Indian corporates could raise record funds through bond issuances this year as they take advantage of attractive interest rates, four merchant bankers said on Tuesday.

"We see consistent supply for the rest of the year with overall supply surpassing last year's record number," said Arnab Choudhury - executive vice president and group head of debt capital markets, SBI Capital Markets.

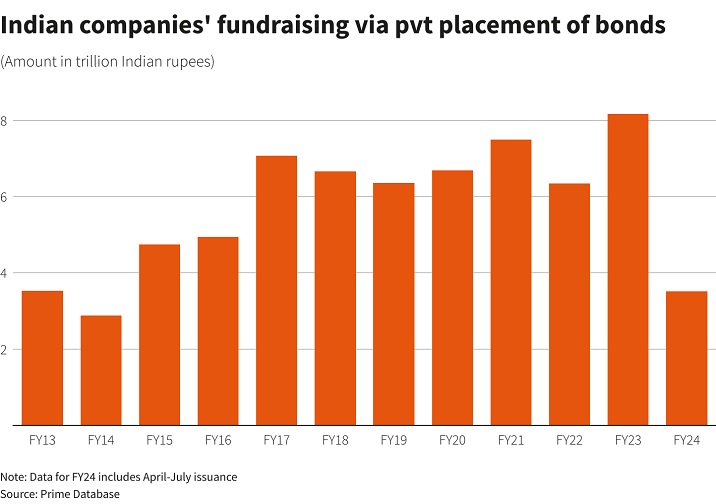

Indian companies raised 8.17 trillion rupees in FY23, an increase of 29% over FY22, data from information service provider Prime Database showed.

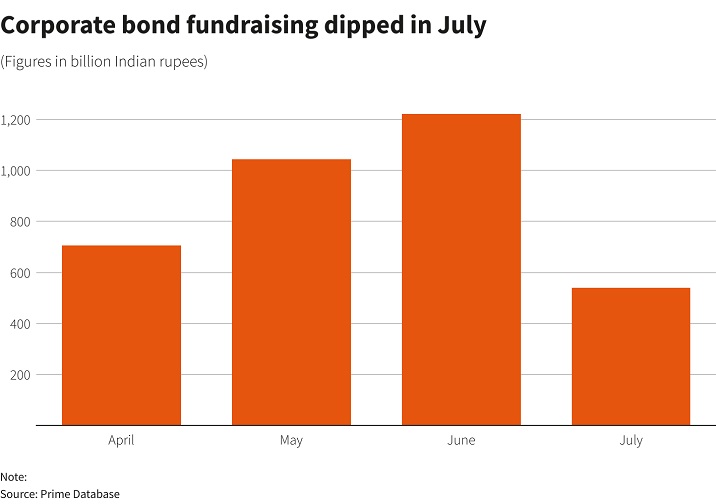

In the months of April to July, firms raised 3.51 trillion rupees via bonds, of which fundraising in July was the lowest at 539 billion rupees. Bankers said the dip was an anomaly.

Expectations of a hawkish U.S. Federal Reserve pushed up U.S. yields, the effects rippling across emerging markets like India. That made issuers stay on the sidelines until rates stabilise, these bankers said.

Abhijit Roy, chief executive officer at GoldenPi, an online bond portal expects issuance to cross 9 trillion rupees in the current year, with major focus remaining on fundraising via shorter duration bonds.

With interest rates expected to remain stable at least till March, bankers are betting issuers will avoid delaying their fundraising plans and keep tapping the debt market.

While Jamnagar Utilities and IREDA are scheduled to raise funds on Wednesday, other lenders like Bank of India and Bank of Maharashtra are also likely to line up. State-run firms like PFC and REC could tap the market after the policy, bankers said.

Reuters benchmark AAA-rated corporate bond yields for three-year is around 7.70%, while State Bank of India's three-year marginal cost of lending rate (MCLR) stands at 8.15%.

SBI Caps' Choudhury said companies that had raised funds via external commercial borrowings last year will shift to local markets as yields have risen.

"The next five to six months should be a busy period...Loan markets are not attractive right now because MCLR rates have moved up, and hence highly rated issuers will continue to come to bond market."

Sujata Guhathakurta, president-debt capital market and infrastructure financing at Kotak Mahindra Bank said corporates would raise debt for refinancing and capex purposes as the current flat yield curve would ensure short-term and long-term money at almost similar levels for higher-rated firms.