: lumenlearning.com

Now here’s where it gets interesting. Last year, we launched the second cohort of our early-stage proptech program. Of the startups that were selected, Earthfokus delivers water management systems and devices known as water savers that can be attached to taps to save up to 95% of water wastage per push. If you go back to the ‘Tragedy of Commons’, this is an incredible way to minimise the incredibly terrifying shortage of water we are facing already. A second cohort, Ambiator offers solar viable cooling sans compressors, thereby delivering 6.5 times more energy efficiency than your typical air conditioner.

In 2020, the first cohort of this proptech program found Zerund – a college level lab project in Assam that delivered a zero-emissions lightweight brick, along with Tellus Habitat, another wastewater management system that has rendered 3.6 million litres of waste water effective for reuse. Sustvest has reduced CO emissions by almost 2.4 million kg through provision of green energy and Safearth, providers of solar solutions, continue to save approximately 1.75 million tonnes of carbon emissions every year.

If you consider working with such companies to resolve the ‘Tragedy of Commons’, you can begin to ‘Cap Off’ your company’s emission rate. In the process, look up Breathe ESG, an ESG SaaS platform that helps measure, manage and effectively offsets your business’ carbon footprint.

Now that you’re ready to trade your carbon credits, you’ve entered the third phase where you can avail the best deal that the Prisoner’s Dilemma has to offer you on a national or an international scale. Being the poker player I am though, I have not yet gone all in. I’d like to envision breaking out of the ‘dilemma’ and offering the incredible solutions these startups provide so there is equal opportunity for every company and the government to operate at zero emission.

Now that’s called a Royal Flush. And I invite you all to have a winning hand. Because our planet’s health… well that’s not something we should ever consider playing with.

Now think twice before ordering that coffee.