Our latest round of checks with policy experts in New Delhi and Mumbai suggest that the new RBI Governor’s top priority will be to launch a new and improved currency defence at the earliest. This defense is likely to include the potential initiation of a currency swap with a developed country’s central bank, use of forex reserves as well as tight monetary policy. As regards fiscal policy, most fiscal experts in Delhi are confident that despite the passage of the Food Security Bill, the Finance Minister is likely to ensure that his budgetary target of 4.8% of GDP will be delivered upon, implying that Government expenditure growth will have to be pared in 2HFY14.

The new Governor is likely to focus on the currency and inflation Our checks with policy experts in New Delhi late last week suggested that the new RBI Governor’s top priority will be to launch a new and improved currency defense. His second priority is likely to be inflation control, with stimulating growth being last on his FY14 priority list.

Whilst the outgoing Governor too was in favour of a currency defence, his defense was half-hearted (in the form of the tight liquidity measures administered over the course of July 2013) owing to a combination of three reasons: (1) the lack of support from internal advisors such as his deputy governors who either lacked the macroeconomic acumen or did not enjoy the Governor’s trust, (2) the lack of support from the Technical Advisory Committee (TAC) of the RBI, and (3) a push from Delhi to defend the currency but without any significant supporting measures from Delhi (other than a successful squeezing of gold imports).

The new Governor (who takes charge this week), on the other hand, is a trained macro-economist and is known to belong to the school of thought which says that a rapid depreciation of a currency ought to be checked given that: (1) its adds to the fiscal deficit, (2) prevents USD inflows and promotes outflows, and (3) adds to domestic inflation (which could be boosted by the coming round of price increases triggered by the higher cost of imported goods).

Our discussions with economists close to policymaking in Delhi and Mumbai suggest that the RBI’s new, improved defence of the INR is likely to include the potential initiation of a currency swap with a developed country’s central bank (the Bank of Japan appears to be the most likely candidate), use of forex reserves as well as clearer articulation of the RBI’s view on managing currency dynamics.

Given that the incoming Governor has written extensively on the virtues of inflation-targeting and given his views in favour of launching a currency defence, we expect the Governor to implicitly de- focus on growth (at least for the duration of the currency defence). Whilst he seems likely to roll back the distorted form of quantitative tightening that the RBI has pursued since mid-July (given the distortions that it creates for the banking system and given the pressing need to help banks access liquidity), if need be the new Governor may well use interest rate increases to cement the currency defence.

Given that the new Governor’s priorities, in descending order, are likely to include ‘currency’, ‘inflation’ and ‘growth’, we now expect the RBI to increase the repo rate by 50-75bps over the rest of FY14 as against our earlier expectation of rate cuts of 0-25bps over the rest of FY14. Even if the Governor does not explicitly increase rates in the next couple of months, he is likely to use the tone and tenor of his policy to keep short-term interest rates high. This combined, with the likely credit rating downgrades for Indian corporates impacted by the slide in the INR, is likely to result in higher cost of capital for corporate India in FY14 than we had previously expected.

(A month ago, India Ratings, had stated, “India Ratings & Research (Ind-Ra) may revise the Outlook to Negative or downgrade the ratings of 65 of its 290 investmentgrade issuers, if the rupee remains weaker than INR60/USD for a sustained period. However, these 65 corporates, contributing 16% to the investment-grade debt, are unlikely to default under this stressful scenario.†Since, it appears unlikely that in the near term, even with a successful currency defence, the INR will strengthen to below Rs60/USD, such a credit downgrade of corporates looks inevitable now.)

This is our current view after our deliberations last week with policy economists in Delhi and Mumbai. Obviously, we will know more once the Governor presents his first RBI policy (likely to be on September 19, 2013).

Government expenditure growth is likely to taper-off in 2HFY14

Most fiscal experts in Delhi are confident that the Finance Minister will deliver on his fiscal target of 4.8% of GDP despite the passage of the Food Security Bill and despite the likely slippage in various revenue items. The motivation for defending the fiscal deficit target emanates from the need to prevent a sovereign credit rating downgrade, underpinned by the FM’s own desire to ready a perfect report card in case he gets a chance to lead the country post the General Election in 2014.

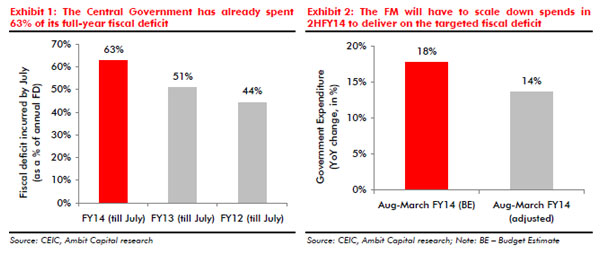

Given that the Central Government has already spent 63% of its full-year fiscal deficit by the end of July (see Exhibit 1 below) and given that slippage on the receipts side is likely to amount to a minimum of Rs400bn (factoring in Rs100bn of slippage each on disinvestment, spectrum auctions and tax revenue), the Government will have to pare expenditure in the rest of the financial year.

In view of these dynamics, we cut our Government revenue expenditure growth assumption for FY14 from 15% YoY (which factored in additional spending of Rs200bn owing to the Food Security Bill) to 11% YoY. This builds in curtailed revenue expenditure growth given that the FM will have to cut spends to make up for the revenue slippage.

(Ritika Mankar Mukherjee is analyst and Saurabh Mukherjea is the head of Equities at Ambit capital.)

To become a guest contributor with VCCircle, write to shrija@vccircle.com.