India’s life insurance sector has taken the first steps toward consolidation while private insurers are taking the fight to the government-owned Life Insurance Corp (LIC).

On 17 June, HDFC Standard Life and Max Life said they had agreed to discuss a possible merger, in what would create the biggest private-sector life insurance company in India. And on Monday, Mint reported that Bajaj Finserv was in talks to buy out its German partner Allianz SE’s stake in their two insurance joint ventures in a deal estimated at Rs 10,000 crore.

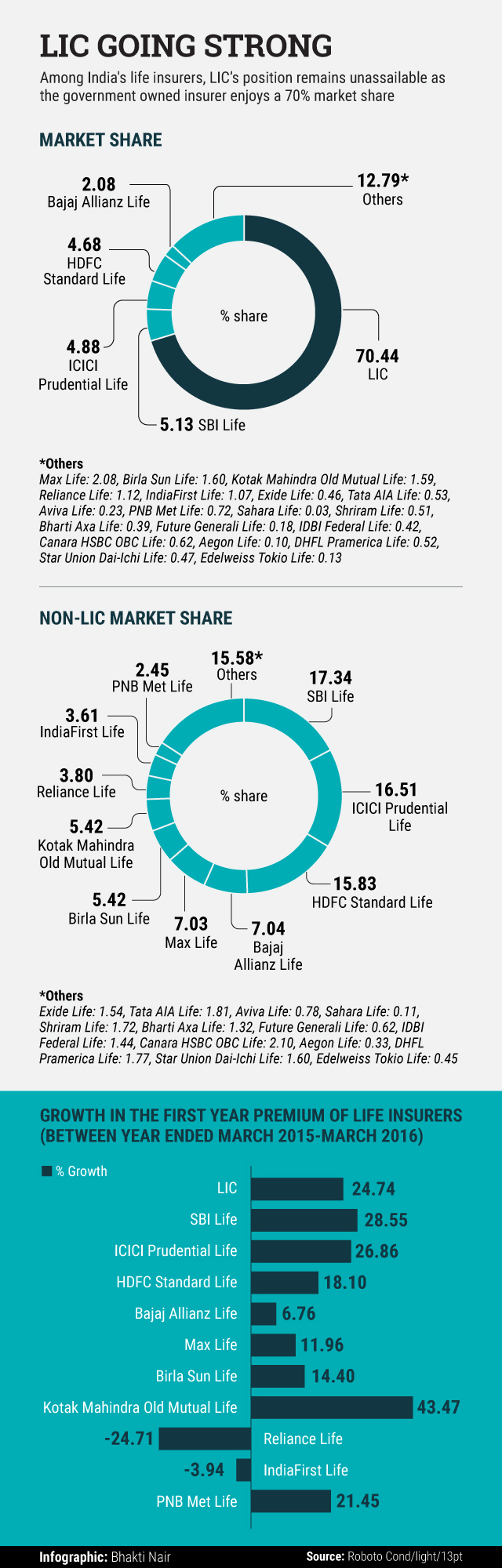

Still, not only does LIC remain the most dominant player, by a mile, but it also continues to outgrow most of its private competitors. It has maintained its market share between 2014-15 and 2015-16 around 70% and its first-year premium income has risen faster than most private-sector insurers.

This, even as it has to contend with burgeoning non-performing assets (NPAs) on its books. Although, at Rs 65,000 crore, NPAs on the insurer’s books are less than 3% of the Rs 25 trillion worth of its assets, it was recently reported that LIC was the biggest lender figuring on a list of willful defaulters and defaulting borrowers prepared by the Reserve Bank of India.

Moreover, on several occasions in the past, LIC has virtually been bullied into bailing the government out by mopping up huge chunks of shares of public sector companies in a bid to meet the government’s fiscal deficit targets.

Also, on 22 June, it was reported that LIC chief SK Roy had resigned two years before his scheduled departure.

India has as many as 24 life insurance companies including LIC. If one considers the first-year premiums paid by insurers, LIC’s domination in the life insurance market becomes apparent, both in terms of market share and growth.

LIC’s first-year premium income grew 24.7% in 2015-16, according to data from the Hyderabad-based Insurance Regulatory and Development Authority. Although Kotak Mahindra Old Mutual Life and SBI Life did grow faster than LIC, they command only 1.5% and 5.1% of the market respectively.

Incidentally, among the top 10 non-LIC insurers, at least two—Reliance Life and IndiaFirst Life—saw their market share drop, indicating that the government-owned insurer continues to hold its own even when others are facing headwinds.

The fight really is for the non-LIC market. Data show that if the HDFC Standard Life-Max Life deal does go through, the combined entity would have a market share of 6.7%, surpassing SBI Life’s 5.1%. While this is not enough to bother LIC’s pole position, it does signal that a round of consolidation in the life insurance sector might be imminent.

Like this report? Sign up for our daily newsletter to get our top reports.