“We will be profitable in the next 1 year! …”

“Another round of funding should take us to order economic efficiency …”

The current e-retail model dynamics do not work

These are some of the common promises we hear being shouted within the Indian e-retail industry before every round of funding, without any due consideration to their business specifics or the market dynamics. IntelligenceNODE estimates that the Indian e-retail space will struggle to be profitable if the same business practices are sustained.

Our rule of thumb is:

PRICE-WARS --> INCREASING RELIANCE ON COUPONING AND DISCOUNTS --> NEGATIVE MARGINS --> PLUMETTING BOTTOM LINES --> RISING CASH BURN --> RISING COST OF EQUITY --> OUT OF CASH!!!

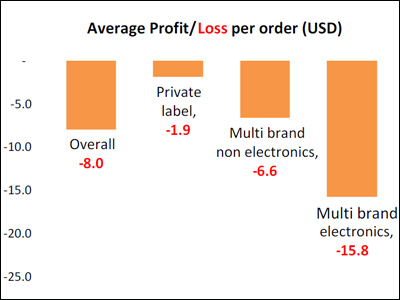

IntelligenceNODE’s profitability score and ranking tool is based on order economic co-efficient benchmarking across its proprietary database, comprised of India’s top 45 e-retailers by revenue. It shows that on average, e-retailers in India lose approximately $8 (USD) per order.*

* Average Profit/Loss per order = Per order (Average Selling price – average discount/rewards – tax – packaging and shipping cost – transaction cost CoD/Merchant Account – Marketing cost per transaction)

* All statistical results are based on info from IntelligenceNODE proprietary database of India’s top 45 e-retailers by revenue.

To add to this, retailers are over-dependent on paid traffic and heavy couponing to lure customers to their online stores. In order to justify this marketing spend, companies bank on each individual customer to becoming a repeat purchaser. Anywhere from 4 to 15 repeat purchases are necessary to justify their cost of acquisition.

It quickly becomes clear than an emphasis on actual margins, rather than top-line revenue is the new order of the day. As such, optimized pricing, marketing ROIs and product coverage has never been more important.

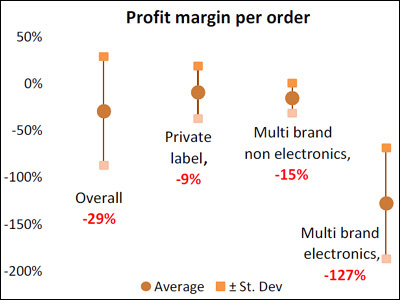

Currently, all major groups on average are reporting negative margins:

Profit margin = Profit per order/Average selling price per order of provider

An understanding of volume-adjusted pricing is critical to any optimization effort, and helps expedite savings realization. However, the necessary data to support this is not readily available in the market, and prices are often set based on intuition or other faulty or arbitrary reasoning. The often-practiced intuitive price positioning for products (in both multi-brand and private label space) leads to one of the scenarios below:

Products are priced too high --> which leads to a lower sell-through; or

Products are priced too low --> which impacts margins.

Complexity is equal to non-profitability

Another commonly voiced frustration from both the investors and consumers has been the significant lack of innovation from product- based and consumer-idea focused e-commerce players.

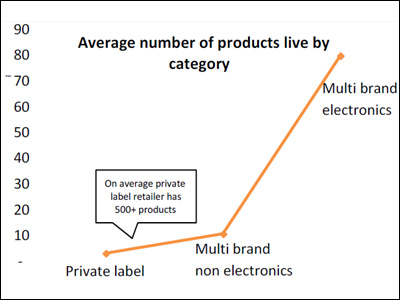

One of the most significant obstacles to growth for most start-ups, established e-retail players and even large offline players entering the digital space in India is their prevailing tendency to complicate what should definitely be kept simple, like the everyday decisions of product procurement, positioning, pricing, marketing money allocation and controlling operational cost of revenue.

The majority of firms in the Indian eCommerce market lack the sophistication or the ability to track in real-time all these dimensions in order to get a holistic view of the business. Consequently, when they try to manage all the parameters across thousands of products (keeping in mind that some general retailers have more than 1 million products on “eDisplay”), it is very easy to make expensive mistakes.

The industry needs a systematic approach to solve its problems

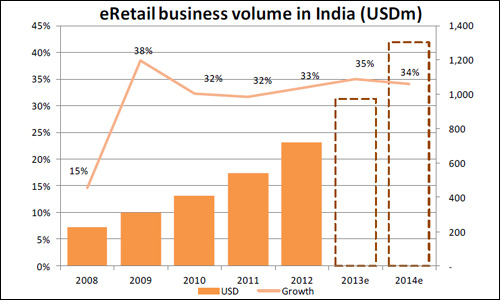

Since 2007, the e-commerce, and specifically the e-retail landscape, has dramatically grown in terms of the number of players, product coverage, and active online buyers. This exponential growth curve is hoping to sustain itself until 2014, when it’s anticipated to surpass $1 billion (USD). Hope, however, does not guarantee a certain result.

Despite the strong top-line growth and over $500 million (USD) of VC funding, profitability and positive order economics remain complicated riddles for all major players. As a result, the environment we are facing is one of significant pressure on businesses to build traditional retail organizations that operate on margins, and not top-line targets alone.

IntelligenceNODE strongly believes that by constantly improving internet penetration, heightening consumer confidence in online retail, and by taking advantage of the abundance of investment capital, the platform is set for Indian e-retail companies to actually achieve the billion dollar revenue dream, and to establish their footprint in the global internet space.

In order to reach this goal, the decision-makers in the e-retail space need to take a more holistic approach to their business. Instead of being seduced by temporary upward swings generated by offering large discounts. They need to focus on creating sustainable revenues and sales, which, correspond with repeat purchasers and take margins into account.

Sanjeev Sularia is the co-founder and CEO of intelligenceNODE,a boutique e-retail consultancy outfit. He was previously the CFO of Exclusively.In and Shersingh.com group.