Byju’s parent Think & Learn Pvt Ltd released its financials for FY21 after an 18-month delay, revealing a decline in its revenues, losses on account of bleeding subsidiary Whitehat Jr coupled with increasing marketing and legal expenses.

Byju's has 50,000 employees, 71 investors on its cap table, and is India's most-valued startup so far at about $22 billion but over the last 18 months, the edtech startup has been forced to correct its revenue recognition practices.

This issue was flagged by the auditor, Deloitte, and prompted it to knock off revenues amounting to over Rs 1,156 crore from the management-projected revenues of FY21. The company reported losses amounting to Rs 4,588.75 crore, up from Rs 231.69 crore in FY20.

The auditor also presented an adverse opinion on the company’s weak internal controls.

Founder Byju Raveendran addressed both these points in an interview.

But there are some other key highlights:

Ballooning legal, marketing expenses

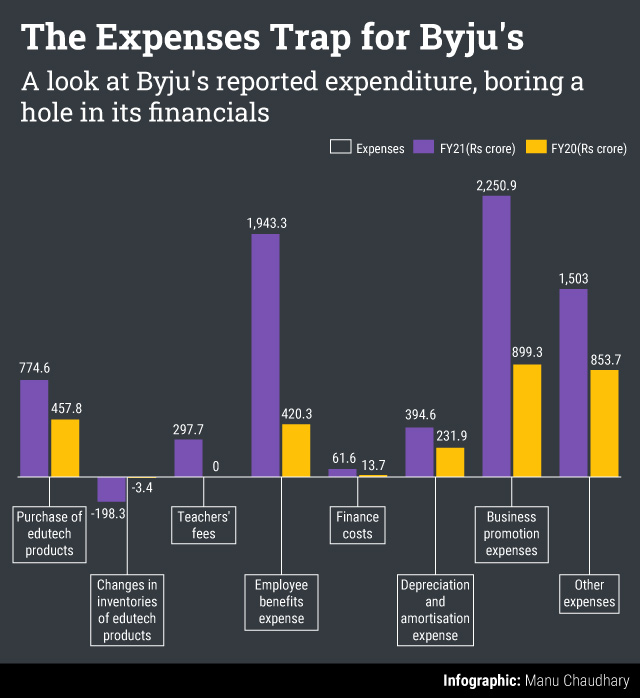

Byju’s reported total expenses at Rs 7,027.47 crore in FY21 against Rs 2,873.34 crore in FY20. The bulk of its expenses went towards what the company called business promotions and legal expenses. The startup, known for its aggressive marketing strategies, especially around the Indian Premier League (IPL), spent Rs 2250 crore in business promotions in FY21, the company said. Its legal and professional fees alone stood at Rs 672.94 crore.

Expense distribution

1. Purchase of edtech products: Byju’s spent Rs 774.64 crore in procuring edtech products such as tablets and SD cards, up 69.22% from Rs 457.77 crore in FY20.

2. Teachers' fees: The fees of teachers stood at Rs 297.70 crore in FY21. Nil in FY20.

3. Employee benefits expense grew to Rs 1,943.30 crore in FY21 from Rs 420.26 crore in FY20. Such expenses also include provident fund, employee state insurance scheme, gratuity fund, and compensated absences.

4. ESOPS: Stock compensation expense during FY21 grew to Rs 466.67 crore from Rs 0.82 crore previously.

5. Finance costs grew 448.61% to Rs 61.55 crore, from Rs 13.72 crore. The total fee for legal and professional charges for auditors stood at Rs 5.80 crore in FY21, up from Rs 1.75 crore in FY20.

Statutory audit fees, for which BYJU’S paid a total of Rs 4.50 crore, included Rs 3.5 crore towards the additional effort incurred in the audit consequent to material weaknesses observed in internal controls.

6. Business promotion expenses jumped to Rs 2,250.94, up 150.28% from Rs 899.34 crore in FY20.

7. Other expenses soared to Rs 1,503.03 crore in FY21 from Rs 853.73 crore in FY20. Under other expenses, legal and professional fees stood at Rs 672.94 crore, up from Rs 576.24 crore in FY20.

