Aimed at providing a cushion to ailing domestic metal-producing industries such as steel and aluminium, India’s ministry of mines has written to the ministry of finance and the Prime Minister’s Office (PMO) to hold back the proposed increase in a green cess for at least a year.

Finance minister Arun Jaitley had announced in the Union budget last month to double the cess meant to fund National Clean Energy Fund (NCEF) from Rs200 per tonne to Rs400 on coal. This proposed increase in the clean environment cess is aimed to reduce the use of the fossil fuel and strengthen India’s position as a green energy champion.

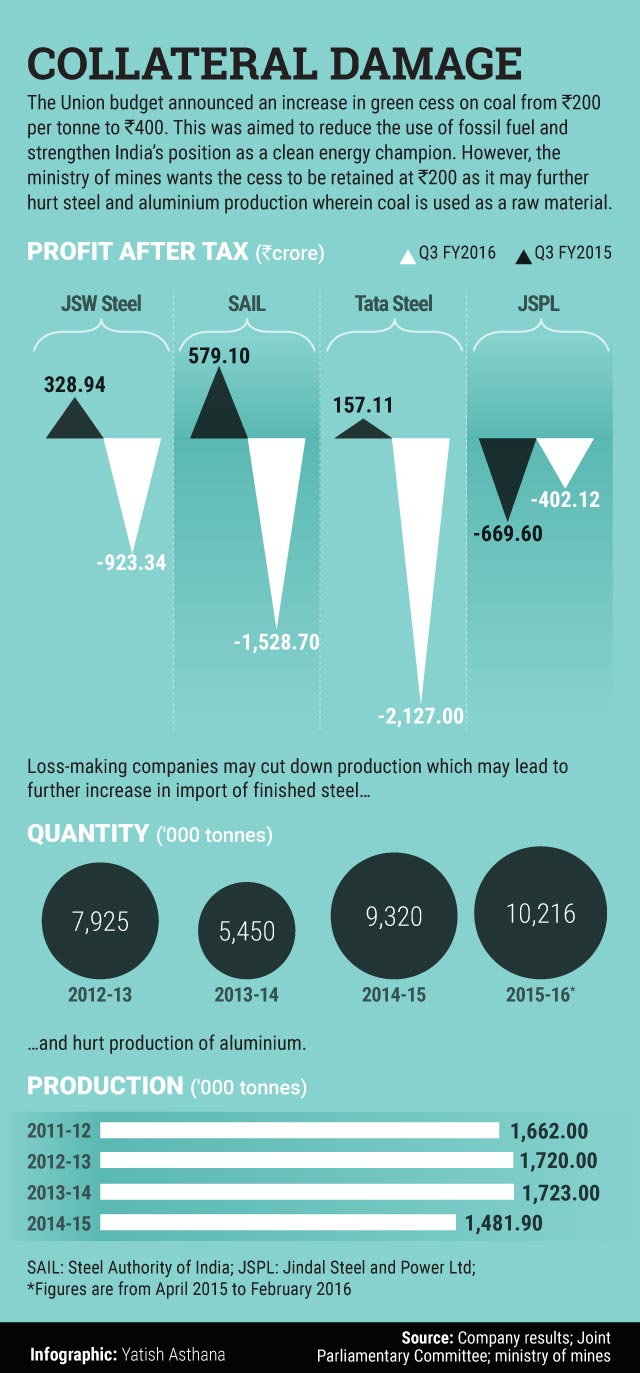

According to two Indian government officials, who did not want to be named, the steel and aluminium industries are struggling given the slump in demand and lower prices.

“The finance ministry and the PMO have been informed that doubling of the cess would have a significant impact on the steel and aluminium industry, for which coal is a vital raw material,†said one of the officials.

The mines ministry is of the view that the step to increase cess on coal comes at a time when the domestic market is facing severe competition from cheap Chinese imports and performance of steel and aluminium companies is under pressure.

The NCEF was announced in the Union budget of 2010-11, making India among the first countries in the world to have introduced a carbon tax on coal. A Rs100 per tonne cess translates into a collection of around Rs6,000 crore per year. India produced 612.44 million tonnes of coal in 2014-15 and aims to mine 1.5 billion tonnes by 2020.

Experts call the mines ministry’s demand a pragmatic one.

“There is no disputing the fact that India is committed to Conference of the Parties 21 target of reducing carbon intensity in the industry, but given the global slowdown and the stress that the Indian metal companies are facing through, this could have been postponed by a year or two,†said Debasish Mishra, senior director at Deloitte in India.

Queries emailed to the spokespersons of the ministries of finance, steel and the PMO on 21 March remained unanswered.

The National Democratic Alliance government is evaluating protectionist measures such as anti-subsidy duty on stainless steel imports from China and anti-dumping duty on imported steel to safeguard the beleaguered domestic steel industry. Also, the Union budget announced an increase in customs duty on aluminium. Production of aluminium also requires coal.

“The budget gave some bit of relief by increasing customs duty on aluminium from 5% to 7.5% and on other aluminium products to 10% from 7.5%, but nullified it completely by increasing the cess on coal. Maximum cost incurred by aluminium companies is on account of power as it is the main feedstock of the industry. This is why the mines ministry has written to finance ministry to hold the proposal for one year,†said the first government official quoted above.

Electricity generated from India’s coal-fuelled projects may become costlier by around 12 paise per unit following the cess increase. The average cost of electricity from coal-based projects currently ranges between Rs3.50 and Rs4.00 per unit.

There are other measures in the works. The Mint newspaper on 22 March reported the government’s plans to bring in a package to help the debt-ridden steel companies.

India’s consumption of finished steel was 77 million tonnes (MT) for financial year 2014-15. Of this, imports accounted for 9.32 MT, a jump of 71% over the previous fiscal. Import of finished steel has further gone up to 10.216 MT till February this financial year compared with 9.32 MT in FY2014-15.

A Tata Steel Ltd spokesperson said that the additional impact of doubling of the cess on the company would be close to Rs300 per tonne of crude steel, thus driving up the cost of steel.

Also, state-run aluminium producer, National Aluminium Co. Ltd (Nalco), will have to shell out additional Rs140 crore on account of the proposed increase in cess.

“During the present scenario, aluminium industry will not able be to carry this additional expenditure,†T.K. Chand, chairman and managing director, Nalco told VCCircle.

Aluminium imports have been a big concern for the industry with imports accounting for 56% of Indian aluminium consumption in 2014-15, with Indian producers accounting for the rest. India's aluminium production also went down to 1.48 MT in FY2014-15 compared with 1.72 MT in FY2013-14.