An absence of multi-billion dollar deals meant merger and acquisition (M&A) activity didn’t sizzle like private investments that hit a record high this year.

However, M&A dealmakers saw hectic activity with the number of deals spiking to 934, the highest ever, according to provisional data from VCCEdge, the data research platform of VCCircle.

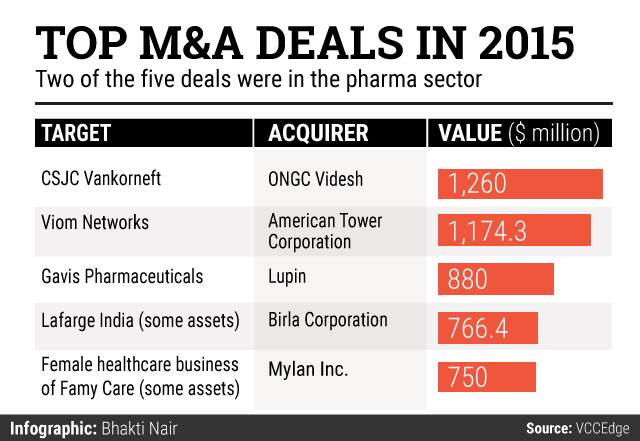

Here are the top M&A deals for the year:

ONGC-Vankorneft

A slump in oil prices due to oversupply and a slowing world economy didn’t stop state-run Oil & Natural Gas Corp from making one of the biggest transactions in the oil exploration field this year. The company’s overseas arm, ONGC Videsh Ltd, in September acquired a 15 per cent stake in largest Russian oil producer Rosneft's Vankor oil field in Siberia for $1.26 billion. The Vankor oil and gas condensate field is Russia's second biggest.

ATC-Viom

In the second-largest M&A transaction this year, NYSE-listed American Tower Corporation (ATC) inked a deal to buy a 51 per cent stake in PE-backed telecom tower firm Viom Networks Ltd for Rs 7,635 crore ($1.2 billion) in cash. The deal saw some PE backers including IDFC Alternatives part-exiting the enterprise with SREI Group selling its entire shareholding and Tata Teleservices Ltd also paring its stake. ATC would pip Indus Towers to become the world's largest tower firm by number of communication sites on completion of this deal.

Lupin-GAVIS Pharma

Lupin, India’s second-biggest drugmaker by market value behind Sun Pharmaceutical, inked the biggest-ever overseas transaction in the pharmaceutical sector and the top cross-border buy this year with America's GAVIS. The transaction was a big step for Lupin, the country’s third-biggest drugmaker by revenue behind Sun Pharmaceutical and Dr Reddy’s Labs, to strengthen its hold on the US market. It also gave the company an opportunity to acquire 65 more products under development in the world's biggest drug market.

Birla Corp-Lafarge units

Birla Corp took an opportunistic bet to expand its cement business by inking an agreement to buy two factories from Lafarge India. This followed an order by Indian anti-trust authority Competition Commission of India (CCI) asking French cement producer Lafarge to sell the two units, located at Jojobera (Jharkhand) and Sonadih (Chhattisgarh), as a condition to allow its Indian leg of the global merger with Holcim.

Mylan-Famy Care unit

The pharmaceutical sector saw another major deal with Mylan picking up the women healthcare business of Mumbai-based privately held firm Famy Care. This marked a return for the American drugmaker to strike a large deal just two years after buying Agila from Strides Arcolab. Famy Care counts AIF Capital as a shareholder.