Private investments in the media and entertainment industry hit a new peak during the year as investors bet on content distribution businesses and digital media ventures in particular.

With a week to go, the number of private investment transactions in the sector is just two short of the record high of 34 in 2008 while the announced value of deals peaked at $809 million, as per preliminary data collated by VCCEdge, the data research platform of VCCircle.

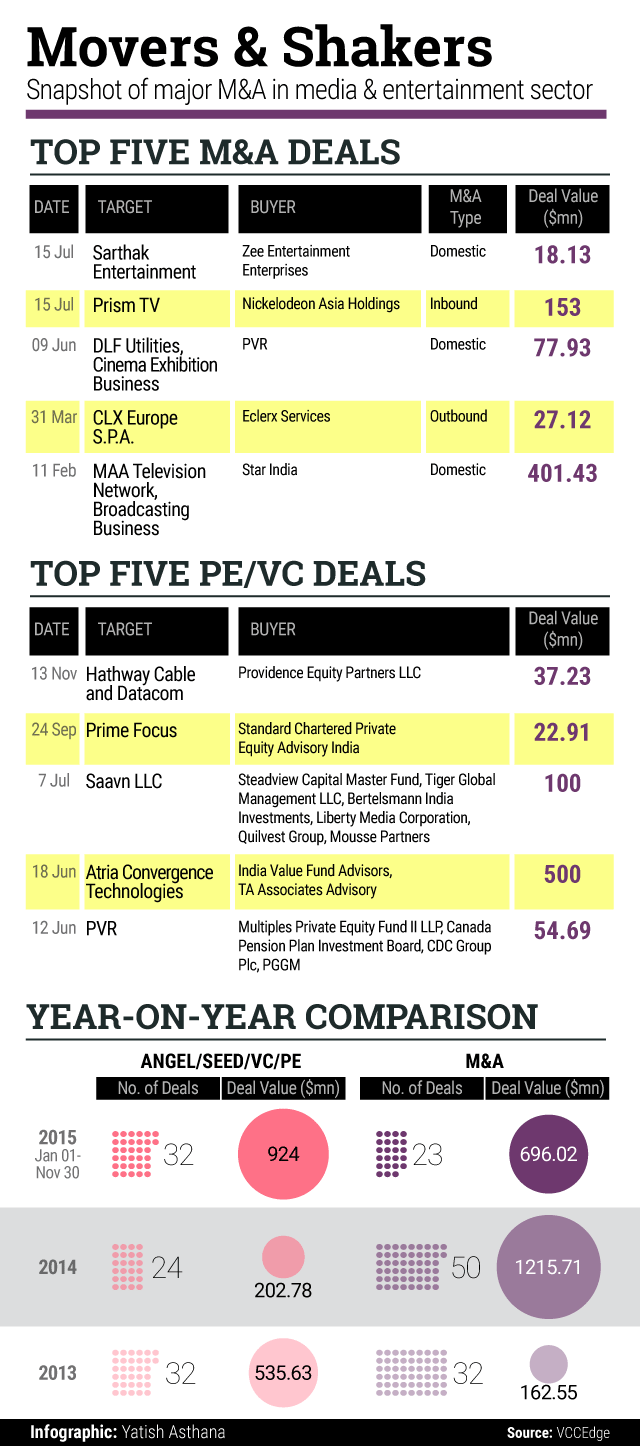

To be fair, the overall value of investments is skewed in favour of Bangalore-based broadband service provider Atria Convergence Technologies Pvt Ltd (ACT). TA Associates joined its existing investors India Value Fund Advisors (IVFA) to strike a $500-million deal, by far the largest PE deal in the sector.

All of the money did no go to the company, however, as IVFA rolled over its existing investment into a new fund. So a part of the money went to buy stake from the old fund.

Last month, Providence raised its stake in the country's top cable distributor Hathway Cable and Datacom Ltd from Macquarie Bank.

This transaction came on the heels of the Indian government easing foreign direct investment norms in broadcasting. As per the new set of rules, foreign investors are allowed to invest 100 per cent in cable networks.

“We completed the first and second phase of cable TV digitisation. Post completion of phase three and four, we can expect major strategic investors coming in,†said G Subramanian, CFO, Hathway Cable & Datacom.

In another notable deal, online music streaming venture Saavn raised a large funding round.

M&As

While private investors were busy sealing new deals, strategic acquirers went a tad slow. The number of M&A deals hit the lowest level in a decade and while the value of deals was on the higher side of the average down the years, it almost halved from the record high in 2014, as per VCCEdge.

Television broadcasters consolidated their regional footprint with key acquisitions in the southern and eastern markets. The year started with a big bang as 21st Century Fox-owned Star India Pvt Ltd announced the acquisition of broadcast business of Maa Television Network. The business was recently integrated with Star.

“The acquisition fills a critical gap in our portfolio and will allow our advertisers targeted access to the large Telugu speaking population. We plan to invest further in this important market to fundamentally change the content quality paradigm,†said Uday Shankar, CEO, Star India.

Star India is part of 21st Century Fox, the media house controlled by Rupert Murdoch. Murdoch also controls News Corp, the parent of this news website.

Interestingly, Star India's competitor Zee Entertainment Enterprises Ltd (ZEEL) too upped its ante in the regional space this year with the acquisition of Odiya channel Sarthak. Earlier in an interview to VCCircle, Mihir Modi, chief finance and strategy officer at Zee Entertainment Enterprises Ltd (ZEEL) said that the Odiya channel was acquired keeping in mind the company's intention to have a robust presence in the eastern and north eastern belt. “Two pockets we now are evaluating are Kerala, with a channel in Malayalam, and the North East,†he added.

Private FM was another sub-sector where the M&A momentum continued. Bennett, Coleman & Co Ltd (BCCL)-promoted Entertainment Network India Ltd that runs the country's top private radio network under Radio Mirchi, owned by Living Media India Ltd's subsidiary TV Today Network Ltd.

This was the second big acquisition in the private radio sector, after Jagran Prakashan Ltd completing the acquisition of Music Broadcast Pvt Ltd, which runs private FM channel Radio City 91.1 FM, this year. The company also operates its own radio stations under the Radio Mantra brand.

“The basic synergies would definitely be in marketing and ad sales. Jagran has a very strong footprint in the North markets, primarily in the tier 2 and 3 towns. With the Radio City and Radio Mantra combination, we have dominance in high potential markets and thus deliver the maximum impact for our national clients. We also have a dominant footprint in the most important clusters such as Maharashtra, Uttar Pradesh and Rajasthan for local advertisers,†said Apurva Purohit, president, Jagran Group.

Jagran Prakashan Ltd, the publisher of Hindi daily Dainik Jagran, counts PE major Blackstone as a shareholder.