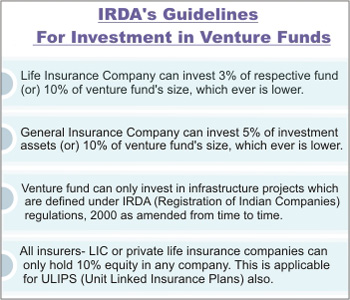

In a significant dvelopment, Indian insurance regulator - Insurance Regulatory & Development Authority (IRDA) - has fixed exposure norms for insurance companies with regard to venture capital and private equity funds. In its latest released guidelines, IRDA has allowed life insurers to invest 3% of their total investible corpus in VC funds or 10 per cent of the fund's size, whichever is lower. For general insurers, the limit is 5% of their investment assets or 10% of the fund size, whichever is lower.

Based on Life Insurance Corporation's assets under management of Rs 700,000 crore, potentially over Rs 21,000 crore can flow from the insurer alone. The new guidelines say, "10% of outstanding shares (face value) or 10% of fund size, whichever is lower, can be invested in equity shares of investee company. A sum of 10% of subscribed share capital, free reserves and debentures / bonds of investee company or 10% of fund size, whichever is lower, can be invested in debt instruments of investee company.''

IRDA has also removed the differential treatment of provisions applicable to public sector and private sector insurers, mandating that no insurer can hold more than 10% equity in any company. This move is said to have irked LIC since the insurer could hold more than 20% of the equity in a company. The norms have also been broadened to include Ulips.

Will The Fund Flow Increase?

"Insurance firms have been investing in PE/VC firms already. This has not opened any kind of fresh door to the VC / PE funds. In short term, I dont seee any significant impact happening. In the long term, it can prove to be good. I see it more in line with pension funds being allowed to invest in the VC funds," said Ajay Kumar Kapur, CEO of SIDBI Venture Capital.

Life Insurance Corporation

LIC is the biggest institutional investor in many companies with a staggering Rs 7.5 lakh crore of investments, and in many of them, its investments exceed 10% .Once the new rules come into force, LIC would have to bring down its exposure limit in a single company from 30 per cent to 10 per cent. This would deprive LIC the flexibility it enjoyed on its investment portfolio.

It is yet to be seen as to what would be the implications of such moves as LIC, annoyed over IRDA's guidelines is now pondering to appeal Ministry of Finance and IRDA to review these fresh guidelines before imposing.