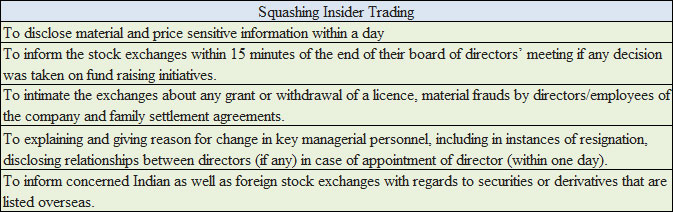

The capital market regulator Securities and Exchange Board of India (SEBI) has proposed a stringent set of norms for listed companies, making it mandatory for them to disclose material and price sensitive information within a day along with the reasons for such developments, so as to ensure that disclosures are not only timely but also adequate.

In a discussion paper, the capital market watchdog has asked the entities to inform the stock exchanges about all the events, which are material in nature, price sensitive and have bearing on business performance. This will include information with respect to unlisted subsidiaries of public listed companies.

"In cases where the disclosures are made after a day, the listed entity shall, along with such disclosure, provide suitable explanation for delay in making the disclosure,” the discussion paper said. Also, the companies will be required to make periodic disclosures on the associated material developments till the time the event is in progress or complete.

SEBI believes that entities use ‘materiality’ as a definition subject to their ‘suitability’ and ‘discretion’; therefore, it has sought to define ‘material transactions’ to make sure price sensitive information is disseminated to stock exchanges in a timely manner.

As per the current clause 36 of equity listing agreement between listed entities and stock exchanges, there are seven broad categories of material events that are required to be disclosed by the companies. However, SEBI is of the view that there is a need to review clause 36 to ensure a steady stream of disclosures “to enable investors to make informed decisions”.

Now, the capital market watchdog has drawn up an elaborate list of 16 categories of material and price sensitive events. To determine materiality and whether any information is price sensitive, SEBI has defined certain quantitative and qualitative criteria and also prescribed two litmus tests — a price impact test and a reasonable investor test.

The 26-page discussion paper showed that any information that could influence investor decisions could be considered as price sensitive.

The discussion paper has mentioned various activities under an indicative list of material and price sensitive information, including commencement or postponement of commercial operations, changes in general character of existing business, strategic arrangements and de-mergers.

Among other fresh additions, SEBI has proposed that companies would be required to inform the stock exchanges within 15 minutes of the end of their board of directors’ meeting if any decision was taken on fundraising initiatives, issue of bonus shares, re-issue of forfeited shares, payout of dividends, cash bonus, buyback of shares, or any changes in capital, including calls, financial results, provide details and reasons for restructuring as well as the overall impact to the exchanges, and voluntary delisting.

Also, SEBI has made it mandatory for companies to intimate the exchanges about any grant or withdrawal of a licence, material frauds by directors/employees of the company and family settlement agreements.

Other additions to existing requirements include explaining and giving reasons for changes in key managerial personnel, including in instances of resignation, disclosing relationships between directors (if any) in case of appointment of director (within a day).

SEBI has also suggested that the companies should inform Indian as well as foreign stock exchanges concerned with regards to securities or derivatives that are listed overseas.

(Edited by Joby Puthuparampil Johnson)