After a rather dormant period, thanks to the global economic slowdown drying up liquidity channels in the West, over two dozen private equity funds—both institutional and star GP (general partners or fund managers)-led—have hit the fund-raising trail.

Early trends indicate that while the fund-raising sentiment may have improved, the environment is still beset with challenges. But, there is a significant improvement from last year when LPs or investors shied away from new investments and were only doing follow-on funding, PE industry watchers say.

In 2008, global funds with Asia as one of their economies raised capital of $44.3 billion, according to data from VCCEdge. Last year, $46.3 billion changed hands in which funds only focusing on India mopped up close to $4.2 billion in 2008 and about $2.9 billion in 2009. The latter months of 2008 and the first quarter of 2009 were rather testy.

"Fund raising is coming back”, said Kathy Jeramez Larson, Executive Director, ILPA (Institutional Limited partners Association), a non-profit organization serving institutional investors in the private equity sector representing $1 trillion of PE capital.

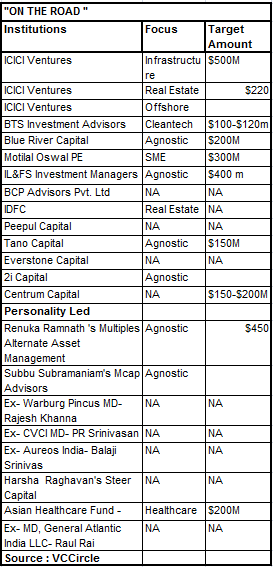

That should really sound like music to scores of funds and GPs that are on the road: IDFC real estate fund, ICICI offshore tranche, BTS cleantech fund, BCP Advisors, Peepul Capital, Everstone Capital, Blue River capital. Personality-led funds include Renuka Ramnath's Multiples Alternate Asset management, Subbu Subramaniam's MCap Advisors, Harsha Raghavan's Steer capital while ex-Aureos team is also setting up its own fund and PR Srinivasan or PRS (former MD, CVCI) too are out to raise funds.

Harsha Raghavan of Steer Capital, which is on fund-raising mode, says, “The current global capital and liquidity constraint remain a challenge as well as the reducing ability of the LPs to commit long-term capital such as 10-year lock-in funds remain another concern,” he said. According to him, globally trained and experienced managers will have an advantage in the fundraising space. Harsha Raghavan has launched Steer Capital with WNS co-founder Neeraj Bhargava.

According to a recent report by Emerging Markets Private Equity Association (a non-profit, independent, global industry association for PE & VC investing in emerging markets), fund-raising for emerging markets-dedicated private equity funds slowed in 2009, but investment activity was comparatively strong. Emerging markets captured 9% of global private equity fundraising and 26% of global private equity investment, with deal activity by transaction volume down by only 11%.

Echoes Eugene Choung, Managing Director, Emerald Hill Capital Partners, an Asian private equity fund-of funds, which just closed its second fund at $300-million target. “India has been a significant part of our investments from fund I and continues to be very important for Fund II”, he said.

While sentiment has definitely improved with people starting to do more due diligence, no one is writing that many checks yet. “They are willing to look but there aren’t many people willing to buy”, said an LP, with an on the ground presence in India who did not wish to be quoted.

Added to it are Eurozone concerns which may be pushing a lot of LPs to reallocate their portfolios, take more time on due diligence and also seek more favourable terms from their GPs. Apart from these macro-economic concerns, LPs are now more focused on liquidity, historical returns and less leveraged investments. LPs are essentially asking for greater visibility through the exits from the last funds, more favourable terms in carry and management fee and a hands-on role in their advisory boards.

According to Subbu Subramaniam, who left Baring Private Equity to float his own fund MCap Advisors, says, “All Asia-based fund of funds (FoF), which have a mandate to invest in Asia, prefer China over India as returns delivered in China are higher. Only FoF which are fully allocated or over-allocated to China are evaluating India and some of the new emerging economies like Vietnam, Indonesia etc.”

The most compelling question that many LPs are asking relates to exits in India. “India is a growth economy but I am not seeing my money come back. Where is my money? You can’t ask me to reopt into your fund, when I have not got any money in the last five years”, said the LP, who did not wish to be quoted. A limited amount of visibility in exit is very disconcerting to LPs, he adds.

It may seem that star GPs, who have an established track record and are currently on the road, will find the going easy. But, a PE industry observer says, such funds are taking much longer than expected and may be ending up raising smaller sums.

Says Subramaniam, “There are about 50 funds at last count, almost a third doing follow on funds, a third being set up by professionals with track record that are simultaneously in the market. As in all businesses, getting the first customer or the anchor investor is a challenge after which there is natural traction given that many investors are followers and not leaders.”

Adds Sudhir Variyar, investment director, Multiples Alternate Asset Management, "LP's understand that in any market, as it matures, there will be a shift from institutional platforms to independent platforms – which will in the process create new GPs. The moot question being asked of new GPs is, are you a first-time investor. As we go forward, institutional capital is more and more likely to be allocated to fund managers with established track record, distinctive investment styles and demonstrated ability to build and nurture constructive long term relationships with managements. This is an expected evolution, and is more a reflection of the growing maturity of the Indian private equity market, than that of the global fund raising environment."