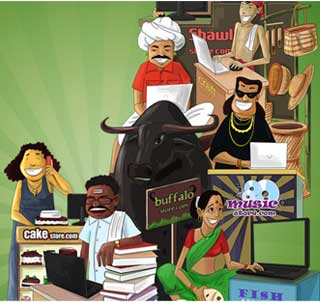

vendors to consumers online

Infibeam Incorporation Ltd, the parent of horizontal e-commerce platform Infibeam and e-commerce enabler BuildaBazaar, has received a green signal from securities market regulator SEBI for its initial public offering (IPO) to raise up to Rs 450 crore.

If it goes ahead with the issue, Infibeam would be the first pure-play e-commerce firm in the country to float an IPO in India and would test the general investors’ appetite for the sector. E-commerce in India has absorbed billions of dollars in the past four years, much of it from foreign private equity and venture capital firms.

Infibeam happens to be an exception as it has not tapped into any significant private investor till now. It is promoted by a Gujarat-based affluent family whose business interest straddles a dealership for Toyota cars.

Its only external equity funding has come from media house Bennett, Coleman & Co Ltd, which bet around Rs 33.3 crore through the ad-for-equity investment platform Brand Equity Treaties Ltd (BETL). BETL owns a 1.8 per cent stake in the firm. BETL also pitched in with Rs 2 crore of non-convertible debentures, which are outstanding.

Infibeam, which joins more than a dozen firms with SEBI approval to float their IPOs, would become one of the youngest firms to list on a national bourse. The company, started in 2010, is also among the youngest home-grown e-commerce ventures. Having restricted itself from raising private capital, unlike its peers, it did not get too aggressive in customer acquisition to drive the B2C business.

For full details on its proposed IPO, click here.