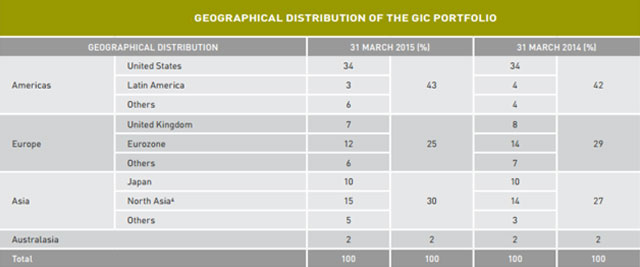

Singapore’s GIC, one of the most active sovereign wealth funds in India, raised its exposure to Asia (outside Japan), making the continent its second-biggest geographical bet behind Americas last year, it said in its annual report.

In the previous year ended March 31, 2014, GIC had bet on European recovery with Europe being the sole region where it had hiked its exposure.

The Americas region, including the United States (34 per cent), Latin America (4 per cent) and others (4 per cent), accounted for 42 per cent of its portfolio in the year to March 2014, against 44 per cent in FY13.

As a result, Asia, which was the second-biggest region as of FY13 had slipped to the third spot as GIC’s exposure to the region fell from 28 per cent to 27 per cent of its assets. This rose last year as GIC's European exposure fell back to 25 per cent from 29 per cent of the total.

The rise in exposure to Asia was primarily due to markets outside Japan and North Asia (China, Hong Kong, Taiwan and South Korea), which would include markets like India and other Southeast Asian markets. Its assets in these other Asian countries rose from 3 per cent of the total assets to 5 per cent last year. North Asia presence also rose but only marginally.

The only other region which matched up in terms of South and Southeast Asia in attracting GIC was Americas outside the US and Latin America. This would include Canada and other Central American markets.

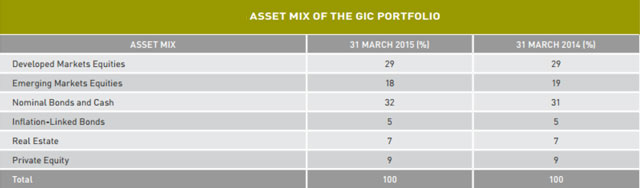

In terms of asset classes, GIC pretty much maintained the mix of the previous year with the only change being a small switch from emerging market equities to bonds and cash. This shows GIC turned more defensive in the light of volatility in global stock markets, especially so in the emerging markets pack. The recent crash in Chinese market and correction in Indian market show that it bet in the right direction.

The current asset mix also shows the headroom for future investment. For instance, in private equity, where GIC has put money in some 100 funds including a few in India, its exposure is just 9 per cent against its policy portfolio of 11-15 per cent of the total assets. The policy portfolio is the guiding factor for its asset mix.

Similarly, it has been underweight on real estate with just 7 per cent of its assets in it against 9-13 per cent under its policy portfolio.

It is overweight on bonds and cash which means it is playing conservative and preserving cash. Exposure to equities in developed market at 29 per cent is near its upper reference band of 20-30 per cent. Exposure to equities in emerging market is also near its upper end of 15-20 per cent.

Meanwhile, GIC said it achieved a 20-year annualised real rate of return of 4.9 per cent for the financial year ended 31 March 2015 compared with 4.1 per cent in the previous year.

This was the best rolling performance in almost a decade.

However, it cautioned: “We cannot expect this level of returns to continue. The current high asset prices are likely to result in low returns over the next 5 to 10 years. The results underline the point that to benefit from long-term investing, we have to be prepared to tolerate short-term unrealised losses.”