Private investment activity started on a tepid note in 2016 with private equity dealmaking staying weak while venture capital firms turning cautious on backing startups in the first three months.

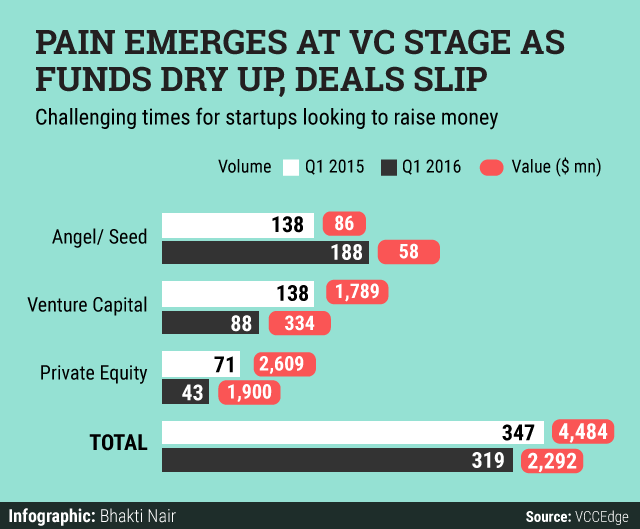

Investors shelled out $2.29 billion across 319 firms in the January-March quarter, according to preliminary data compiled by VCCEdge, the financial research platform of VCCircle. The total investment value halved and the number of firms that attracted capital fell by a fifth compared with the preceding quarter. The numbers also dropped compared with the same quarter last year (see chart).

While the overall data show private investments at large got off to a poor start in 2016, there is one distinct trend for startups. Angel and seed-stage investors are backing more ventures than ever before, writing a cheque for startups every 12 hours this year as against every 16 hours a year earlier.

In contrast, institutional VC deals have fallen by a third from a year earlier when big-ticket funding transactions involving Ola, ShopClues and FreeCharge (before it was acquired by Snapdeal) had boosted the investment value.

This means both good and bad news for startups. Those looking for their first cheque are more likely to get initial funding support, but those looking at a bigger chunk of money may struggle to find takers. This is a continuation of the early trends this year (read here) as also the picture for 2015 as a whole (click here).

Meanwhile, the more mature PE dealmaking remains weak. This is partly to do with consolidation in the PE business as also cautious sentiment for fresh investments.

Moreover, corporate valuations have tempered in line with a correction in the stock markets; benchmark indices have lost a sixth of their value after hitting an all-time peak last March. Some companies looking to raise capital are waiting for markets to improve to get better valuations and don't want to rush into a transaction.

Financials, industrials, consumer discretionary, IT and healthcare were the top five sectors to attract significant private capital (including early-stage, VC and PE deals) during the quarter.

At the same time, the new year has also begun on a slow note with respect to exits by VC and PE firms.

While it is early days, the trend is unlikely to change significantly during the year. The VCCircle PE-VC Outlook Survey for the year also indicated a preference for seed-stage deals in venture funding (click here to read more).

M&As

Things are not too rosy on the merger & acquisition (M&A) street either. The number of M&A transactions declined to 211 even though the value of deals shot up. The value was higher due to UltraTech's $2.4 billion deal to buy a majority of Jaypee Cement and state oil firms picking up a stake in a Russian field for $1.3 billion.

Deal value for domestic and outbound transactions rose but slipped significantly for inbound acquisitions. The number of inbound deals halved, reflecting poor interest among multinational firms to buy into the India story.