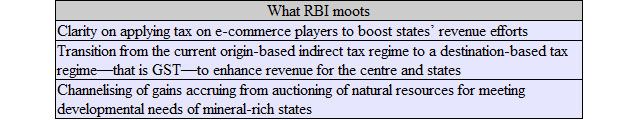

Taking cue from developed countries where laws are amended to tax inter-state online sales of goods and services, the Reserve Bank of India (RBI) has stressed on the need for clarity on taxation of e-commerce transactions, while also suggesting that states could tax the booming sector to boost revenues.

The suggestion by the central bank comes at a time when a few e-commerce companies have been in a logjam with states over the issue of taxation.

Amazon was dragged to court last year by Karnataka government while Kerala recently slapped a fine worth Rs 54 crore on Flipkart, Jabong and a few others for tax evasion.

As more and more Indians are getting on to the internet for their shopping needs, the e-commerce industry is set to grow and command a larger share of the consumer's retail wallet. According to a 2014 PwC survey on e-commerce, the size of the e-retail sector is poised to be $10-20 billion by 2017-2020.

Goldman Sachs, in a report last week, said e-commerce will account for 2.5 per cent of the India's GDP by 2030, growing 15 times and reaching $300 billion.

Conscious of a possible loss of tax from the burgeoning e-commerce sector, RBI directed the states to develop a uniform strategy for taxation of the sector.

"The rapidly growing e-commerce could contribute to states’ revenue efforts, provided there is greater clarity in rules and procedures to enable better compliance," said RBI in a study on state government finance released on Tuesday.

The central bank also made cross-country references to highlight the issues of taxation. "In view of the complex problem faced by countries in taxing e-commerce, India needs to develop a uniform model across states that is easy to implement. Leveraging technology and plugging the gaps in the state laws will lower the cost of compliance and monitoring of e-commerce taxation," RBI added.

While the report centres around a few questions regarding setting up the incidence of tax, it points to the fact that states employ divergent means to deal with tax issues.

However, experts caution saying taxation should be thought through. Sunil Jain, partner at law firm J. Sagar Associates, said more research is needed before taxing e-commerce.

"We are still debating and a huge amount of research is required as to how, why and who should tax e-commerce. There is very little inventory based model in actual operation—it is basically about the market place. My understanding is that instead of chasing sales tax- or VAT-related defaults, we should treat them as some kind of service providers or limited sellers and apply a small percentage of tax on them."

The RBI report also mentioned the role of the goods and services tax (GST) in solving problems faced by online sellers while doing inter-state sales. The bank highlighted the need for transparency and simplification which would entail in implementation of GST to increase tax compliance among online retailers.

"The laws on taxation are archaic while e-commerce is a new sector which has been in place for the last decade. The new GST can provide for clarity given that the government creates specific provision for e-commerce in GST, while clarifying the dispensation between the state of the seller and the buyer and on the services of the e-commerce industry," Jain added.

While the Lok Sabha last week passed the constitutional amendment bill on GST, the government was forced on Tuesday to refer the bill to a panel after the Opposition insisted on the legislative scrutiny of the proposed legislation in the Rajya Sabha where the government faces a number crunch, further delaying the implementation of the landmark tax regime.

How the government is going to address the concerns of e-commerce players in GST is also to be seen.