In 2015, when angel, seed and venture investments hit a peak, many companies had to wait for no more than six months to get a fresh round of funding from new investors. However, fresh funding rounds from a new set of backers have declined this year as venture capital investors return to their traditional ways of waiting for almost a year as they gauge the performance of companies before betting their money on them.

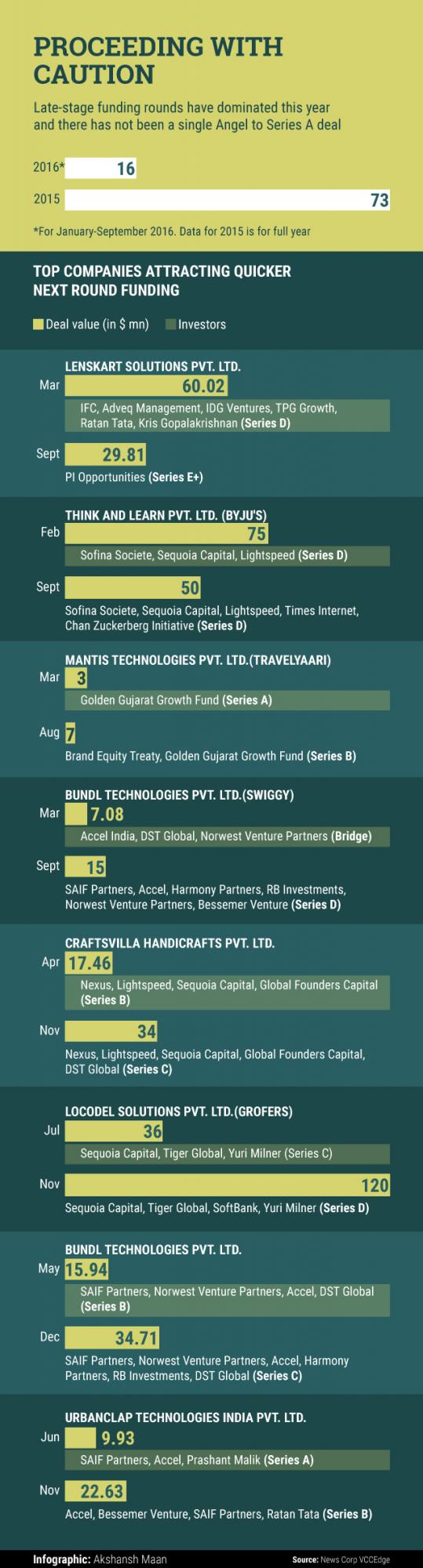

A total of 16 companies received multiple funding in the January-September period as compared with 25 in the same period last year, according to News Corp VCCEdge, the data research platform of VCCircle. Overall, a total of 73 deals involving fresh funding from new investors were done last year. This means a bulk of new funding came in during the October-December quarter and this year’s number could inch up in the remaining two months.

Another key difference this year is that a bulk of the fresh rounds this year are late-stage deals such as Series C, Series D and bridge rounds, which saw participation from a new angel investor or a new fund.

Major companies that received multiple funding during the period include eyewear e-tailer Lenskart getting Series E funding from PI Opportunities six months after receiving Series D funding from International Finance Corporation, TPG Growth and other investors.

Notably, not a single startup that received an angel or seed round of funding this year attracted interest from VCs for the Series A round so far. In the same period last year, a total of nine companies got Series A funding in a span of five to six months after getting the initial funding. In the full year 2015, the number of companies getting Series A funding after the angel/seed round had hit 25.

Major companies that received Series A funding last year just some months after their angel or seed rounds include media veteran Vir Sanghvi-backed restaurant reservation firm EazyDiner Pvt. Ltd and medical diagnostics device maker UE LifeSciences.

Multiple rounds drying up particularly in the early-stage mirrors the larger trend that shows angel and seed deals falling to 820 in the January-September period this year from 1,051 a year earlier.

In 2015, a lot of startups with strong market size received validation from prominent angel investors prompting VCs to also cut a check for them in just three to four months, said Devendra Agarwal, founder and CEO, Dexter Capital Advisors, a boutique investment bank.

Besides, a number of startups run by good founders got funded last year itself, he said. VCs have now realised that the startups in sectors they are interested in are already capitalised and have decided to wait.

"VCs also want to see entrepreneurs use the capital at their disposal and prove their mettle before bringing in funds. VCs have essentially reverted to their old model of waiting typically for nine to 12 months after a company gets funds,†Agarwal said.

Like this report? Sign up for our daily newsletter to get our top reports.