Cross-border M&A is nothing new for the Indian IT services industry. The difference between cross-border M&A of the past and what is needed now is that the goal must change.

In the past, size alone helped drive enterprise value with acquisitions designed to acquire horizontal offerings, scale, new customers or expanded global footprints. Now ‘what you do’ matters in increasing enterprise value.

So, the focus must be on acquiring technology driven, differentiated, vertical business solutions that will help drive margins higher. This will be a key to keeping margins and valuations higher for Indian IT companies going forward.

The reason? Clients are putting pricing pressure on horizontal solutions, which are becoming more commoditised, and global competition has closed in on scale in their offshore delivery capability.

Why the Indian IT industry’s value proposition must change

Historically, the Indian IT industry’s competitive advantage has been a large skilled workforce with cost arbitrage. This edge enabled the industry to grow rapidly over the past decade—reaching more than $100 billion in annual revenue—and become competitive on a global scale.

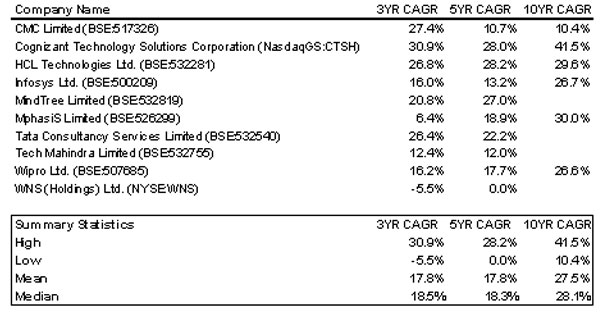

As shown in Table 1, India’s Tier I IT services companies have experienced double-digit growth over the past 10 years.

Table 1: Indian Tier I IT Services Companies’ Revenue Growth, 10-Year CAGR

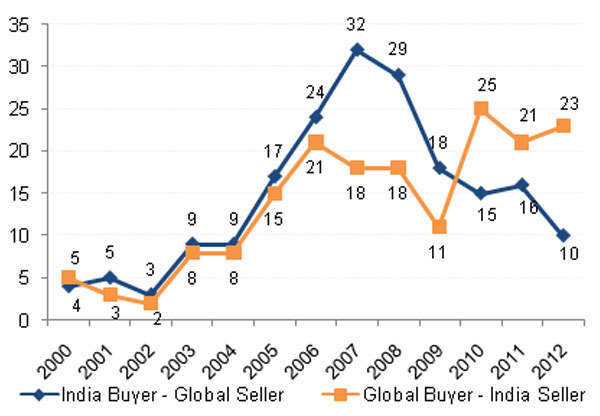

Cross-border M&A has contributed to this rapid growth either by contributing to top-line right away, or allowing companies to cross sell rapidly. As shown in Figure 1, Indian cross-border M&A activity increased significantly in the first half of the 2000s, both for outbound and inbound transactions.

Figure 1: Indian IT Services Cross-Border Transactions, 2000-2012

Number of Transactions

The sharp increase in outbound M&A activity between 2004 and 2007—with transactions rising from 9 to 32—reflected Indian IT services providers expanding and filling gaps in their portfolios through acquisition. When the recession began in late 2007, the number of overall transactions dropped precipitously. But inbound transactions have rebounded, and now are at an all-time high.

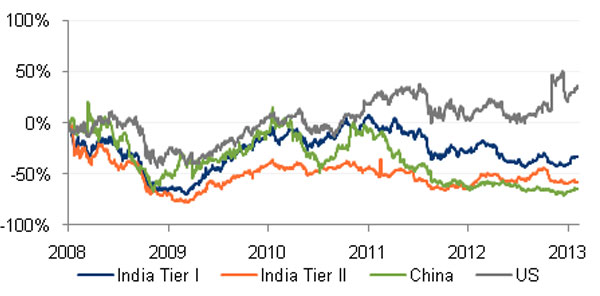

As shown in Figure 2, since 2008 EV/EBITDA for Tier II Indian IT services companies has declined 33 per cent while that of US professional services companies has increased EV/EBITDA by 35 per cent.

The takeaway from the valuation comparison between IT services and professional services firms is that in the new search for value creation, Indian IT services companies must acquire high-end services capabilities and continue to move up the value-chain.

Figure 2: Relative EV/EBITDA Changes in India, China and US; 2008-2013

The changing nature of cross-border M&A deals

In fact, this shift in acquisition priorities is already occurring. The following section highlights some of the key cross-border acquisitions that have been completed since 2011.

Indian Buyers – Global Sellers

In May 2013, Wipro announced an agreement to enter into a strategic partnership and take a minority position with an investment of $30 million in US-based Opera Solutions, LLC, a leading global Big Data science company.

December 2012 - Mphasis Ltd, an application development and maintenance, infrastructure outsourcing services, and BPO services company, acquired Digital Risk, LLC, a mortgage risk management solutions firm, for $202 million.

September 2012 – Infosys Ltd, a business consulting, technology, engineering, and outsourcing services company, acquired Lodestone Management Consultants AG, a management consulting firm that advises international companies on strategy and process optimisation as well as IT-enabled transformation, for $349.15 million.

June 2012 – WNS Holdings Ltd, a BPO services company, acquired Fusion Outsourcing Services (Pty) Ltd, a South African BPO services company for $15.63 million.

May 2012 – ICRA Techno Analytics Ltd, an IT services, engineering and KPO services company, acquired BPA Technologies, Inc, an IT services company, for $8 million.

April 2012 – Wipro Technologies Ltd, a provider of IT products and services, acquired Promax Applications Group Pty Ltd, an Australia-based analytics company that designs and delivers trade promotion planning, management, and optimisation solutions, for $36.45 million.

Global Buyers – Indian Sellers

August 2012 – Bain Capital, a US-based private equity company, acquired a 30.49 per cent stake in Genpact Ltd, a business process management and IT services company for a little more than $1 billion.

May 2011 – Serco Group plc, a UK-based services company operating in civil government, defense, science and nuclear, local government and commercial sectors, acquired Intelenet Global Services Pvt Ltd, a BPO services company, for $641.57 million.

January 2012 – NTT Communications Corporation, an information and communications technology solutions company, acquired Netmagic Solutions Pvt Ltd, a hosting services company for $129.97 million.

With increased global competition and unresolved political and economic issues at home, over the next 12-24 months, we expect to see even more cross-border focussed, redefined M&A activity as Indian IT services companies target higher value capabilities, including technology enabled non-voice BPO, analytics and enterprise mobile solutions companies.

(Gaurav Sharma is senior vice president and managing director of India Practice.)