Startups at the pre-revenue concept stage comprise just 12% of early-stage ventures that have raised funding this year, down from more than a quarter (27%) in 2016, according to a report by venture debt firm InnoVen Capital.

The trend serves as an indication that investors are increasingly looking to back startups that have gained traction and have started making money.

The findings of InnoVen Capital’s Early Stage Investment Insights Report 2018 are based on early-stage funding activity — angel and pre-Series A investments — and a survey of 14 institutional early-stage investors.

These include Mumbai Angels, Indian Angel Network, Chennai Angels, Hyderabad Angels, LetsVenture, Axilor Ventures, Blume Ventures and Kae Capital.

For one in every two investors who participated in the survey, less than 10% of their portfolio companies got funded at the pre-revenue stage.

Consumer and enterprise technology & artificial intelligence have emerged as the most active sectors this year and investors expect this trend to continue in 2019, the report stated.

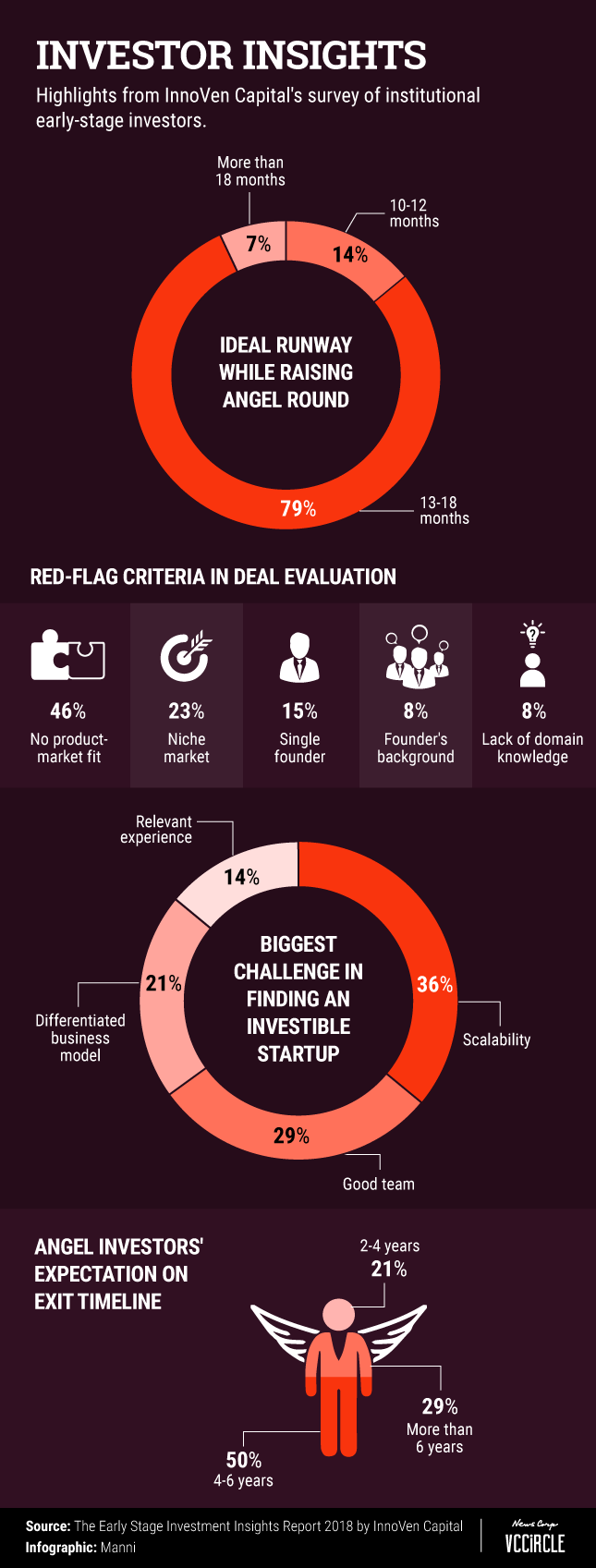

It further said that 70% of the companies that failed to obtain funding from institutional investors either had no product-market fit or were addressing a niche market opportunity.

The majority of investors have seen more than 40% of their portfolio companies secure follow-on funding.

The survey further shows that 78% of the startups which got funded have founders with at least five years of experience. About 92% of the funded startups have two co-founders. Only 17% of the startups had at least one female co-founder.

The top deal-sourcing channel for investors is referrals which could be through a founder of portfolio company or from a top angel investor. Networking at startup events is least effective, the report stated.