There is scant downside risk to the Indian economy in the last months of this financial year from the Omicron coronavirus variant, according to economists polled by Reuters who said New Delhi should focus on fiscal prudence in its February budget.

Asia's third-largest economy is in the midst of a resurgence in coronavirus cases driven by the new variant that has forced most states to impose localised restrictions.

The Jan. 11-18 poll of over 45 economists forecast 5.0% economic growth this quarter, a sharp downgrade from the 6.0% given in December, finishing the year at 9.2% compared with 9.5% in the previous month's poll.

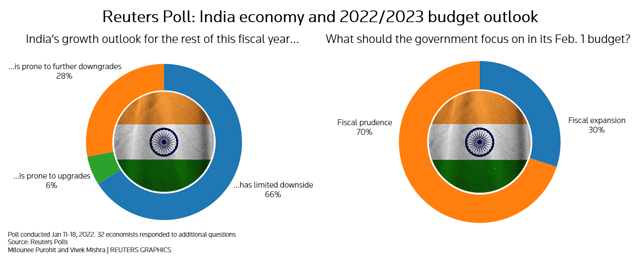

But nearly two-thirds of those responding to an additional question, 21 of 32, said there was limited downside to the outlook for the rest of this fiscal year which ends in March.

Nine said it was at risk of downgrades, and two said it was prone to upgrades. The median growth projection for the next fiscal year was upgraded to 8.0% from 7.5% a month ago.

"The current phase of restrictions is not as harsh as it was during the previous waves. So, I think Omicron and the economic damage it inflicts is a Jan-March story and will only be limited to this fiscal year," said Madhavi Arora, lead economist at Emkay Global Financial Services.

Arora reckons the first quarter of the next financial year starting in April will get an extra boost once the third wave passes, assuming it does.

The latest poll also estimated economic growth at 14.7% for the same quarter.

Inflation was expected to peak at 5.8% this quarter and then fall, remaining under the Reserve Bank of India's 6.0% upper threshold until at least the end of fiscal 2023-24, taking pressure off the Bank for future interest rate rises.

India's finance minister Nirmala Sitharaman will present the country's 2022/2023 federal budget on Feb. 1, providing new targets for government spending, tax receipts, economic growth and fiscal deficits.

When asked what the government should focus on, 16 of 23 respondents said fiscal prudence rather than expansion, despite pandemic-related risks.

"India and other emerging markets will have to start thinking about consolidating their COVID-19 year budget deficits in a global monetary environment where the U.S. Fed is starting to normalise policy," said Miguel Chanco, senior Asia economist at Pantheon Macroeconomics.

"We are expecting quite aggressive tightening from the Fed this year and that is going to raise borrowing costs not just for India but for most EMs."

The country's federal fiscal deficit surged to 135.1% in the April-November period of the last financial year but in the current year it narrowed to 46.2% for the same period, helped by a rise in tax collections.

The fiscal deficit target for next financial year was predicted to be 6.0%, and 5.5% for FY 2023/2024, both lower than this year's 6.8%.

"They will be pretty conservative with spending and revenue projections," said Robert Carnell, head of Asia Pacific research at ING.

"It is really more of a revenue worry from Omicron, so I do not think you should be spending on the off-chance that Omicron is bad. Because that sort of bakes in the fact that the targets get missed at that point."