Inflexor's Mazumdar on the firm's second and third funds, thesis and more

Inflexor Ventures, technology-focussed venture capital firm, earlier this month announced the first close of Inflexor Opportunities Fund, which it will use to partly fund the acquisition of the entire portfolio of its earlier vehicle. The firm is targeting to raise a corpus of Rs 350 crore by this month. A major ......

Venture capital firm RPSG Capital to rope in top Orios executive

Early-stage venture capital firm Orios Venture Partners, which is an investor in companies like Country Delight, ixigo, BeatO and Pharmeasy, suffered another top management exit, a year after partners Anup Jain and Rajeev Suri quit to float their own firm. Currently deploying capital from its $120-million fund, Orios’ chief financial and ......

Bottomline: NIIF-backed Aseem Infra's profit jumps on growth in loan book, strong asset quality

For a non-banking finance company that began its lending operations only four years back, Aseem Infrastructure Finance Ltd has come a long way. From a loan book of Rs 1,588 crore at the end of 2020-21, the shadow bank now manages an asset book in excess of Rs 14,500 crore. Since ......

Saudi VC SEEDRA onboards sovereign investor as LP for second fund

SEEDRA Ventures, a Saudi Arabia-based venture capital firm that backs early-stage companies and currently manages a portfolio of 26 startups, has secured a commitment from a local sovereign investor for its second outing. The Riyadh-based VC firm has onboarded Saudi Arabia’s Public Investment Fund (PIF)-owned Jada Fund-of-Funds as a limited partner ......

Former Brand Capital executive Rajesh Sharma floats own fund

Rajesh Sharma, a seasoned leader in private equity and venture capital, has announced the roll out of a new fund aimed at identifying and investing in high-growth sectors. Sharma, who previously served as director at Brand Capital, the private equity and venture capital arm of The Times Group, brings over two ......

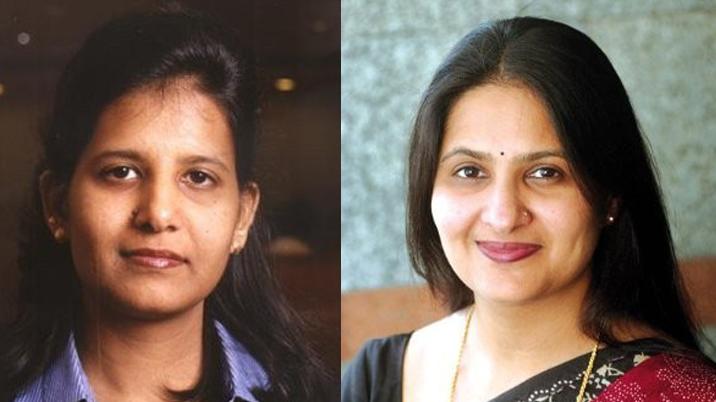

Women founders-focussed Colossa Ventures looking to tap offshore LPs for maiden fund

Venture capital investor Colossa Ventures, which focusses on funding women entrepreneurs, is in talks to rope international limited partners (LP) for its maiden investment vehicle, a person aware of the matter told VCCircle. The Mumbai-based firm, which was floated by former executives of Crisil and Aditya Birla Private Equity, is in ......

Former 360 One exec floats private equity firm for bets on emerging themes

A former senior partner at alternatives asset management fund 360 One (formerly IIFL Wealth & Asset Management) has floated a new private equity firm to invest in companies operating in emerging sectors. The PE firm, which will back companies in sectors across healthcare, enterprise tech, industrials and consumer, has been floated by ......

Kinara Capital gasps for breath as GNPA nears COVID level, AUM shrinks on firefighting

MSME-focused Kinara Capital has tightened its purse strings as the Gaja Capital-backed lender’s gross non-performing asset (GNPA) ratio neared the 9%-mark as on September 30, amid an industrywide asset quality stress in the unsecured business loan segment, VCCircle has learnt. After clocking a strong AUM growth in FY24, the company has ......

Pepperfry-backer Panthera Growth sets sight on $300 mn fund next year

Singapore-based Panthera Growth Partners (PGP), whose portfolion includes BigBasket, Pepperfry, and Zivame from its first two funds, plans to soon launch its third investment vehicle, at least two people aware of the matter told VCCircle. The growth-stage venture capital firm, which seeks to invest in technology, infrastructure, analytics, and software-as-a-service sectors ......

Genuine stress in market, no signs of improvement yet: Indifi’s Alok Mittal

ICICI Venture-backed Indifi currently does not see the need to raise funds. However, the reasons for this are not particularly positive. The MSME-focused fintech lender, which had to grapple with rising bad loans in the financial year ended March 2024, has not seen any signs of the situation improving thus far ......