Early-stage venture funding, which started showing signs of stabilising after the big slide that began last August, could be headed for a deep plunge this month.

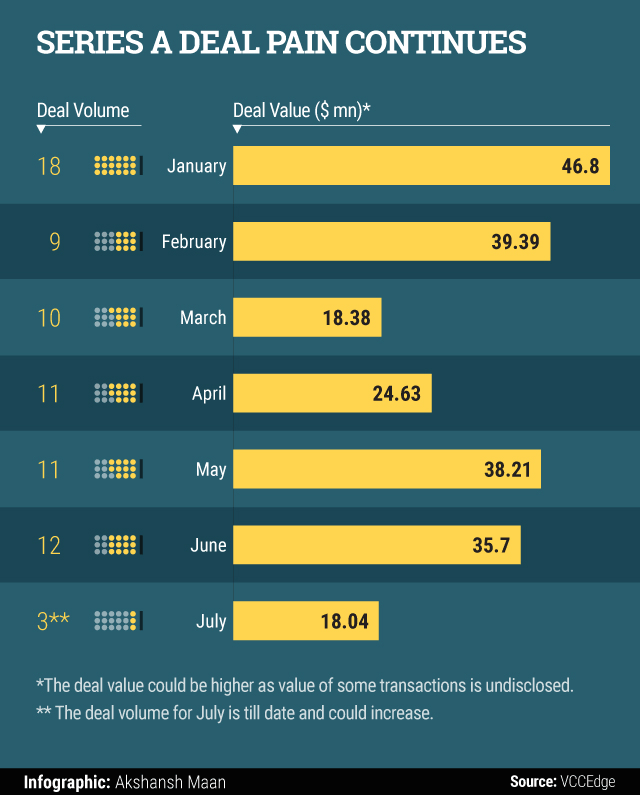

There have been just three Series A stage funding for Indian startups in the first 20 days of this month, according to VCCEdge, the data research platform of News Corp VCCircle. Although this number could be revised upwards as more transactions are announced or collated from non-public sources, it may fall short of the dozen odd deals every month over the last quarter.

Series A venture capital deal-making is crucial for startups as it marks the first institutional round of funding and brings a larger stash of capital compared to angel or seed funding rounds. It also sets the stage for bankrolling bigger expansion plan for a startup.

"We expect milder pace of Series A investing to continue for the next 12-18 months so July shall be no different. It is a period of cleansing when angel investors and family offices shall support promising startups with bridge funding," said Sunil Goyal, founder and CEO of YourNest, which essentially chases pre-Series A deals.

The only respite to draw from July is in terms of valuation. The month saw former Flipkart executives Ankit Nagori and Mukesh Bansal’s yet-to-launch online preventive healthcare platform Curefit raising $15 million in a Series A round of funding from Accel Partners, IDG Ventures and Kalaari Capital. This was an unusually high amount for a Series A stage deal, which pushed up the average transaction value.

Like this report? Sign up for our daily newsletter to get our top reports.