The Reserve Bank of India on Wednesday kept interest rates unchanged in a surprise decision and lowered its growth forecast for the current financial year due to the government’s sudden withdrawal of high-value banknotes last month.

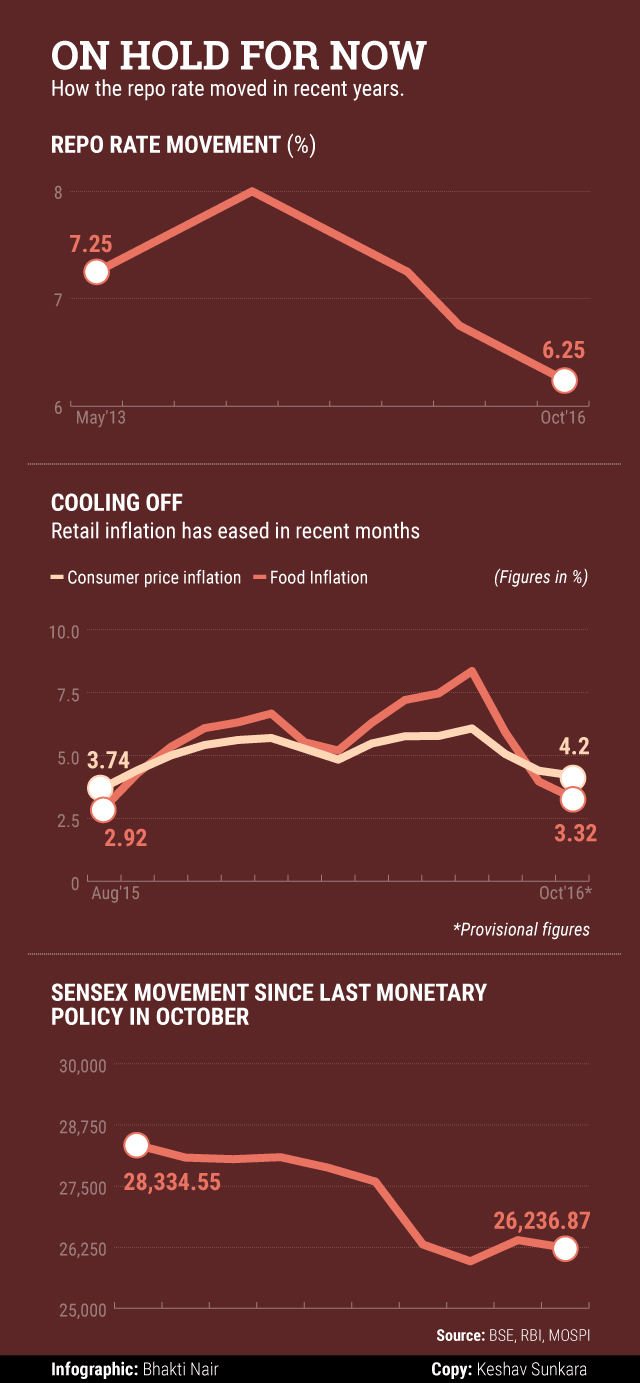

The central bank’s monetary policy committee kept the benchmark repo rate at which it lends to commercial banks at 6.25%. The reverse repo rate remains at 5.75%, it said at the end of the two-day meeting.

The unanimous decision by the six-member panel comes as a surprise as a rate cut was widely expected, particularly after Prime Minister Narendra Modi’s shock decision on 8 November to scrap Rs 500 and Rs 1,000 notes crimped economic activity.

The RBI said in a statement that the decision is consistent with an “accommodative stance of monetary policy”. The decision is also in line with the goal of keeping consumer price index inflation at 5% by March 2017 and the medium-term target of 4% within a band of plus or minus 2%, it added.

The RBI separately said it was withdrawing the incremental cash reserve ratio, which it had announced on 26 November in a bid to suck out excess liquidity following demonetisation.

This is the second policy review since Urjit Patel took over as the RBI governor in September and the committee was formed to decide monetary policy. At the previous meeting in October, the committee had cut interest rates by 25 basis points.

Growth concerns, demonetisation

The central bank said that the withdrawal of banknotes may drag down growth this year and may “transiently interrupt” some part of industrial activity in November-December due to delays in payments of wages and purchases of inputs.

In its statement, the RBI said that the trajectory of growth in gross value added (GVA)—a measure of the value of the goods and services produced—had turned uncertain after the “unexpected loss of momentum” by 50 basis points in the July-September quarter and the effects of demonetisation.

Growth in GVA for the July-September period fell to 7.1% from 7.3% in the previous quarter, government data showed last month.

The central bank lowered its GVA growth estimate for 2016-17 to 7.1% from 7.6%, “with evenly balanced risks”.

The RBI also said that the demonetisation decision was “not taken in haste” and that it was a considered decision with the objective of flushing out black money, or untaxed wealth.

RBI officials said banks have thus far received deposits in old notes worth Rs 11.55 lakh crore. Currency worth Rs 14.16 lakh crore had been sucked out, and the government had initially said that it did not expect a substantial portion to come back into the banking system. That does not seem to have happened.

Governor Patel said the central bank has recalibrated the denominations of the currency notes it is pumping back into the system. This will ease concerns of non-availability of notes of certain denominations like Rs 100 and Rs 500, he said.

Inflation risks

The central bank flagged upside risks to inflation and said the withdrawal of high-value banknotes could lead to a temporary reduction in inflation. It estimates headline inflation at 5% in January-March 2017.

The RBI said that inflation had eased more than expected for the third consecutive month in October, driven down by a sharper-than-anticipated deflation in vegetable prices, but there was an upturn in momentum as prices rose month-on-month across the board. Also, inflation excluding food and fuel continues to show “strong persistence”, it said.

“Moreover, volatility in crude prices and the surge in financial market turbulence could put the inflation target for Q4 of 2016-17 at some risk,” the central bank said. “It is prudent to wait and watch how these factors play out and impinge upon the outlook.”

Chief economic adviser Arvind Subramanian echoed the central bank’s view and said it was a time to ensure continuity and stability. “Because these are uncertain times, due to the domestic environment, it is prudent to wait for a month and two. It will stabilise markets and allow us to consider the data that is coming in,” he said.

Sunil Kumar Sinha, principal economist at India Ratings & Research, said that various global factors, including Britain’s decision to leave the European Union, Donald Trump’s election as the next US president and Italian prime minister Matteo Renzi’s defeat in a referendum, have created political uncertainty. “In a situation of flux—both locally as well as globally—the prudent policy stance should be status quo,” he said.

Dinesh Thakkar, chairman and managing director at Angel Broking, said there should be greater clarity on inflation and the impact of demonetisation on GDP by the next policy review and the RBI could then go for rate cuts. He also said that the central bank’s decision to hold rates means rate-sensitive stocks could remain under pressure.

Like this report? Sign up for our daily newsletter to get our top reports.