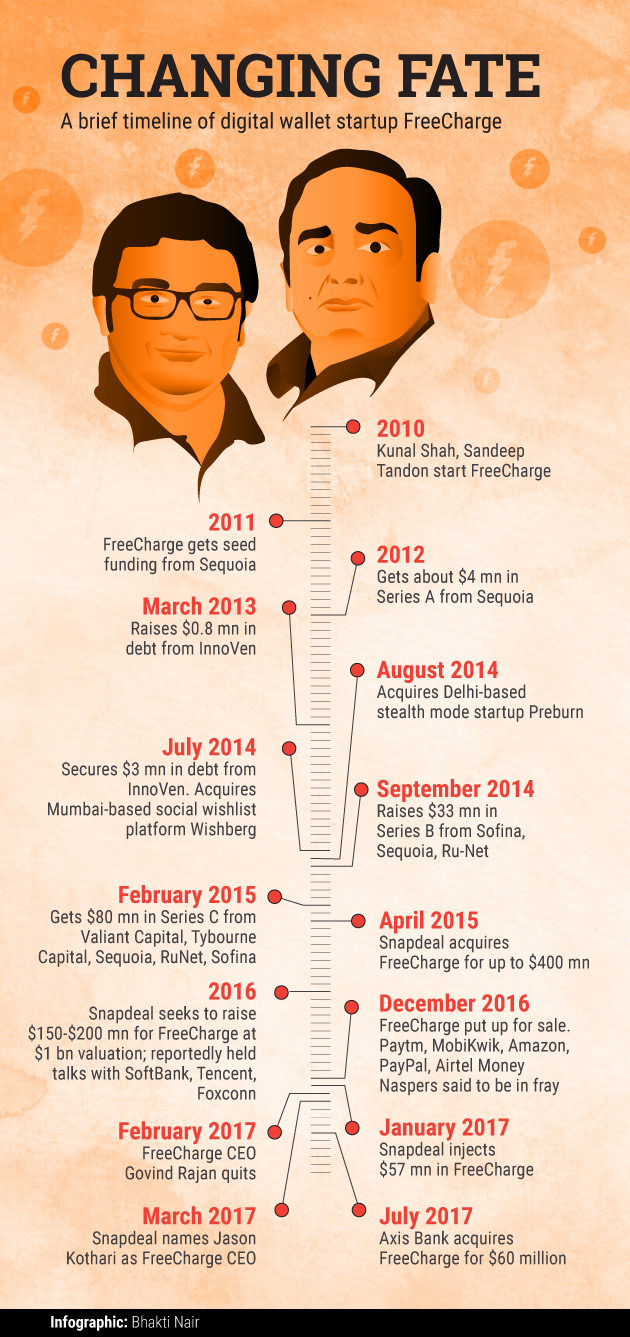

In April 2015, online retailer Snapdeal shelled out as much as $400 million for digital payments startup FreeCharge in what was then the biggest acquisition in India’s consumer Internet sector. Two years on, Snapdeal has agreed to sell FreeCharge for just $60 million (Rs 385 crore) to Axis Bank, India’s third-largest private sector lender.

The deal comes after months of talks between Jasper Infotech Pvt Ltd-owned Snapdeal and potential suitors that reportedly included digital payments firm Paytm and e-commerce giant Amazon.

The sale marks a significant reversal of fortunes for the company. FreeCharge was set up in 2010 and attracted marquee investors such as Sequoia Capital before it was acquired by Snapdeal. But the company struggled in the face of rising competition from the likes of Paytm and MobiKwik.

For much of last year Snapdeal tried raising funds for FreeCharge at a valuation as high as $1 billion. After failing to do so, and as its own problems mounted, Snapdeal put up FreeCharge for sale.

FreeCharge's current valuation of $60 million is a steeper fall when compared with that of Snapdeal itself; the e-tailer is looking to merge with bigger rival Flipkart for around $900 million, far lower than its peak valuation of $6.5 billion.

The acquisition is similar to another deal in the startup sector—Flipkart’s fashion e-tailing arm Myntra acquiring smaller rival Jabong. Myntra paid $70 million (Rs 470 crore) for the acquisition, again far below the $1.2 billion valuation that Rocket Internet-backed Jabong was seeking in late 2014 when it was in talks with Amazon.