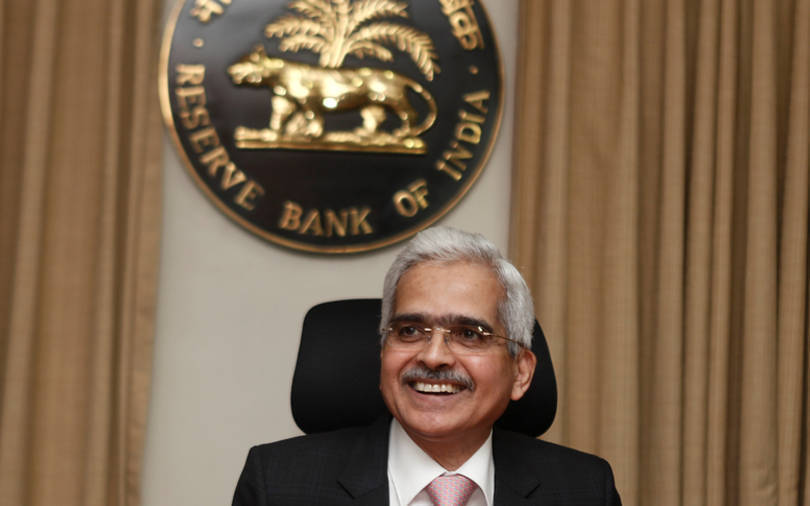

Indian startups should constantly evaluate the build-up of risks and vulnerabilities to make their businesses sustainable in the long-term, RBI governor Shaktikanta Das said on Thursday.

Das spoke at an event organized by the Central Board of Indirect Taxes and Customs (CBIC). His comments come at a time when startups are finding it difficult to raise fresh funds following Russia’s invasion of neighbouring Ukraine. This has led to several startups laying off employees as they attempt to cut operational costs.

Mint reported last month that the startup sector is facing a crunch and at least 5,000 employees are expected to be laid off. Within the startup sector, edtech firms have seen major layoffs. Recently, large entities such as Unacademy, Vedantu and WhiteHat Jr have either retrenched staff or seen mass resignations of employees.

Calling it “unsolicited advice” to young entrepreneurs and startups, Das said that he understands that many such businesses might already be assessing risk and risk-taking is a part of their business model. Nonetheless, these are things which should always be kept at the back of one’s mind for long-term sustainability of any business, he said.

Disruptive technologies like artificial intelligence and their increased adoption are getting accelerated across businesses and offer opportunities to young enterprises to create their own niche, he said.

“A reflection of this is seen in the emergence of several startups in the Indian business landscape as entrepreneurs experiment with ideas in digital payments, online retail, on-demand delivery, education, software and more,” said Das.

The number of unicorns, or new businesses valued at over $1 billion, is rising very fast, he said, adding that these startups are supported by a new ecosystem of angel and venture funding, incubators and accelerators – as well as new patterns of consumption in society.

Speaking on corporate governance, Das called it the single most important aspect that determines the long-term success of a business. He said that good governance entails effective and collective oversight by the board and senior management of a company. It also includes control layers of risk management and internal audit.

Das said that business models and business strategies of companies should be conscious choices, that are adopted following a robust strategic discussion in the board, after considering all relevant aspects. Businesses, he said, should avoid aggressive short-term reward seeking culture, without regard for the build-up of excessive risks in the balance sheet.

Some of the common characteristics of inappropriate business models include inappropriate funding structure; building asset-liability mismatches that are highly risky and unsustainable; unrealistic strategic assumptions and particularly excessive optimism about capabilities, growth opportunities and market trends. Lastly, excessive focus on business considerations with a neglect of risk, control and compliance systems is another common characteristic, he said.

Meanwhile, Das also said that RBI would soon issue a “regulatory architecture” for digital lending applications. The problem of predatory lending came to the fore during covid-19 when hit by the pandemic, borrowers turned to loans from such apps at usurious interest rates. Unable to repay such high interest rates, many consumers got into a debt trap and ended up borrowing from several apps to repay their past dues and it was reported that some even died by suicide.