Private investments in the healthcare sector rose to an estimated $1.6 billion this year, surpassing the previous peak clocked two years ago, as investors signed large transactions across pharmaceuticals, hospitals and diagnostics chains, as per preliminary data collated by VCCEdge, the data research platform of VCCircle.

However, the headline numbers mask some interesting statistics that show how deal-making in healthcare, just like all sectors at large, is getting skewed towards startups.

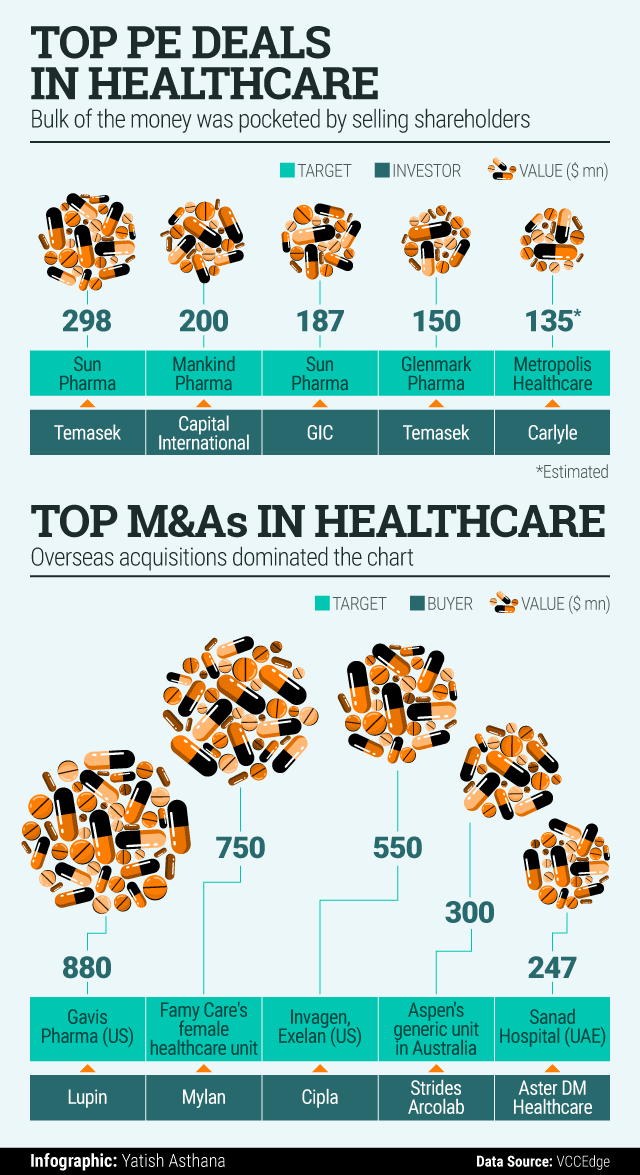

Indeed, the number of PE deals in the sector halved even as the aggregate value of such investments crossed the $1.3-billion mark. Bulk of this was bets made by Temasek, the investment arm of Singapore government. It accounted for three of the top six deals this year.

VC deal-making rose, albeit marginally, in volume terms but the aggregate value of investments shot up almost three times as startups attracted money at higher valuations. The top private investment deals in the sector this year include Practo's $90 million Series C round of funding, which barely missed out of the top five deals chart.

The number of angel and seed funding deals also rose.

M&As

Mergers and acquisitions (M&As) declined a tad both in terms of the number of deals and the announced value of transactions as the bunch of top deals this year could not match up to the mega transaction between Sun Pharma and Ranbaxy announced in 2014.

That said, a slew of large cross-border deals were announced in the pharmaceutical sector.

In particular, overseas acquisitions struck by Lupin, Cipla and Strides Arcolab kept investment bankers busy. One notable M&A-related development was the increasing exposure of Malaysia's IHH in India. IHH acquired a majority stake in two mid-sized hospitals for around $250 million in total, marking rare inbound deals in the healthcare delivery segment.

Click here to see the highlights of the year.