Blackstone-backed upskilling platform Simplilearn Solutions Pvt. Ltd, on Wednesday said that it expects to reach net profitability by FY24, a top executive told VCCircle.

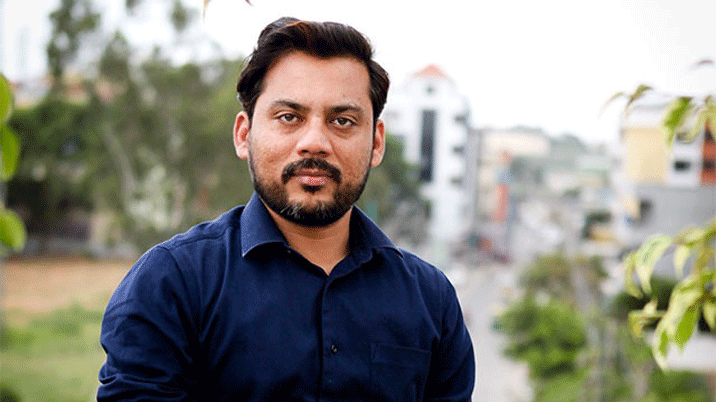

“Last year, we lost money after a long time because we did a lot of growth experiments after Blackstone came on board. But our goal is to get to profitability as soon as we can,” said Krishna Kumar, founder and chief executive officer at Simplilearn, adding that this year the company may not be able to achieve profitability, but is optimistic about FY24.

Simplilearn - a training destination for professional certification courses - reported a net loss of Rs 149.9 crore for FY22 against FY21’s loss of Rs 5.65 crore. It reported a net profit of about Rs 1.4 crore in FY20.

Simplilearn’s consolidated revenue from operations grew about 41% in FY22 to Rs 479.7 crore against the Rs 340.9 crore in FY21.

The company’s founder also said that Simplilearn aims to touch Rs 1,000 crore in consolidated revenue by end of FY23. He added that the upskilling player’s revenue growth was about 60% higher year-on-year for the 9MFY23 (April-November) period.

The company also raised $45 million (about Rs 366 crore) in a Series E funding round from a consortium led by GSV Ventures. The round also saw primary investments with no existing stakeholders making an exit from the firm.

According to Kumar, Simplilearn's valuation is currently pegged at around $500 million after the series E current round.

With this fundraise, Simplilearn looks to deepen its operations in existing markets including through increased recruitments. Simplilearn currently operates in US, India, Singapore, Saudi Arabia, Dubai and Thailand. Apart from product improvement, the edtech player also looks to expand its upskilling offerings for all kinds of professionals including those in HR and finance industry with these funds, Kumar said.

The round also saw participation from Clal Insurance and DisruptAD, ADQ’s venture platform, as per a press statement.

Global private equity firm Blackstone is an investor in the firm as it picked a controlling stake in the company in July 2021 through its about $250 million fund infusion in the company. The deal was largely secondary that paved the way for the exit of early investors such as Kalaari Capital and Mayfield.

“This funding by GSV, others came at a time when the industry is going through turmoil and stands as a testimony to our profitable growth,” said Kumar.

Founded in 2010 by Kumar, Simplilearn is based in San Francisco, California, Bengaluru and offers access to work-ready training to individuals and businesses globally.

Kumar, in an earlier interaction with VCCircle said that the company sees a huge global opportunity and its priority will be to grow rapidly in the US even as India has seen an increasing shift to online learning in the wake of the coronavirus pandemic.

Avendus Capital was the financial adviser to Simplilearn and its shareholders on the transaction.