Precision agriculture and aquaculture are two emerging sectors that hold significant potential in Indian agritech, according to a report by Bengaluru-based venture capital firm, Kalaari Capital.

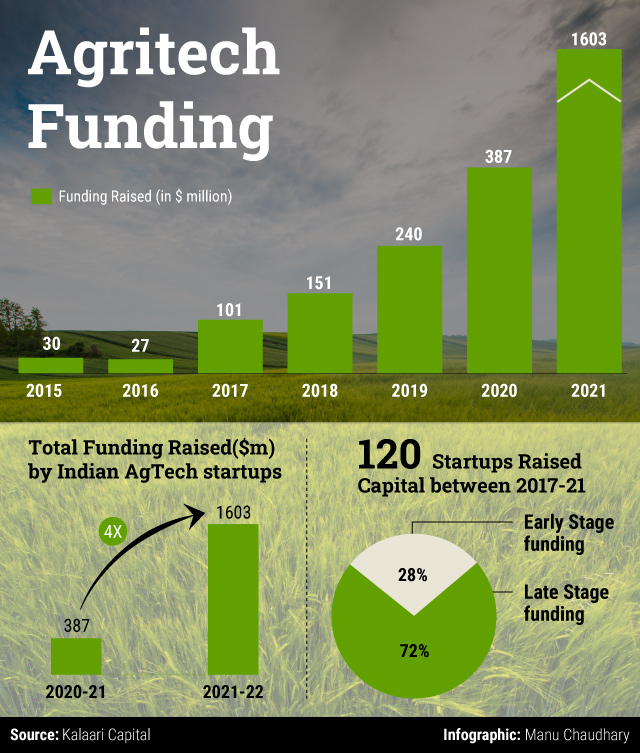

The report, "Agritech: India’s sunrise sector," said these themes attracted about 23% of the total $1.6 billion capital VCs poured into agritech in FY22.

The total investments in the agritech industry grew 4 times in 2021-22, driven by better mobile internet penetration, technology solutions, innovative founders, the adoption of newer supply chains and the government's focus on farm-reforms.

Average cheque size in the seed stage doubled to $2 million. In Series A, startups raised an average of $8 million.

Since 2017, more than 120 startups of the 1,500 active agritech startups in the country have raised capital over the span in question.

However, the agritech market, expected to grow over $24-billion over the next four years, is still in its infancy with a penetration of 1.5%, the report said citing a 2020 report by Ernst & Young.

Kalaari, in its report, highlighted the challenges the sector faces across the supply chain and in scaling technology-based solutions.

For instance, precision agriculture, which involves the use of technology to ensure that crops and soil receive scientifically adequate nutrition, is limited to high value or horticulture crops such as fruits, vegetables.

Farmers use drones, farm-based IoT devices, satellite-based data, mechanisation and intelli-machines to improve yield as a part of precision agriculture.

“Startups are not able to unlock scale here and raise growth capital. However, a lot of innovation is happening in space and economics for farms can work,” the report said.

Only about 8% of total funding received by agritech startups has gone to the precision agriculture segment, which is a $3.4 billion market in India and remains largely untapped and underfunded, the report said.

Even with better technology penetration and growing addressable market, its mass adoption will require affordable solutions, marketing campaigns and support from the government . Currently, the country isn’t ready to deploy these solutions at scale, as small farm lands do not make it economically viable.

“The government could consider supporting purchase of products like drones, IoT devices, and soil testing machines,” the report added.

The other emerging sector is aquaculture or under-water agriculture, with more than 5 million farmers involved in the practice.

Commercially, it is a $7 billion market opportunity in India.

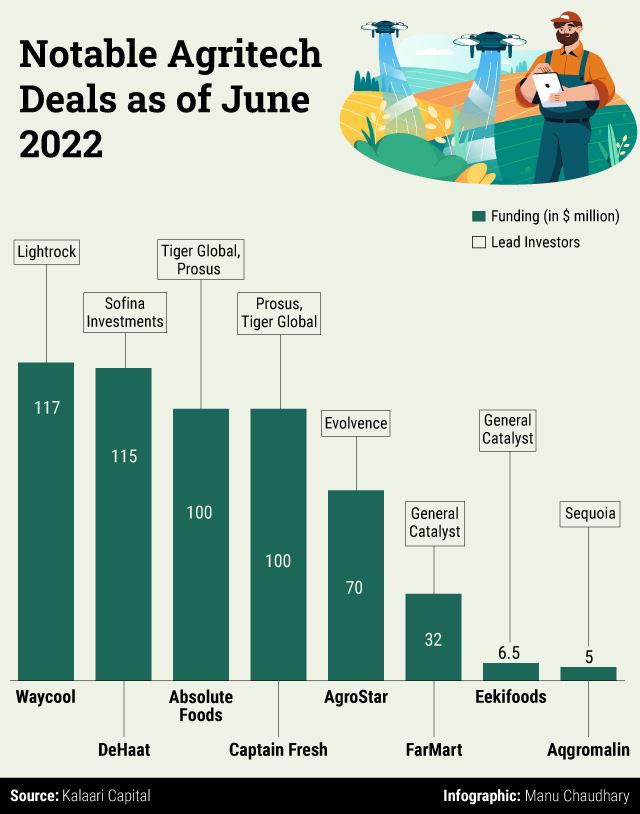

Aquaculture-related startups raised $140 million–about 8.75% of the total funding-from investors like Tiger Global, Sequoia Capital and Prosus in 2020-21.

“Value chain stretches more than 1000 km and lacks trust. 20-25% of the total produce is wasted due to degradation and rejections,” the report said.

Startups like Licious, Captain Fresh, FreshtoHome are trying to overcome problems around supply-chain, low-technology use and lack of organisation in the sector.

The largest share of agritech funding (29%) was attracted by input linkages i.e. startups focused around pesticides, fertilizers and manure.

The agri input space is a $10 billion market in India with prominent startups including DeHaat, BigHaat, Farms, Agrostar, FarMart trying to solve the problem of lack of access to quality inputs.

This year, input space got more funding than output for the first time in five years. Output linkages attracted 18% of the capital and managed farming attracted 21% of the capital in the space.

Output linkages in agriculture in India are a complex supply chain, consisting of several players. However, most of the market is unorganised, with middleman making combined margins of over 60% from farmers to end-consumers.

“Organised players control less than 5% of Indian fruit & vegetables trade that totals $480 billion. For staples and processed outputs like pulses and wheat, the percentage is even lower,” Kalaari said.

Startups like Ninjacart, Jumbotail, Vegrow among others operate in the space.

To solve problems related to agri output, “we believe part of the solution lies in creating technologies to predict demand from different sources,” Kalaari said in the report.