Swiss impact investor ResponsAbility Investments AG and Belgium-based Incofin Investment Management have put $20 million (nearly Rs 130 crore) in Sohan Lal Commodity Management Pvt. Ltd, a Delhi-based farm logistics services provider, a media report said.

The transaction comprises a secondary sale of shares by Sohan Lal’s existing investors Everstone Capital, Mayfield Advisors, Nexus Venture Partners and Emerging India Fund, the Mint reported, citing executives at the company and the new investors.

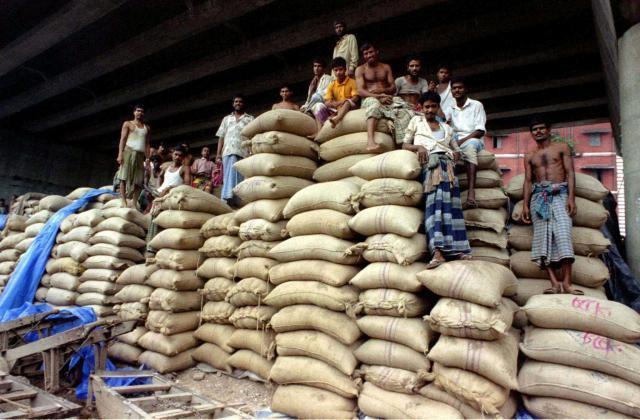

The company, which was launched in 2008, provides services such as warehouse management, agriculture financing, collateral management and procurement mainly to farmers, processors, millers and traders.

It handles agriculture commodities including cotton, barley, bajra, wheat and pulses. As of January 2017, it had 1,502 warehouses and 19 cold storages in India with a total capacity of 3.88 million metric tonnes.

The company had raised Rs 100 crore in its previous round led by impact investor Creation Investments Capital Management. Everstone also participated in that round.

Incofin, which invested in Sohan Lal through its $175 million AGRIF fund, had in the past backed Fusion Microfinance Pvt. Ltd, Grameen Financial Services Pvt. Ltd, Annapurna Microfinance Pvt. Ltd and Arman Financial Services Ltd.

ResponsAbility Investments, which manages over $3 billion in development investments, counts biomass aggregator Punjab Renewable Energy Systems, sanitary services provider Saraplast Pvt Ltd and BPO service provider DesiCrew Solutions Pvt Ltd among its previous bets in the country.

Like this report? Sign up for our daily newsletter to get our top reports.