Nifty and Sensex recovered from a plunge to close about 4% higher on Friday.

They staged a recovery amid hopes of globally coordinated stimulus measures to counter the impact of coronavirus.

The indexes initially dove more than 10%, resulting in a halt for the first time since 2009.

Following the 45-minute halt, Nifty and Sensex staged the third-biggest intra-day recovery in Indian market history as they rose 16.36% from the day's low.

Still, both recorded their worst week since 2009. The indexes closed down more than 9% each for the week.

Housing Development Finance Corp. Ltd recording its best day in nearly 11 years.

HDFC Bank Ltd jumped 4.8% while State Bank of India rose 13.8%. Tata Steel Ltd closed up 13.7%.

Meanwhile, capital market regulator Securities and Exchange Board of India (SEBI) issued a statement on Friday, re-iterating its risk mitigation and risk management framework.

The statement highlighted the market conditions and recent sharp declines in India and overseas owing to concerns relating to covid-19 pandemic and resultant fears of economic slowdown.

SEBI and stock exchanges are prepared to take suitable action as may be required,” the market regulator said on Friday.

Indian stocks had plunged into the bear zone on Thursday with the Nifty slumping 8.3% to its lowest close in two-and-a-half years and the Sensex diving 8% to a near two-year low.

Stock markets from the US to Japan have plunged over the past few days due to the fast-spreading coronavirus that has infected nearly 130,000 people worldwide and killed more than 4,700. India reported its first death due to the virus late on Thursday.

The selloff gathered momentum after the World Health Organization declared the coronavirus outbreak as a global pandemic and US President Donald Trump shocked investors by imposing a one-month travel ban from Europe.

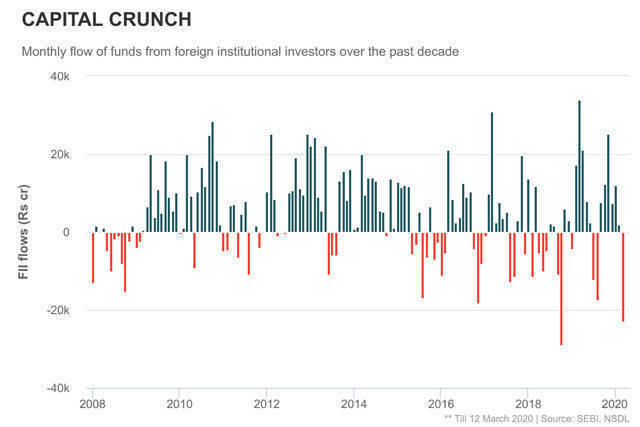

So far this month, foreign portfolio investors (FPIs) have net sold nearly Rs 23,000 crore in stocks (cash segment), the second-highest monthly selling in the last 12 years.

In October 2018, foreign investors had net sold shares worth nearly Rs 29,000 crore in the aftermath of the IL&FS crisis, the highest monthly sale in the past 12 years, according to data released by SEBI.

A separate data set by Bloomberg shows that equity markets like Taiwan, Brazil and Japan have seen even greater foreign fund outflows.

Taiwan has recorded $5.56 billion in outflows so far this month, taking its tally this year so far to $10.92 billion.

Brazil has seen a sell-off of nearly $1.8 billion this month, taking the tally so far this year to $11.11 billion.

Japan recorded net sale of $6.99 billion this month, taking the tally to $10.73 billion this year, while South Korea saw net equity outflows of $5.4 billion so far this month, leading to $8.6 billion in FPI outflows so far in 2020.

Funds flowed into regions such as Eurozone, France, Italy, and Luxembourg.

Outside of China, Italy is the second-most affected by the covid-19 breakout. More than 1,000 people have died, and many new cases are being reported, as the country has adopted radical measures to curtail the deadly viral infections.

Eurozone saw net inflows of $2.67 trillion since 1 January, Bloomberg data shows.

Luxembourg saw foreign inflows of $1.48 trillion, while Italy saw inflows of $10.5 billion.

Experts foresee that FPI selling in emerging markets to further accelerate as panic sets in deeper, forcing global funds to pull out even more money from assets and securities the world over.

In India, investors have lost (mark-to-market) wealth worth Rs 30.8 trillion ($116 billion at current exchange rate) on BSE listed shares since the beginning of 2020, stock exchange data showed.