Bangalore-based HealthCare Global Enterprises Ltd (HCG) has set the price band for its public issue that opens on March 16, eyeing a valuation of Rs 1,854 crore ($276 million).

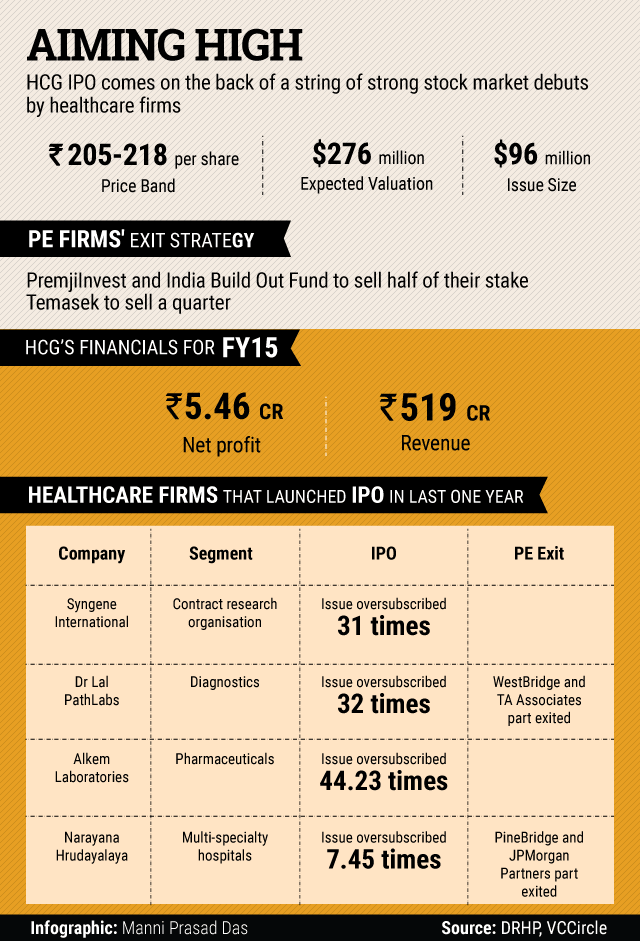

The cancer treatment hospital chain, which had filed its draft red herring prospectus (DRHP) with securities market regulator SEBI in July last year, has priced the offer in the band of Rs 205-218 per share.

The IPO comprises a fresh issue of up to 1.16 crore equity shares and an offer for sale of up to 1.82 crore shares by its existing shareholders. The Rs 650 crore ($96 million) issue will close on March 18.

The offer would constitute up to 35.03 per cent of the company's post-offer paid-up equity share capital.

HCG had roped in a string of PE firms to back it over the years and has previously given exits to two of them—IDFC Alternatives and India Life Sciences Fund.

Among the existing investors, PremjiInvest, India Build Out Fund (now under Quadria Capital) and Temasek have offered to sell shares in the IPO.

While PremjiInvest and India Build Out Fund are looking to sell half of their holding, Temasek, which invested in the company just two years ago, had offered to sell a quarter of its stake.

Kotak Mahindra Capital, Edelweiss, Goldman Sachs, IDFC Securities, IIFL and Yes Bank are the book managers to the issue.

Founded in 1998, HealthCare Global Enterprises provides specialty healthcare in India focused on cancer and fertility under the brand HCG. It started expanding operations in 2006.

The Indian IPO market rebounded strongly last year and a string of healthcare firms either launched, filed or got SEBI's approval for the IPO.

Early in January, Narayana Hrudayalaya Pvt Ltd, the country's second-largest hospital chain by the number of operational beds, made a strong stock market debut. Prior to Narayana Hrudayalaya, diagnostics chain Dr Lal PathLabs Ltd and drugmaker Alkem Laboratories Ltd also made spectacular stock market debuts.

Thyrocare Technologies Ltd, India's largest thyroid testing company, and single-specialty firm Centre For Sight have recently got SEBI's nod for IPOs.