Indian digital payments leader Paytm, which counts Ant Group and Softbank among its backers, has sought approval for India’s largest initial public offering (IPO) worth Rs 16,600 crore.

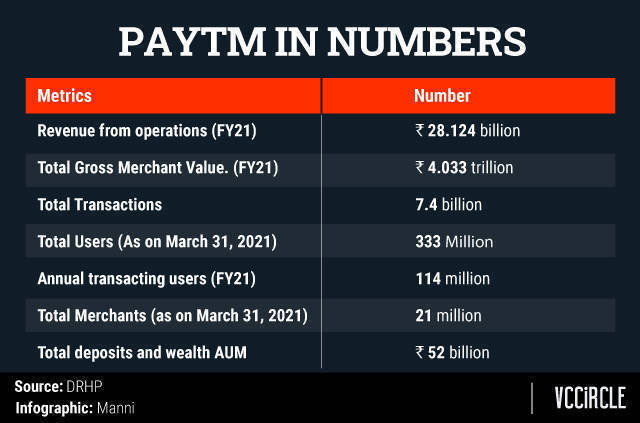

With total gross merchandise value (GMV) of over Rs 4 lakh crore during the year ended March 2021, Paytm boasts Rs 5,200 crore in total deposits and assets under management.

It has had over 33.3 crore customers, 2.1 crore merchants, and 7.4 billion transactions on its payments, commerce, cloud, and financial platforms. Despite the scale and penetration of the business it has been reporting losses since inception.

Below are the key takeaways from the IPO draft papers that VCCircle found worth sharing with readers:

- The company has listed a couple of key revenue segments for its business: Payment and financial services and commerce and cloud services.

- The payments platform witnessed an annualised growth of about 11.5% and grew from Rs 1,700 crore in FY19 to about Rs 2,100 crore in FY21.

- Revenues from commerce and cloud services have less than halved from over Rs 1,500 crore in FY19 to less than Rs 700 crore in FY21.

- This has led to an annualised decline of 7% in aggregate net sales from FY19 to FY21 for the business.

- Despite a fall in revenue numbers, the company has managed to improve its profitability. Ebitda (earnings before interest, tax, depreciation and amortisation) losses that stood at negative 130% of the revenue during FY19 have less than halved to about 60% of net sales.

- To be clear, draft papers also state that the company might not be able to turn profitable in the near future due to rapidly changing dynamics of the business environment.

- Since the company does not distribute its expenses across different business segments, it calculates profitability through an additional metric. The firm looks at the contribution profit of the entire business.

- Contribution profit is the difference between the revenue from operations and costs such as payment processing charges, promotional cashback expenses, connectivity and content fees, contest, ticketing and logistic costs.

- The company reported close to Rs 2,000 crore as contribution losses during FY19 that got converted to contribution profit of Rs 363 crore during FY21.

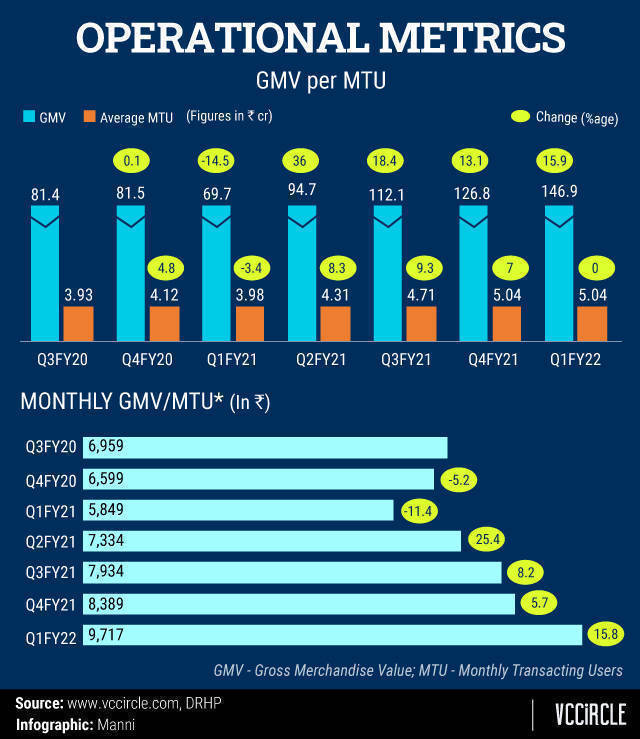

- Another important metric that the company looks at to gauge the performance is gross merchandise value per monthly transacting user (GMV/MTU). It defines GMV as the rupee value of total payments made to merchants through transactions on the app over a period. MTU is unique users with at least one successful transaction in a particular month

- The draft papers show that GMV/MTU in rupee terms has increased by close to 48% from Oct-Dec 2019 to Jan-Mar 2021.

- Additionally, a strong investor base sure makes things prettier for Vijay Shekhar Sharma, who still owns close to 14.6% stake in the company including the 5% held through VSS Holding Trust. He along with the selling shareholders will be part-exiting through the IPO.

- The largest investor Chinese e-commerce giant Alibaba.com, Japan’s SoftBank, Warren Buffet’s Berkshire Hathway, and Elevation Capital are the key selling shareholders among others.

- According to a VCCircle analysis, the weighted average acquisition price per share for all the selling shareholders together is close to Rs 930 apiece.

- Paytm is expected to attain a post-money valuation of $25 billion to $30 billion, media reports said.