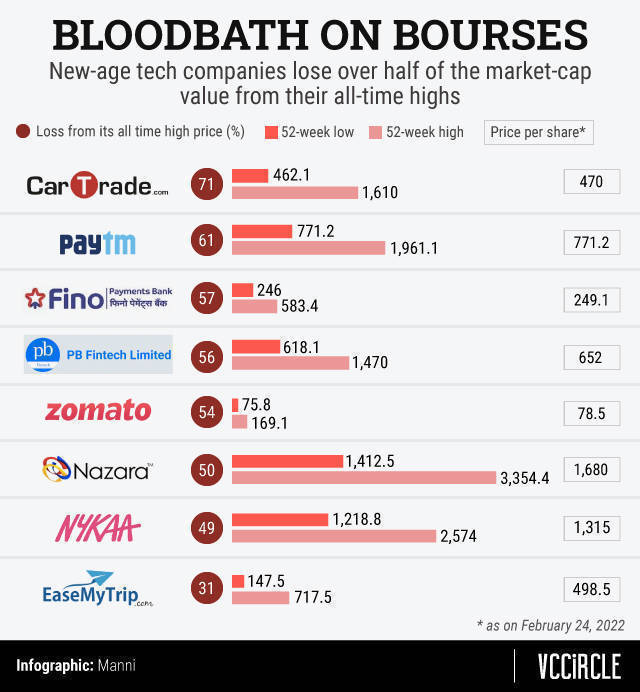

Six out of the eight new-age technology firms that got listed on the Indian bourses in 2021 hit a fresh all-time low today, eroding about 53% of their cumulative market capitalization on average, reveals a VCCircle analysis.

Barring Easemytrip, which lost close to a third of the value from its 52-week high value, all the other seven companies saw their shares decline by at least 49% from their respective all-time highs.

The BSE Sensex closed at 54,530 points after declining by 4.72% (or 2,702 points) in a day today. The worst performers by far were automobile classifieds portal CarTrade and digital payments platform Paytm.

CarTrade lost over 70% value from its 52-week high of Rs 1,610 apiece. The share was issued at Rs 1,585 apiece in the IPO and closed at Rs 470 apiece on Thursday. Paytm, which launched the largest ever IPO in terms of size in the history of the Indian markets, has lost over 64% of its investor money from the IPO price of Rs 2,150 per share. Its shares hit a 52-week high of Rs 1,961 apiece and fell over 60% to close at Rs 771 apiece today.

Other firms that have eroded over 50% of their shareholders’ value were FINO Payment, PolicyBazaar’s parent company PB Fintech, and food-delivery start-up Zomato.

Zomato issued each share at an IPO price of Rs 76 and was valued at about $8 billion. Its valuation crossed over $15 billion at its 52-week high share price of Rs 169.1 per share. It closed at Rs 78.5 apiece after today’s market plunge. PB Fintech also witnessed a share-price correction from its 52-week high of Rs 1,470 apiece to Rs 652 apiece on Thursday, eroding 56% of its market capitalization from its peak.

Even high-performing startup shares like beauty care e-commerce platform Nykaa, Gaming firm Nazara Technologies, and hospitality start-up Easemytrip that have more than doubled in value since their IPO, were under pressure on Thurday.

Nykaa’s shareholders have witnessed a 49% slide in their share value from its all-time high of Rs 2,574 apiece. Nazara Technologies, which saw its stock triple from Rs 1,100 per share at the time of IPO to over Rs 3,350 apiece at its peak, saw its shares drop to Rs 1,680 apiece today. The company has witnessed an all-time low of Rs 1,412.5 apiece till date.

Easemytrip has been the best performer amongst all the new-age technology stocks that listed in 2021. The company's issue price at the time of its IPO was Rs 187 apiece. It rose to a high of Rs 717 per share last year to fetch 4X in gains for its investors. The company has since then lost a third of its equity value amidst the sell-off.