Digital gaming platform Mobile Premier League said on Wednesday it has acqui-hired Pune-based software development company Crevise Technologies Pvt. Ltd in its first takeover.

MPL, operated by Galactus Funware Technology Pvt. Ltd, didn't disclose the value of the cash-and-stock deal.

MPL co-founder and chief operating officer Shubham Malhotra said in a statement the acquisition will help it strengthen its platform and improve customer experience.

“The [Crevise] team brings their rich end-to-end product engineering capabilities to the table,” he said, adding that the two companies had previously collaborated on projects.

Crevise, founded by Mukta Aphale and Atul Aphale in 2016, will continue its operations from Pune. “eSports is becoming a mass-market phenomenon in India and MPL is spearheading it,” Mukta said.

The deal comes just days after MPL said it had raised about Rs 250 crore in a Series A funding round led by investment firm Sequoia Capital.

Other investors in the round included Times Internet, GoVentures and RTP Global.

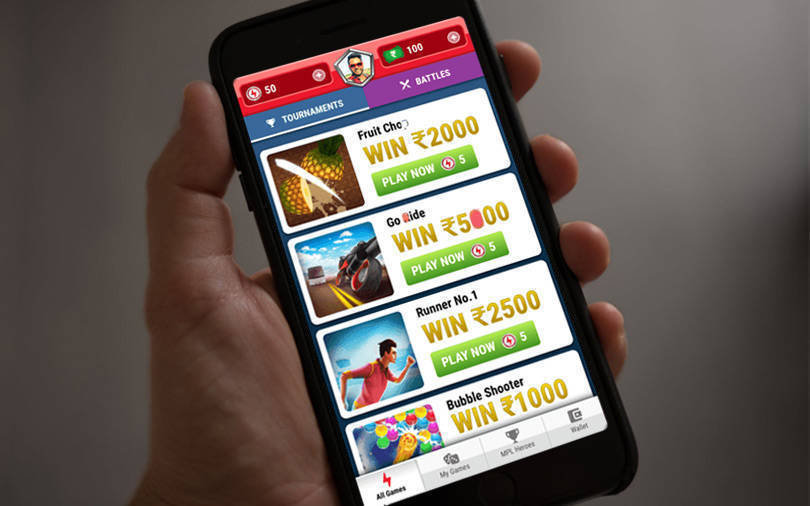

The startup claims it has registered over 25 million users since it launched in September 2018. The platform lets its customers choose games such as Sudoku and BrickBreaker and then play tournaments based on their budget. Winners of tournaments can cash out immediately through services such as Paytm or the Unified Payments Interface.

Gaming in India

The widespread adoption of smartphones, digital payment systems and cheaper internet data have played a large part in the rise of the gaming services industry in India. Companies in the sector have capitalised heavily, raising large amounts of money from investors and firms.

For example, in March, Mumbai-based fantasy sports startup HalaPlay Technologies Pvt. Ltd raised Rs 40 crore from Nazara Technologies Ltd and Delta Corp Ltd in a Series A funding round.

Earlier this week, Nazara invested an undisclosed sum in vernacular social contests platform Bakbuck.

Dream11 Fantasy Pvt. Ltd became the first gaming unicorn in India in April after Hong Kong-based Steadview Capital invested in the startup.