Grapevine: Warburg Pincus, Micro Life Sciences, Ola Electric, and KPMG in news

Micro Life Sciences is in talks to raise about funds, Ola Electric is cutting nearly jobs across teams as part of a restructuring and KPMG India's deal advisory unit is set for another leadership shakeup, according to various media reports. Micro Life Sciences Micro Life Sciences, India’s largest medical devices company, ......

Inflexor's Mazumdar on the firm's second and third funds, thesis and more

Inflexor Ventures, technology-focussed venture capital firm, earlier this month announced the first close of Inflexor Opportunities Fund, which it will use to partly fund the acquisition of the entire portfolio of its earlier vehicle. The firm is targeting to raise a corpus of Rs 350 crore by this month. A major ......

Venture capital firm RPSG Capital to rope in top Orios executive

Early-stage venture capital firm Orios Venture Partners, which is an investor in companies like Country Delight, ixigo, BeatO and Pharmeasy, suffered another top management exit, a year after partners Anup Jain and Rajeev Suri quit to float their own firm. Currently deploying capital from its $120-million fund, Orios’ chief financial and ......

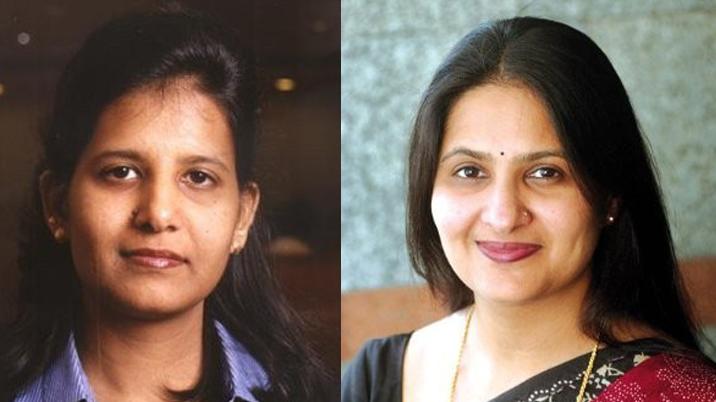

Women founders-focussed Colossa Ventures looking to tap offshore LPs for maiden fund

Venture capital investor Colossa Ventures, which focusses on funding women entrepreneurs, is in talks to rope international limited partners (LP) for its maiden investment vehicle, a person aware of the matter told VCCircle. The Mumbai-based firm, which was floated by former executives of Crisil and Aditya Birla Private Equity, is in ......

Saudi VC SEEDRA onboards sovereign investor as LP for second fund

SEEDRA Ventures, a Saudi Arabia-based venture capital firm that backs early-stage companies and currently manages a portfolio of 26 startups, has secured a commitment from a local sovereign investor for its second outing. The Riyadh-based VC firm has onboarded Saudi Arabia’s Public Investment Fund (PIF)-owned Jada Fund-of-Funds as a limited partner ......

After Swiggy, another portfolio firm of Prosus draws up plan for mega IPO

Global technology investor Prosus had recently monetised its investment in Swiggy when the food delivery and quick commerce company went for a public listing. Now, Prosus is readying another of its portfolio firm, for yet another mega IPO. Homegrown ecommerce player Meesho, which competes with the likes of Amazon and ......

How much upside KKR is sitting on in its two-year old bet as new investor comes in

Global private equity giant KKR seems to be sitting on a decent upside, two years after it bet on hybrid seeds company Advanta Enterprises Ltd, also a subsidiary of farm solutions company UPL Ltd, even as the private seed company attracted another investor on its cap table. Now, US-based Alpha Wave ......

Exclusive: Manipal family office Claypond strikes control-oriented deal in healthcare

Ranjan Pai-led Manipal Group, which gave up control in its flagship enterprise Manipal Hospitals to Singapore’s state investment firm Temasek a year ago, has now inked a control-oriented deal in the healthcare space via its family investment office Claypond Capital, VCCircle has gathered. The family office - active in dealmaking after ......

Former Brand Capital executive Rajesh Sharma floats own fund

Rajesh Sharma, a seasoned leader in private equity and venture capital, has announced the roll out of a new fund aimed at identifying and investing in high-growth sectors. Sharma, who previously served as director at Brand Capital, the private equity and venture capital arm of The Times Group, brings over two ......

MENA Digest: Lean Tech, UnifyApps lead funding activity; overall mop-up falls in Oct

Startup funding in the Middle East and North Africa region was led by at least a couple of high-value growth-stage investment deals last week. These include a high double-digit Series B funding raised by Saudi fintech infra platform Lean Technologies, followed by a UAE-based SaaS solutions provider UnifyApps, which raised ......