Inflexor's Mazumdar on the firm's second and third funds, thesis and more

Inflexor Ventures, technology-focussed venture capital firm, earlier this month announced the first close of Inflexor Opportunities Fund, which it will use to partly fund the acquisition of the entire portfolio of its earlier vehicle. The firm is targeting to raise a corpus of Rs 350 crore by this month. A major ......

Venture capital firm RPSG Capital to rope in top Orios executive

Early-stage venture capital firm Orios Venture Partners, which is an investor in companies like Country Delight, ixigo, BeatO and Pharmeasy, suffered another top management exit, a year after partners Anup Jain and Rajeev Suri quit to float their own firm. Currently deploying capital from its $120-million fund, Orios’ chief financial and ......

Bottomline: How a multi-crop strategy boosted Sahyadri Farms’ growth

Sahyadri Farms Post Harvest Care Ltd managed to almost double its revenue and triple its operating profit over the three years through March 2024 as it expanded beyond grape exports, although topline growth could moderate in the current year. The operator of farms for fruits and vegetables recorded high growth ......

Consumer electronics firm Indkal eyes fat PE cheque as revenue accelerates

Indkal Technologies Pvt Ltd, one of the country's fastest-growing consumer electronics companies, is in talks with a clutch of private equity investors within five months of its first external round of funding, at least two people aware of the development told VCCircle. The Bengaluru-based Indkal had raised around Rs 300 crore ......

Grapevine: Gaja Capital, Lightspeed, SolarSquare, Omnivore VC, and Farmley in news

Gaja Capital has set in motion its plan for a public listing while Lightspeed Venture Partners and Omnivore are likely to invest in a renewables company and a dry fruit brand, respectively, according to various media reports. Gaja Capital Domestic private equity firm Gaja Capital plans to go public and aims ......

MENA Digest: Lean Tech, UnifyApps lead funding activity; overall mop-up falls in Oct

Startup funding in the Middle East and North Africa region was led by at least a couple of high-value growth-stage investment deals last week. These include a high double-digit Series B funding raised by Saudi fintech infra platform Lean Technologies, followed by a UAE-based SaaS solutions provider UnifyApps, which raised ......

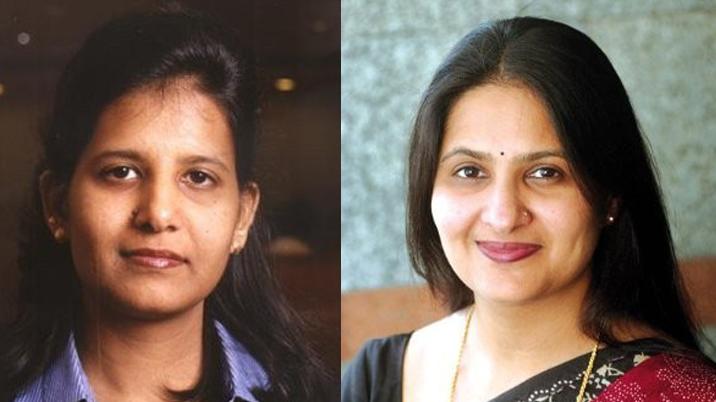

Women founders-focussed Colossa Ventures looking to tap offshore LPs for maiden fund

Venture capital investor Colossa Ventures, which focusses on funding women entrepreneurs, is in talks to rope international limited partners (LP) for its maiden investment vehicle, a person aware of the matter told VCCircle. The Mumbai-based firm, which was floated by former executives of Crisil and Aditya Birla Private Equity, is in ......

Former 360 One exec floats private equity firm for bets on emerging themes

A former senior partner at alternatives asset management fund 360 One (formerly IIFL Wealth & Asset Management) has floated a new private equity firm to invest in companies operating in emerging sectors. The PE firm, which will back companies in sectors across healthcare, enterprise tech, industrials and consumer, has been floated by ......

Pepperfry-backer Panthera Growth sets sight on $300 mn fund next year

Singapore-based Panthera Growth Partners (PGP), whose portfolion includes BigBasket, Pepperfry, and Zivame from its first two funds, plans to soon launch its third investment vehicle, at least two people aware of the matter told VCCircle. The growth-stage venture capital firm, which seeks to invest in technology, infrastructure, analytics, and software-as-a-service sectors ......

Deals Digest: Funding regained momentum last week as festive season takes breather

Private equity and venture capital funding saw an uptick last week compared to the preceding one, as the week-ended 8 November saw significantly low activity on account of Diwali holidays. While, deal volume during last week stood at 22, lower compared to the preceding week, total funding for companies backed by alternative ......