Three Singapore-based funds have been actively cherry picking stocks in the Indian markets - Nalanda Capital, Tree Line Asia Investment Management and Orient Global. These three funds have invested more than Rs 1,000 crore ($250 million) in Indian markets from late August to end of October this year.

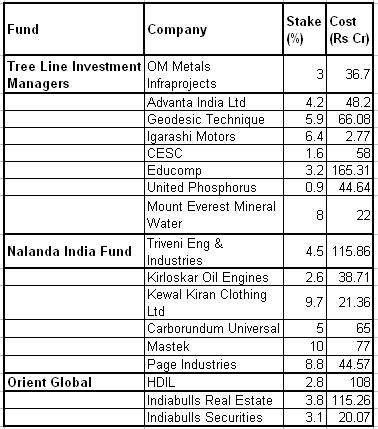

Hong Kong and Singapore-based Tree Line Investment Management, one of the biggest hedge funds in Asia with capital under management of $1.3  billion, has picked up stake in eight companies.

billion, has picked up stake in eight companies.

Pulak Prasad's Nalanda Capital, who has picked up stakes in six companies including Mastek, Triveni Eng and Carborundum. Nalanda Capital has $400 million fund with a mandate to invest only in listed Indian companies. Prasad was a managing director with Warburg Pincus in India earlier and went on to set up his own fund couple of years ago.

Advertisement

Another Singapore based private equity firm that is active in Indian capital markets is Orient Global, which has done several big ticket private equity deals in India. It has picked up stakes in the real estate and financial services arm of Indiabulls , and also realty major HDIL. Orient Global has previously invested in Yes Bank, India Infoline and also Cairn India.

Advertisement

The markets are attractive currently. On November 13 last year, Bombay Stock Exchange (BSE) bellwether closed at 19,289. At that time several banks and brokerages were predicting that the Sensex would go upto 30,000 and the growth in the Indian markets is intact. The Sensex later touched its all time high of 21,206 earlier this year. However, the rally tapered off soon and with the global economic slowdown, the Sensex has shed nearly two thirds of its value and reached a low of 7,697 last month.

With publicly listed high growth companies available at rock bottom prices, the opportunity is just too tempting for PE players to sit back. Almost every fund wants to do PIPE (private investment in public equity) now. "In the current market conditions, PIPE deals make more sense and we are definitely looking to do a few deals," said Sumir Chadha, Managing Director, Sequoia Capital India.

Advertisement

Promod Haque's Norwest Venture Partners India, which was till now doing venture capital deals in technology space, has shifted its gears to growth capital, PIPEs, and late stage investing. It has hired Goldman Sachs' Sohil Chand to lead the new strategy. "Valuations now look attractive and markets have over corrected relative to fundamentals and there are interesting opportunities," said Chand. Other funds who are looking to enter markets are SAIF Partners and TVS Capital Funds.

Advertisement

When the markets were at the peak last year, many PE firms negotiated with companies and invested in them through a fresh issue of shares. But now many funds are picking up shares straight from the market through open market bulk deals.

Law of Averages

Advertisement

There are certain funds getting back to their old portfolio companies since they are available for much lower price. ICICI Venture and ChrysCapital are buying back into the companies they have successfully exited. ChrysCapital successfully exited Gammon India in 2006, making 4.75x returns. The PE fund has invested in Gammon again this year, buying a 5.8% stake in construction firm for around Rs 86 crore.

ICICI Venture, which exited multiplex chain firm PVR Ltd with 4x returns last year, has picked up 8.78% stake from open market since June this year.

Another interesting trend among these deals is many of these funds who bought a little too early or did deals when markets were at the top, are now averaging their deals. The stocks are now available at less than half or a third of the initial deal price.

Warburg Pincus bought shares of electrical equipment maker Havells India through fresh issue of shares at Rs 625 per share for a 7.18% stake in October 2007. Now its averaging its investment, and has bought 3.06% stake through two bulk deals priced at Rs 370 per share in June and Rs 233 per share in October of this year.

Tree Line Asia has also averaged its investment in OM Metals Infraprojects, buying shares in March for Rs 38.5 and then in October for Rs 13.

These are indeed interesting times where private equity is changing and assuming the role of a hedge fund or an institutional investor, increasingly departing from its traditional role play. "PIPE transactions can be interesting where one can negotiate this as a deal where you have rights, where you can actually implement changes and private equity can play the traditional role that it is required to. But unfortunately for the most part, PIPE transactions don't work out like that and that's where we run up against a bit of a problem", said Shrivastava of CDC Group.