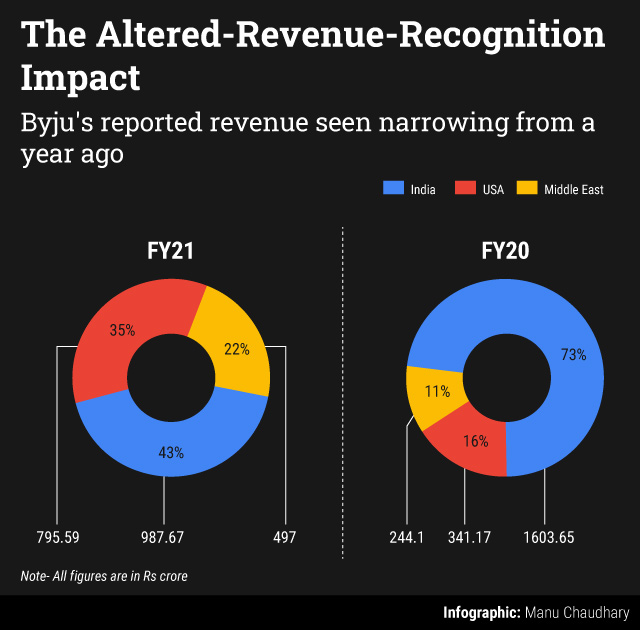

Drop in India earnings; US, Gulf Cooperation Council (GCC) revenue up

Byju’s reported increased revenues from the sale of educational content to customers based in Gulf Cooperation Council (GCC) countries, which amounted to Rs 497 crore in FY21--up from Rs 245 crore in the previous fiscal. However, Byju’s paid Rs 237 crore in commission to a Dubai-based unrelated entity to achieve these sales. All the sales from GCC countries are invoiced under this entity. In FY20, BYJU’S paid Rs 115.01 crore to the unnamed firm.

This comes at a time when its India revenue dropped to Rs 987.67 crore in FY21 from Rs 1603.65 crore in FY20.

Its US revenue grew to Rs 795.59 crore in FY21, from Rs 341.17 crore previously. The company operates in the US via Byju's Inc and its owned venture Tangible Play Inc.

The total loss from the US market stood at Rs 228.94 crore, accounting for 5.48% of the total loss.

Whitehat Jr acquisition; payment pending to Blackstone

Byju’s announced the acquisition of WhiteHat Jr. in August 2020 by acquiring a 73.91% stake for Rs 1,327.43 crore in cash. It currently owns a 76% stake in the company.

However, its loss stood at Rs 1,118.25 crore, nearly 26.73% of the total loss incurred by BYJU’S in FY21. Since its acquisition, WhiteHat Jr. has contributed Rs 326.66 crore to BYJU'S revenue. Its FY22 losses are also high, as reported on August 4.

Meanwhile, Byju’s has to make the balance payment to Blackstone by September 23, the statements said. According to Raveendran, the delay was on account of an RBI pricing guideline for non-resident investors.

GST Raids

The Directorate General of GST Intelligence finalised its investigation on February 18, 2021, against books supplied during the period July 2017 to October 2020. The company was asked to pay GST of Rs 96.17 crore, the interest of Rs 27.95 crore and a penalty of Rs 14.43 crore. “The authority has concluded the investigation without issuing show cause notice since the GST liability was accepted and paid by the parent company of Byju’s.”

Auditor flags accounting changes

Byju’s loss widened after changes in revenue recognition.

The auditor has flagged two key changes. Revenues from streaming services, which were previously recognised fully on the commencement of the contract, have been adjusted to be recognised rateably over the period of the contract.

For example, if Byju’s sold a two-year course, the company would have taken the complete sale amount as revenue in the same financial year. But this time, the revenues were deferred over the span of time the course remains valid.

The auditor added that interest paid to loan partners on behalf of customers in respect of loans granted directly to customers has been reclassified from finance cost and adjusted against revenues since these payments are in the nature of payments to customers.

Similarly, Byju’s provides First Loss Default Guarantees (FLDG) to its loan partners and is obligated to reimburse for any monthly instalments that remain uncollected and stay overdue for a prescribed period which typically ranges between “overdue for 75 days or 90 days.”

The company’s revenues were revised to include the difference between the consideration received by the parent from the (i) customer and the loan partner and (ii) the fair value of the guarantee at the time of entering into the contract with the customer.

The auditor has noted the estimates of the fair value of guarantee are revisited at the end of every period closing and any changes in the fair value are accounted for as a change in the estimates.