Professionals caught up with promoters of India’s top companies in drawing heavy pay packets last fiscal, with the elite club of 10 highest-paid executives evenly divided between the two, according to a VCCircle analysis of management compensation.

Indeed, four of the top five were professionals (see chart).

This marks a clear departure from the past, when professionals rarely made it to the list. This change, which first surfaced three years ago, became more pronounced last fiscal, depicting how even family-controlled firms in the public domain are banking on external managers to run the show, and paying them accordingly.

“Family-owned companies are diversifying and owners are getting out of the operational part and looking more at strategic issues,†said Ronesh Puri, managing director of headhunting firm Executive Access.

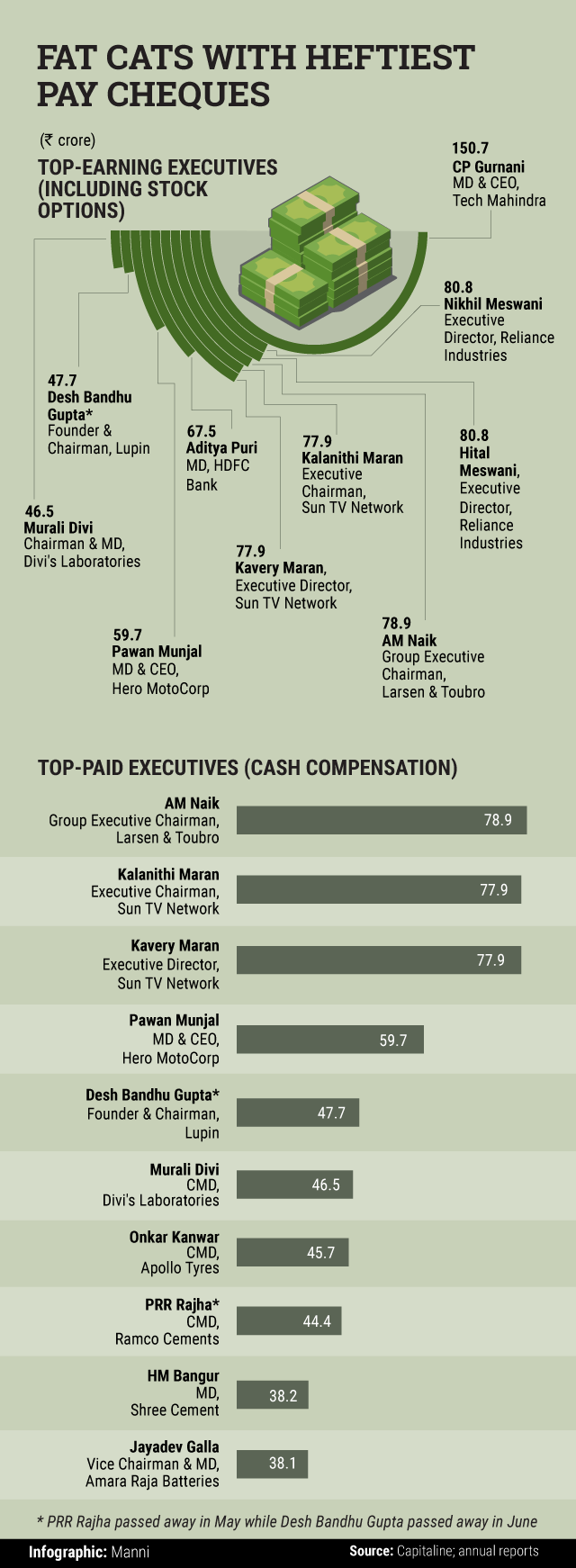

Tech Mahindra’s CP Gurnani topped the charts thanks to his hefty stock compensation. Gurnani, who joined India’s fifth-largest software services provider in 2004 and was elevated as managing director and CEO five years later, drew the bulk of his remuneration (Rs 147.17 crore) in the form of stock options. In fact, his total compensation trumped the pay packet of the entire boards of TCS, Infosys and Wipro, India’s top three IT services firms.

The stock options were granted to him earlier and exercised last year. This means his total remuneration is not a direct reflection of his or the company’s performance during the year.

This is the second time Gurnani has topped the list. In 2014-15, he had pocketed Rs 165.5 crore, then a record sum for an executive of an Indian listed firm. The following year, his former colleague Vineet Nayyar got Rs 179.5 crore ($29 million then), setting a new benchmark.

Next on the list are Meswani brothers, who are cousins of billionaire Mukesh Ambani but not counted among the promoter group. They also drew a large part of the compensation through exercising stock options.

Interestingly, veteran businessman AM Naik, who has led Larsen and Toubro for decades, became the first professional to get the highest cash compensation in a year, beating Sun TV’s husband-wife duo Kalanithi and Kavery Maran, who had been dominating that list for several years. Naik got around half of his cash compensation as retiral benefits.

HDFC Bank chief Aditya Puri was the other professional who made it to the top 10 again, thanks to a hefty remuneration via exercising stock options granted in the past.

Others in the highest cash compensation list were usual suspects: Pawan Munjal (Hero MotoCorp); DB Gupta (Lupin), Murali Divi (Divi’s Labs), Onkar Kanwar (Apollo Tyres), PRR Rajha (Ramco Cements), HM Bangur (Shree Cement), and Jayadev Galla (Amara Raja Batteries).

Galla is the only parliamentarian in the elite list. He represents Andhra Pradesh's Guntur constituency in the Lok Sabha.

Meanwhile, Ramco’s Rajha and Lupin’s Gupta passed away over the last 3-4 months.

Note that this list only covers directors of public listed companies. Indeed, many private companies, especially large multinational firms, pay hefty compensation to local heads. But top management compensation data are not available for all privately-held firms.

Pay equal to thousands!

The pay packets of some of these top executives are worth as much as the remuneration of thousands of employees in their firms. For instance, Amara Raja’s Jayadev Galla took home 2,082 times the median remuneration of a company employee.

In case of CP Gurnani, this ratio is as high as 3,537 times, if the value of the remuneration embedded in his stock options is included.

Larsen and Toubro’s AM Naik’s remuneration is 1,001 times the median remuneration of employees in the engineering giant.

“Income disparities between the top and bottom in the private sector, particularly, are going up exponentially. This is happening in the US also. The bottom of the ladder salaries are not going up while CXO-level salaries are shooting through the roof. We are just copying what is happening in the West,†said Kris Lakshmikanth, chairman of executive search firm Head Hunters India.

“The income disparity is simply not sustainable and at some stage it will break down,†he added.

However, Puri feels it's only the variable component in CXO compensation that is going up while the fixed portion as a percentage of total salary is going down.

Click here for the list of India's top-paid executives in 2015-16.