India’s consumer price inflation eased in August thanks to a good monsoon that helped control food prices but it remained slightly above the central bank’s target level for March 2017, making an interest rate cut unlikely next month.

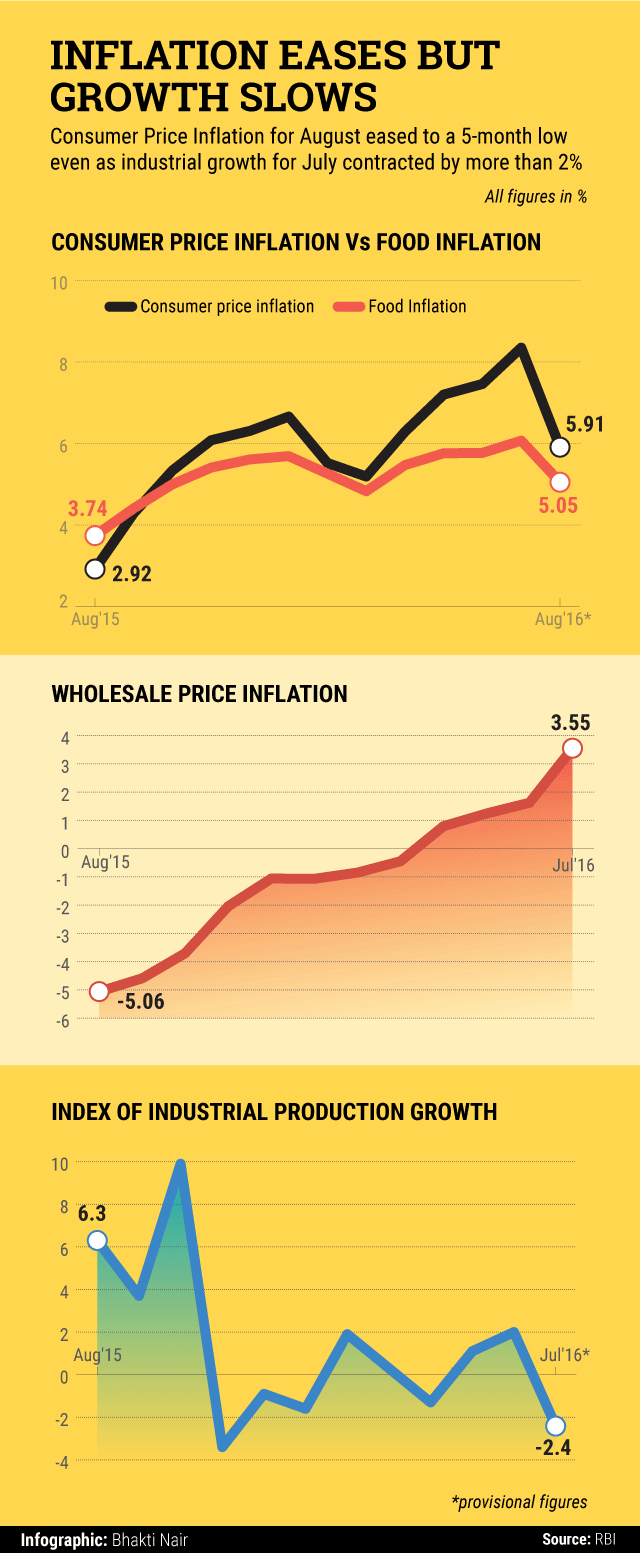

Retail inflation slowed to an annual 5.05% in August from July’s 6.07%, government data showed on Monday. Food price inflation eased to 5.91% from 8.35%.

Another set of data released on Monday showed India’s industrial production contracted 2.4% in July from a 1.9% expansion in June, raising growth concerns.

Even though retail inflation eased below the 6% upper threshold limit the government has set, it remains above the 5% target the Reserve Bank of India (RBI) has fixed for March 2017. This means the possibility of a rate cut in October, when the Reserve Bank of India (RBI) comes up with its bi-monthly monetary policy statement, is remote. This will be the first monetary policy under new governor Urjit Patel, who took office last week.

DK Srivastava, chief policy advisor at EY, formerly Ernst & Young, said that apart from domestic inflation numbers, the RBI will also look at the prospects of a rate hike by the US Federal Reserve, the rupee-dollar exchange rate movement, capital inflows into the country and overall liquidity conditions before deciding on interest rates.

Stock markets across Asia and Europe plummeted on Monday on fears of a possible Fed rate hike later this month. Indian markets, too, followed suit with the Sensex and Nifty slipped 1.5%.

“Patel is already under pressure (to cut interest rates). The call they (the RBI) have to take is how far they can go further down as that would impact the rate of savings in the country,†Srivastava said.

In recent months, Patel’s predecessor and former boss Raghuram Rajan had held his ground by not bringing down interest rates, despite apparent pressure both from corporate houses and from the political class.

This eventually led to several allegations being levelled against him by the Bharatiya Janata Party (BJP) leader and Rajya Sabha member Subramanian Swamy, who said Rajan was acting against the country’s interests. Following a bitter controversy, Rajan decided not to seek a second term at the central bank.

The data released on Monday showed also that, among food items, pulses and sugar registered the highest increase in prices between August last year and this year. While the prices of pulses grew 22%, sugar and sugar products became costlier by 24.75% during the period.

Food prices are, however, likely to ease as a good monsoon has boosted sowing. Kharif crop sowing data released last week by the agriculture ministry shows that the sown area till September this year is 1,054.49 lakh hectares compared with 1,012.35 lakh hectares till the same time last year.

More than 85% of the country has received normal to excess rainfall so far, as compared to drought-like conditions in the previous two years.

Like this report? Sign up for our daily newsletter to get our top reports.