It was a big year for initial public offerings (IPOs) even as the stock markets see-sawed due to uncertainty caused by the US Federal Reserve’s rate hike and the slow pace of reforms in India.

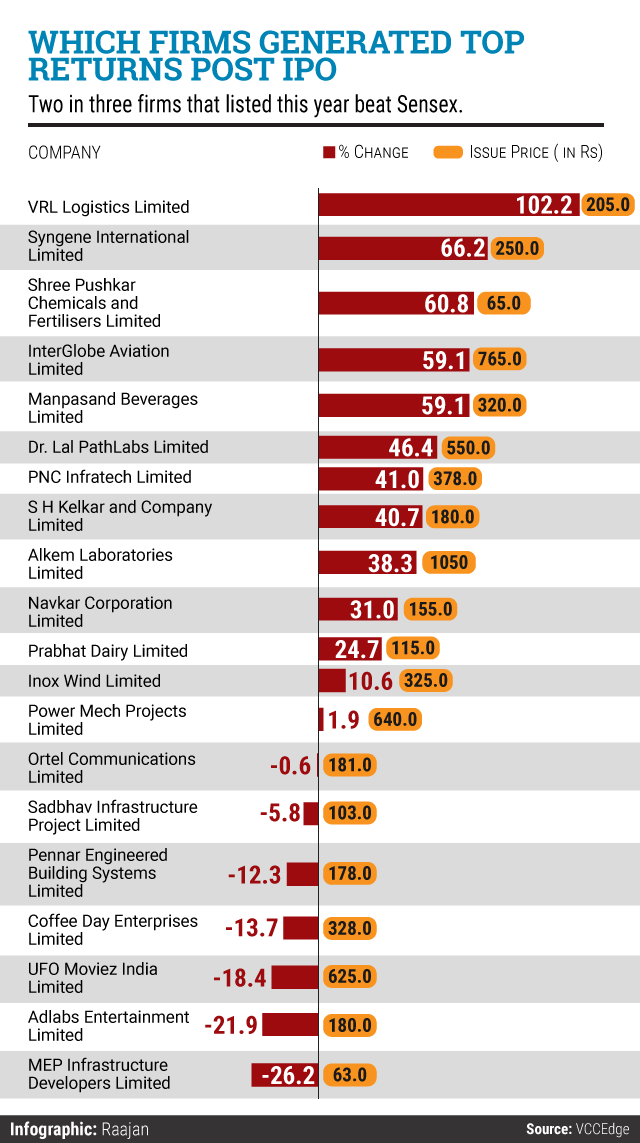

As many as 20 firms -- many of them backed by private equity firms -- went public in the main market and garnered more than Rs 13,000 crore. Thirteen of these 20, or almost two-thirds, are trading above their issue price with an average return of 44 per cent, according to an analysis by VCCircle.

While New Silk Route-backed VRL Logistics generated the best post-listing return as its share price doubled, budget carrier IndiGo’s parent company InterGlobe Aviation's shares surged 59 per cent in just a months’ time.

Healthcare IPOs presented a surprise in the market. Both Alkem Labs and Dr Lal PathLabs have seen their prices balloon up almost 40 per cent from the time of listing just a week ago.

On the other hand, the market was not much receptive for infrastructure and engineering companies as MEP, Sadbhav and Pennar all saw their shares slide below the listed price in line with the correction in the broader stock market. Café Coffee Day’s parent company also couldn’t make much of a splash as its share fell 14 per cent in the last two months.

With many more companies filing for IPOs and a lot of healthcare and microfinance institutions getting ready to sell their shares, 2016 can only expected to be bigger.